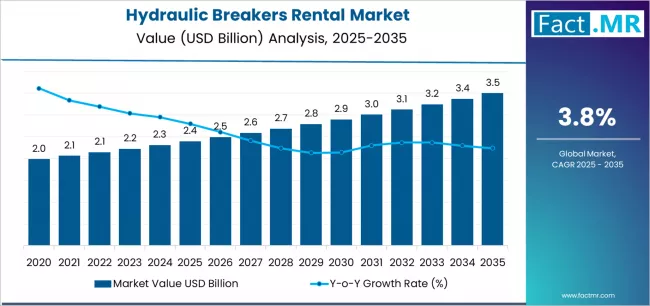

The global hydraulic breakers rental market is witnessing steady growth, propelled by rising demand in construction, mining, and demolition sectors. According to a recent Fact.MR report, the market is projected to grow from USD 2,400.0 million in 2025 to USD 3,500.0 million by 2035, reflecting a CAGR of 3.8% over the forecast period. Rental solutions are increasingly preferred as they offer cost-effective access to specialized equipment without the burden of ownership.

Strategic Market Drivers:

Infrastructure Expansion and Construction Modernization: The construction industry remains the largest driver of hydraulic breaker rentals, with contractors seeking flexible, high-performance equipment for urban development, commercial projects, and infrastructure modernization. Rental options allow companies to deploy appropriate machinery for specific projects, optimizing costs and project timelines.

Mining and Industrial Adoption: Mining operators and industrial contractors are increasingly relying on rental services for rock breaking, trenching, and heavy-duty demolition tasks. Advanced hydraulic breakers enhance operational efficiency while minimizing downtime, particularly in regions experiencing growth in mining operations and raw material extraction.

Technological Advancements in Equipment: Modern hydraulic breakers feature improved impact energy, noise reduction, precision control, and compatibility with a variety of carriers including excavators and skid loaders. Smart monitoring and predictive maintenance solutions offered by rental providers increase uptime and safety, making rentals more attractive for project-based deployment.

Browse Full Report: https://www.factmr.com/report/hydraulic-breakers-rental-market

Regional Growth Highlights:

Asia Pacific: Leading the global demand, driven by rapid urbanization, large-scale infrastructure projects, and industrial expansion in countries such as China, India, and Australia.

North America: Consistent market growth is fueled by well-established construction and mining industries, strict safety regulations, and a preference for equipment rental over ownership.

Europe: Market expansion is supported by advanced construction practices, green building initiatives, and growing adoption of specialized demolition equipment.

Emerging Markets: Latin America, the Middle East, and Africa are witnessing increased adoption, bolstered by mining investments and oil & gas infrastructure projects.

Market Segmentation Insights:

By Type:

- Small (0-5t) – Dominates the market with 45% share, offering compact, versatile solutions for construction projects.

- Medium (5-15t) – Accounts for 35% share, used in mid-sized construction and mining applications.

- Large (>15t) – Represents 20% share, ideal for heavy-duty industrial applications.

By Application:

- Construction – Leading application segment with 50% market share.

- Mining – Growing demand in excavation and material handling.

- Demolition – Increasing adoption for specialized breaking solutions.

By End User:

- Contractors, Industrial Users, and Others benefiting from flexible rental models.

Challenges and Market Considerations:

- High maintenance and operational costs may limit adoption among small contractors.

- Limited availability of advanced breaker models can affect project execution.

- Equipment rental requires skilled operators and technical infrastructure for optimal performance.

Competitive Landscape:

The market is competitive, with major players emphasizing fleet expansion, modernization, and value-added services such as on-site support and operator training.

Key Players in the Hydraulic Breakers Rental Market:

- Epiroc AB

- Indeco Ind. S.p.A.

- Montabert S.A.S.

- Soosan Cebotics Co., Ltd.

- NPK Construction Equipment, Inc.

- Atlas Copco Group

- Furukawa Co., Ltd.

- J.C. Bamford Excavators Limited (JCB)

- Doosan Infracore Co., Ltd.

- Caterpillar Inc.

- Sandvik AB

- Stanley Infrastructure

- Brokk AB

- United Rentals, Inc.

- Boels Rental B.V.

Recent Developments:

- Leading players are expanding rental fleets and introducing high-performance hydraulic breakers with enhanced mobility, precision control, and noise reduction for urban construction sites.

- Strategic partnerships with construction contractors and mining companies are strengthening market presence in high-growth regions.

Future Outlook: Toward Flexible, Efficient, and Smart Rental Solutions

The next decade will see continued adoption of hydraulic breaker rental services, driven by construction modernization, mining expansion, and demand for flexible equipment solutions. Integration of smart technologies, predictive maintenance, and advanced breaker designs will further enhance operational efficiency and project outcomes. Companies prioritizing innovation, fleet optimization, and regional collaboration are poised to lead the market, delivering cost-effective, high-performance rental solutions globally.