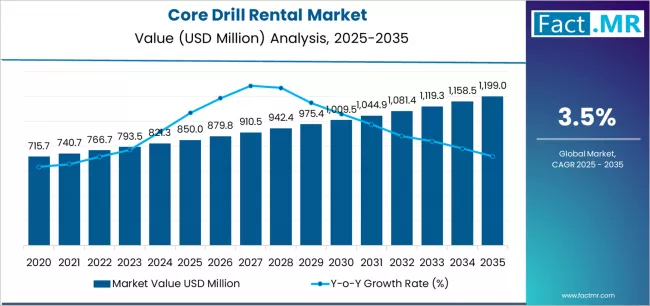

The global core drill rental market is on a steady growth path, fueled by increasing demand from construction, mining, and industrial sectors. According to a recent report by Fact.MR, the market is projected to grow from USD 850.0 million in 2025 to USD 1,199.0 million by 2035, representing a compound annual growth rate (CAGR) of 3.5% during the forecast period.

Core drills are widely used for precision drilling in concrete, masonry, and stone surfaces, offering high efficiency, safety, and cost-effectiveness. As infrastructure projects expand and industrial operations scale up, rental services for core drills are becoming a preferred solution for businesses seeking flexible and economical equipment access.

Strategic Market Drivers:

Expanding Construction and Infrastructure Projects: Ongoing urbanization and large-scale infrastructure development are key growth drivers for the core drill rental market. Core drills are essential for drilling in high-rise buildings, bridges, tunnels, and roads. Rental models provide companies with access to advanced equipment without the need for heavy capital investment.

Mining and Industrial Operations: The mining sector’s focus on efficiency and precision drilling has increased demand for core drill rentals. Rental services allow companies to access specialized equipment for geological exploration, mineral extraction, and industrial applications, optimizing operational costs while ensuring high-performance outcomes.

Technological Advancements and Equipment Innovation: Modern core drills are designed with enhanced durability, safety features, and ease of use. Rental providers increasingly offer advanced models with better control systems, water-cooled options, and low-vibration technology, enabling clients to improve productivity and reduce downtime.

Browse Full Report: https://www.factmr.com/report/core-drill-rental-market

Regional Growth Highlights

North America: Infrastructure Modernization and Construction Boom

The U.S. and Canada are witnessing steady market expansion due to urban development and industrial upgrades. The demand for rental core drills is particularly high among contractors and municipal projects seeking cost-effective, high-performance drilling solutions.

Europe: Regulatory Standards and Sustainable Practices

European countries such as Germany, France, and the U.K. are driving market growth through stringent safety and environmental regulations. Rental services are gaining traction as businesses look for compliant, efficient, and eco-friendly equipment solutions.

Asia-Pacific: Industrial Expansion and Urbanization

East Asian economies including China, Japan, and South Korea dominate demand in the region, supported by rapid urbanization, large-scale infrastructure projects, and industrial development. The region’s expanding construction and mining activities continue to bolster rental service adoption.

Emerging Markets: Latin America and Middle East Growth

Rapid infrastructure development, urban housing demand, and government-led projects in Latin America, the Middle East, and South Asia are creating high-potential markets. Rental solutions are preferred due to flexibility, lower upfront costs, and access to advanced equipment.

Market Segmentation Insights

By Type:

- Handheld Core Drills – Suitable for small to medium-scale drilling applications.

- Floor and Rig-Mounted Drills – Preferred for large-scale construction and industrial operations.

By End Use Industry:

- Construction – Leads market adoption for concrete drilling, roadworks, and building projects.

- Mining & Industrial – Increasing use in mineral exploration, production, and heavy machinery applications.

- Utilities & Infrastructure – Growing reliance on rental drills for pipeline installation, bridgeworks, and tunnels.

Challenges and Market Considerations:

- Equipment Maintenance Costs: Regular upkeep and repair of high-performance core drills can impact rental profitability.

- Fluctuating Steel and Raw Material Prices: Volatility affects equipment production costs and rental pricing strategies.

- Competition from Owned Equipment Models: Some businesses prefer purchasing core drills, challenging rental providers in cost-sensitive regions.

- Logistics and Supply Chain Constraints: Timely availability and transportation of heavy drilling equipment can pose operational challenges.

Competitive Landscape

The global core drill rental market is highly competitive, driven by innovation, service flexibility, and regional presence. Leading companies focus on expanding rental fleets, upgrading equipment, and providing value-added services.

Key Players in the Core Drill Rental Market:

- Hilti

- Husqvarna

- Bosch

- Makita

- DeWalt

- Milwaukee

- Dr. Schulze

- Tyrolit

- Eibenstock

- Blastrac

- Sunbelt

- Boels

- HSS

- Ashtead

- United Rentals

Recent Developments:

- 2024 – Hilti expanded its rental fleet in North America with advanced handheld and rig-mounted core drills for commercial and industrial projects.

- 2023 – United Rentals introduced a digital platform for real-time booking and tracking of rental equipment, enhancing operational efficiency for clients.

- 2023 – Husqvarna launched eco-friendly, low-vibration core drills for sustainable construction practices, available through rental services.

Future Outlook: Flexible and Technology-Driven Growth

The core drill rental market is expected to witness steady growth in the coming decade, driven by infrastructure development, industrial expansion, and technological advancements. The integration of IoT-enabled equipment, digital rental management platforms, and eco-friendly drills will shape the market’s evolution. Companies prioritizing innovation, service flexibility, and regional partnerships are well-positioned to lead the next phase of growth, delivering high-performance drilling solutions across construction, mining, and industria