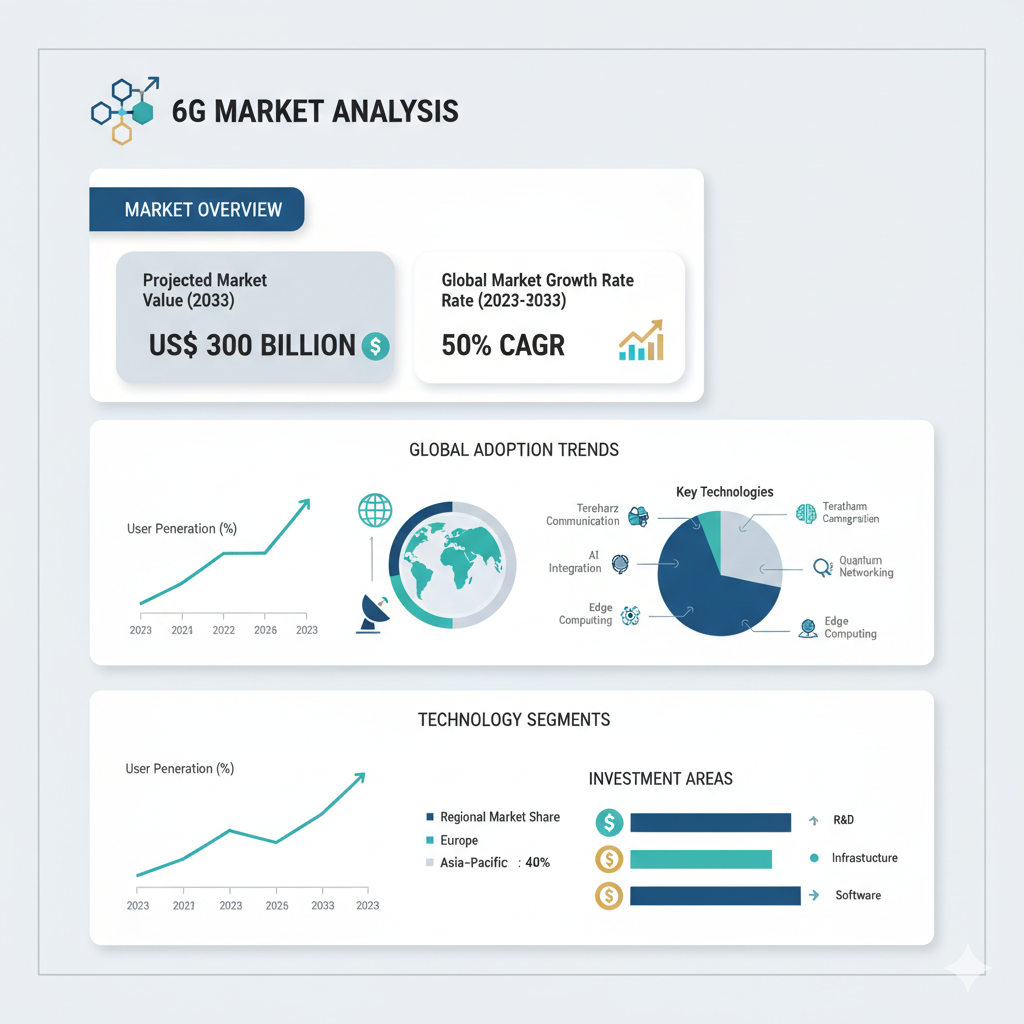

The global 6G market is charting one of the steepest growth trajectories among emerging technologies. In 2023, the market is valued at US$ 5 billion, and it is forecast to balloon to US$ 300 billion by 2033, growing at an astonishing CAGR of 50 percent over the 2023–2033 period. This remarkable expansion underscores the transformative potential of 6G technologies, which promise ultra-high speeds, ultra-low latency, and pervasive connectivity capable of powering entirely new classes of applications across industries.

