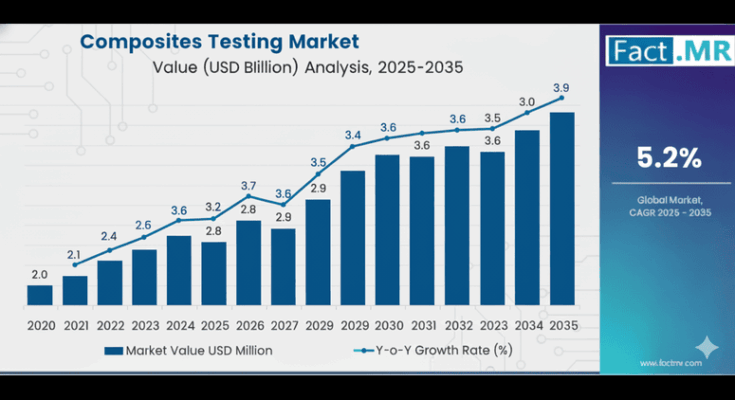

The global composites testing market is projected to grow from USD 2.0 billion in 2025 to USD 3.9 billion by 2035, at a CAGR of 5.2%, according to Fact.MR. The growth is primarily driven by increasing utilization of lightweight and high-strength composite materials in aerospace, automotive, renewable energy, and construction industries. Technological innovations such as AI, digital twins, and non-destructive testing (NDT) are enhancing test efficiency, precision, and predictive capabilities.

Market Dynamics

-

Key Growth Drivers:

-

Rising adoption of composite materials in aerospace and automotive sectors to improve fuel efficiency, safety, and emissions compliance.

-

Expanding wind energy infrastructure driving turbine blade testing requirements.

-

Growing infrastructure and construction projects in emerging economies.

-

-

Technological Enablers:

-

Non-destructive testing techniques including ultrasonic, thermographic, and X-ray CT inspection.

-

Integration of AI and digital twins for predictive maintenance and real-time analytics.

-

Automation and cloud-based testing platforms enabling remote monitoring and data analytics.

-

-

Challenges:

-

High capital investment and operating costs of testing equipment.

-

Shortage of trained technicians and engineers, especially in developing markets.

-

Variability in international standards and cybersecurity concerns in digital testing platforms.

-

-

Opportunities:

-

Expansion of renewable energy and wind turbine manufacturing.

-

Digital transformation of test facilities and adoption of automated, AI-enabled platforms.

Market Segmentation

By Testing Method:

-

Destructive Testing: Poised to grow at 8.5% CAGR; critical for safety-critical industries like aerospace, automotive, and construction to determine mechanical performance under stress.

-

Non-Destructive Testing (NDT): Enables structural evaluation without damaging materials, increasingly favored for high-value composites.

By Product Type:

-

Ceramic Matrix Composites (CMCs): Expected to grow at 10.3% CAGR; high-temperature resistance and mechanical toughness make them ideal for defense, aerospace, and energy applications.

-

Polymer Matrix, Continuous, and Discontinuous Fiber Composites: Widely used in automotive, aerospace, and construction.

By End-Use Industry:

-

Aerospace & Defense: Largest demand driver due to safety-critical applications.

-

Transportation & Automotive: Focused on lightweighting, emissions reduction, and crash safety.

-

Wind Energy: Turbine blade testing and structural reliability.

-

Building & Construction: Urbanization, infrastructure projects, and green building initiatives.

-

Sporting Goods & Electricals: Niche applications with moderate growth.

By Region:

-

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Country-Level Insights (CAGR 2025–2035)

Country CAGR U.S. 5.5% UK 5.0% France 4.8% Germany 5.3% Italy 4.5% South Korea 5.6% Japan 5.2% China 6.0% Australia-New Zealand 4.7% Highlights:

-

U.S.: Aerospace, automotive, and defense sectors dominate; NDT adoption rising.

-

UK: Strong automotive and aerospace sectors; government sustainability initiatives support composites usage.

-

China: Rapid industrialization, EV manufacturing, and wind energy expansion drive demand.

-

Germany & Italy: Automotive and aerospace leaders leveraging composites for fuel efficiency and performance.

Competitive Landscape

Company Market Share (%) Key Offerings & Activities Element Materials Technology 18–22% Full-service destructive and NDT testing; global lab network; safety-critical materials testing. Exova Group 20–25% Acquired by Element; broad composites testing portfolio. Intertek Group 15–20% Advanced NDT, aerospace and automotive testing; international network. Mistras Group Inc. 12–15% NDT-focused; inspection solutions for defense, aerospace, and energy. Westmoreland Mechanical Testing & Research Inc. 5–7% Mechanical/destructive testing; high-precision aerospace applications. Other Notable Players: Matrix Composites, Instron, ETIM Laboratory, Henkel AG & Co. KGaA, Key Composites.

Strategic Trends:

-

Increased R&D investment in AI, automation, and digital twin platforms.

-

Expansion of global lab networks to meet rising regional demand.

-

Strategic collaborations with OEMs, regulators, and technology providers to enhance compliance and efficiency.

Market Outlook

Fact.MR forecasts steady growth through 2035, anchored by:

-

Adoption of high-performance composites across aerospace, automotive, and renewable energy sectors.

-

Digital transformation of testing processes using AI, machine learning, and automation.

-

Regulatory compliance and standardization efforts driving demand for reliable, high-precision testing.

-

Infrastructure development in emerging economies supporting widespread composites application.

Conclusion:

The composites testing market is entering a technology-driven phase, with AI-enabled NDT, digital twins, and predictive analytics redefining material validation. Companies that balance innovation, regulatory compliance, and cost efficiency are positioned to lead in this high-growth sector. -

-