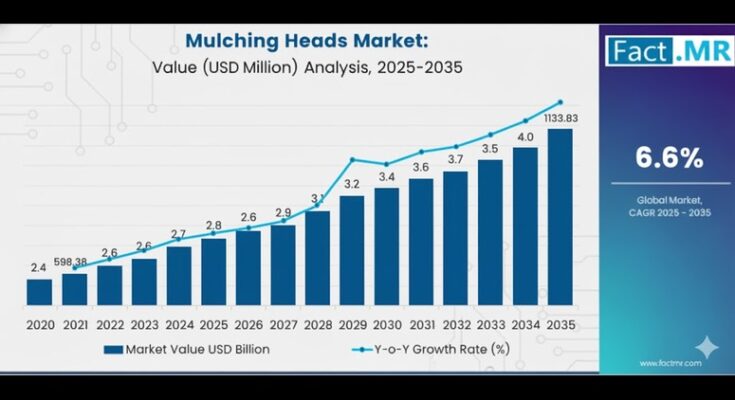

The global mulching heads market is poised for robust growth over the next decade, driven by infrastructure expansion, wildfire mitigation programs, conservation agriculture, and urban vegetation management initiatives. According to Fact.MR, the market is valued at USD 598.38 million in 2025 and is projected to reach USD 1,133.83 million by 2035, growing at a compound annual growth rate (CAGR) of 6.6%.

The report, “Mulching Heads Market Size, Share, and Forecast 2025–2035,” indicates that global revenues will nearly double over the next ten years, as demand for durable, energy-efficient, and automation-ready equipment rises across forestry, agriculture, and utility sectors.

Decade of Growth Anchored by Automation and Electrification

Automation, remote operation, and electrification are transforming mulching equipment dynamics. Between 2025 and 2030, the market is expected to expand significantly due to increased demand for high-flow hydraulic attachments and compact electric mulchers for urban forestry and precision agriculture. From 2030 to 2035, further growth is anticipated as LiDAR-assisted navigation, hybrid-drive systems, and low-noise, emission-compliant machinery gain traction in North America, Europe, and Asia-Pacific.

“Next-generation mulching heads are not only power tools—they are intelligent land management systems,” said a Fact.MR analyst. “Advances in automation, hybrid drives, and digital monitoring are reshaping productivity, operator safety, and environmental compliance.”

Key Market Insights at a Glance

| Metric | Global Estimate |

|---|---|

| Market Value (2025) | USD 598.38 Million |

| Forecast Value (2035) | USD 1,133.83 Million |

| CAGR (2025–2035) | 6.6% |

| Top Drive Type | Direct Drive |

| Leading Mounting Equipment | Compact Track Loader |

| Fastest-Growing Shredding Diameter | 25–40 cm |

Asia-Pacific: The Fastest-Growing Frontier

The Asia-Pacific region is projected to see rapid adoption of mulching heads, fueled by forestry modernization, reforestation initiatives, and rural infrastructure projects. Countries like China, India, and South Korea are investing heavily in compact, electric, and hybrid-drive units suitable for utility corridors and steep terrain.

China, in particular, is witnessing strong uptake from state-owned enterprises engaged in afforestation and urban greening, while India’s emerging precision agriculture and renewable biomass projects are creating demand for mid-sized, low-emission mulchers.

Five Forces Driving Market Expansion

-

Automation Integration: LiDAR, GPS, and remote operation improve safety, efficiency, and terrain adaptability.

-

Sustainable Land Management: Low-noise, emission-compliant equipment supports urban and ecological initiatives.

-

Infrastructure & Utility Expansion: Large-scale right-of-way and pipeline maintenance projects drive procurement of heavy-duty mulchers.

-

Electrification & Hybridization: Rising focus on low-impact, energy-efficient designs.

-

OEM Partnerships & Regional Expansion: Strategic collaborations accelerate adoption and broaden product reach.

Segment Overview

By Drive Type:

-

Direct drive leads due to high mechanical efficiency, torque delivery, and low maintenance.

By Carrier Capacity:

-

20–30 ton carriers are the most lucrative, balancing force and maneuverability for commercial forestry and infrastructure projects.

By Mounting Equipment:

-

Compact track loaders dominate, preferred for soft or uneven terrain and ecologically sensitive areas.

By Max Shredding Diameter:

-

25–40 cm segment shows fastest growth, ideal for mixed-use forestry, orchard clearing, and disaster response.

By Max Cutting Width:

-

48–56 inches offers productivity without compromising maneuverability, favored for municipal and commercial contractors.

Regional Outlook

-

USA: CAGR 7.4% — wildfire mitigation, urban low-noise units, hybrid/electric adoption.

-

China: CAGR 7.1% — state-backed afforestation, smart-enabled mulchers, and electric/hybrid systems.

-

Germany: CAGR 6.8% — precision land clearing, hybrid drives, LiDAR integration.

-

Italy & France: CAGR 6.1–6.3% — wildfire prevention, slope-adaptable hybrid units, urban forestry.

-

UK: CAGR 5.4% — municipal vegetation management and rewilding programs.

-

Japan & South Korea: CAGR 4.8–5.1% — compact, low-noise, battery-electric units for urban and hilly terrains.

Competitive Landscape

Key global players include FAE Group, Fecon, Seppi M., Tigercat Industries, and DENIS CIMAF, collectively accounting for the majority of market share. Companies are focused on:

-

Terrain adaptability and platform compatibility.

-

AI and telematics-enabled monitoring.

-

Product lines for hybrid/electric and compact applications.

Other notable players: Loftness Manufacturing, Caterpillar, John Deere Forestry, Bobcat, MORBARK, Maschio Gaspardo, and Tirth Agro Technology.

FAE Group is expected to lead in 2025 with ~20–25% market share, driven by innovation in hybrid and electric mulching attachments. Fecon (15–20%) dominates North America with high-power attachments, while Seppi M. (12–18%) leads Europe with precision compact mulchers.

Browse Full Report : https://www.factmr.com/report/3964/mulching-heads-market

Market Outlook: Transforming Land Management

Over the next decade, the mulching heads market will evolve from conventional machinery toward automated, energy-efficient, and modular attachments. Next-generation designs will emphasize urban compliance, hybrid drives, LiDAR-assisted operation, and digital connectivity.

“Mulching heads are becoming smart, data-enabled land management tools,” the Fact.MR analyst added. “Manufacturers that invest in automation, sustainability, and global expansion will shape the market’s future.”