Application-Wise 6G Market Trends and Drivers

One of the most compelling aspects of the 6G outlook is how the market is expected to be segmented by applications, each unlocking distinct use cases and value pools. The 6G market can be analyzed across Multisensory XR Applications, Connected Robotics & Autonomous Systems (CRAS), Wireless Brain-Computer Interactions (BCI), Digital Twins, Smart Cities, and Others.

Multisensory XR Applications, which combine haptics, visuals, and audio, are expected to lead the market as immersive experiences demand extremely high bandwidth and ultra-low latency that 5G cannot consistently deliver. Connected Robotics and Autonomous Systems will also see significant growth as 6G enables deterministic, real-time communication for precise control and coordination in industrial, logistics, and transportation applications.

Wireless Brain-Computer Interactions represent a frontier use case that could revolutionize human–machine communication. With 6G’s ultra-low latency and high reliability, brain-machine interfaces could enable neural augmentation and advanced assistive technologies. Similarly, Digital Twins—real-time virtual replicas of physical systems such as cities, factories, and infrastructure—will depend heavily on 6G to synchronize massive streams of sensor data and run predictive simulations with near-instant responsiveness.

Smart Cities are poised to benefit substantially from 6G, leveraging it to integrate autonomous transport, energy management, distributed sensing, and public safety networks into a unified infrastructure. As these systems become increasingly AI-driven, 6G’s speed and reliability will serve as the digital backbone for urban innovation. Beyond these major categories, additional applications such as the Internet of Everything (IoE) and blockchain-based systems will emerge as part of the “Others” segment, expanding the reach of 6G into new frontiers.

Across these segments, key growth drivers include rising demand for real-time interactivity, the convergence of artificial intelligence with edge computing, and the need for deterministic service-level guarantees. The wireless infrastructure and service segments are likely to witness heightened investment as hardware deployment and network orchestration expand globally.

Recent Developments and Competitive Dynamics

While commercial deployment of 6G remains several years away, the competitive landscape is rapidly evolving through research collaborations, partnerships, and strategic investments. Leading telecom operators, technology firms, and academic institutions are joining forces to accelerate 6G innovation. Companies such as Samsung, Nokia, Huawei, Qualcomm, Ericsson, and Intel are heavily investing in R&D to establish technological leadership. In parallel, partnerships between telecom operators and cloud providers are forming the foundation for future 6G testbeds and experimental networks.

In Asia, countries like China, South Korea, and Japan are spearheading early-stage research and spectrum trials. China, in particular, has positioned itself as a frontrunner in the 6G race, emphasizing aggressive research programs, standardization efforts, and satellite-based communication systems. Meanwhile, North American and European players are focusing on open network architectures, energy efficiency, and sustainable deployment strategies.

The competitive ecosystem is further strengthened by collaborations between universities, research centers, and private enterprises. These efforts are fostering advances in terahertz communication, AI-driven network management, and digital twin modeling—key enablers of the 6G era. Companies such as Apple, Google, AT&T, Verizon, and LG are also exploring new applications and services that will leverage the unparalleled capabilities of 6G once it becomes commercially available.

As competition intensifies, firms are not only racing to master hardware and radio design but also striving to build complete ecosystems. The future winners will be those capable of integrating connectivity, computing, and AI into end-to-end solutions tailored for industries such as healthcare, manufacturing, and smart mobility.

Outlook and Strategic Imperatives

As the 6G market matures, several strategic imperatives will shape its future direction. Cross-domain partnerships between telecom operators, chipmakers, cloud firms, and application developers will be essential to unlock the full potential of 6G. The focus will shift from building standalone networks to creating interconnected ecosystems that deliver vertical-specific solutions.

Establishing leadership in standardization and testbed development will be critical to securing early advantages, while managing challenges related to spectrum allocation, cost, and energy efficiency will define long-term competitiveness. Companies must also prioritize robust cybersecurity and privacy frameworks to build trust in a hyper-connected world.