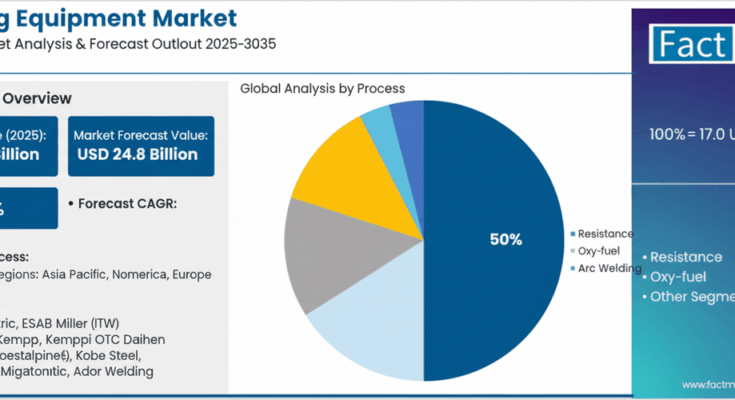

The global welding equipment market is poised for substantial growth over the next decade, with projections indicating an increase from USD 17.0 billion in 2025 to USD 24.8 billion by 2035, representing a CAGR of 3.8%. This growth is fueled by the rising demand for advanced welding technologies in construction, automotive, and shipbuilding industries, coupled with the increasing adoption of automated and precision welding systems worldwide.

Welding Equipment Market Overview and Key Drivers

The welding equipment market is experiencing momentum due to global infrastructure development projects, industrial automation, and modernization of manufacturing facilities. Modern welding equipment offers 85-95% efficiency improvements over traditional methods, enabling manufacturers to achieve higher productivity, consistent quality, and compliance with stringent regulatory standards.

The market’s growth is further supported by government initiatives promoting advanced manufacturing and infrastructure expansion, as well as ongoing technological innovations in arc, laser, and hybrid welding processes. These advancements allow manufacturers to optimize fabrication workflows without extensive infrastructure modifications, meeting the increasing demand for precision joining across diverse industrial applications.

Welding Equipment Market Forecast and Segmental Insights

Between 2025 and 2030, the market is expected to grow from USD 17.0 billion to USD 20.6 billion, accounting for 46.2% of the decade’s growth. This phase will be shaped by infrastructure projects, robotics-enabled welding systems, and the integration of intelligent manufacturing platforms. From 2030 to 2035, the market is projected to reach USD 24.8 billion, contributing 53.8% of overall growth, driven by specialized laser welding technologies, integrated automation solutions, and energy-efficient equipment deployment.

Welding Equipment Market By Process:

- Arc Welding dominates the market, capturing approximately 50% of market share in 2025. Advanced arc welding systems offer multi-material compatibility, superior weld penetration, and automation integration.

- Resistance Welding holds 20%, optimized for high-volume automated applications.

- Laser/Hybrid Welding accounts for 15%, while oxy-fuel and others make up 10% and 5%, respectively.

Welding Equipment Market By End Use:

- Construction leads with 35% market share, fueled by urbanization and large-scale infrastructure projects.

- Automotive follows at 25%, with demand for high-quality, standardized equipment.

- Shipbuilding and machinery contribute 20% and 15%, respectively, while other sectors account for 5%.

Welding Equipment Market By Power Source:

- Inverter-based systems dominate at 60% market share, offering superior energy efficiency and portability.

- Transformer-based systems maintain 40%, providing reliability for heavy-duty industrial applications.

Welding Equipment Market Regional Insights

Asia-Pacific leads global adoption, driven by India and China:

- India is projected to grow at 5.2% CAGR, supported by government-backed construction programs and industrial modernization under initiatives like Make in India. Key hubs include Mumbai, Chennai, Pune, and Delhi.

- China follows at 4.5% CAGR, with major industrial centers such as Shanghai, Beijing, Guangzhou, and Tianjin focusing on industrial automation and advanced welding adoption.

North America and Europe maintain steady growth:

- USA grows at 3.3%, anchored by manufacturing modernization and infrastructure renewal programs.

- Germany leads Europe at 3.5% CAGR, emphasizing precision welding and automated systems integration. Other European nations, including UK, France, Italy, and Spain, collectively contribute significant market shares, driven by manufacturing upgrades and infrastructure projects.

Latin America (Mexico) demonstrates 3.8% CAGR, while South Korea (3.1%) and Japan (2.6%) focus on automation, advanced welding integration, and precision manufacturing.

Competitive Landscape

The market is moderately concentrated, with the top three players controlling 30-40% of global share. Key market leaders include:

- Lincoln Electric – 12% market share, leveraging global service networks and advanced welding portfolios.

- ESAB and Fronius – strong expertise in industrial automation and welding solutions.

Other notable competitors include Miller (ITW), Panasonic, Kemppi, OTC Daihen, Hyundai Welding, Bohler (voestalpine), Air Liquide, Jasic, Kobe Steel, Victor Tech, Migatronic, and Ador Welding. Companies focus on technological innovation, service capabilities, and integrated solutions to maintain competitiveness.

Welding Equipment Market Opportunities and Industry Outlook

The welding equipment market presents compelling opportunities for industry leaders and manufacturers:

- Infrastructure Development: Urbanization and large-scale construction projects create steady demand for welding systems.

- Automation Integration: Advanced robotic welding platforms improve productivity, reduce labor dependence, and enhance precision.

- Technology Upgradation: Investment in inverter-based, laser, and hybrid systems can offer significant operational advantages.

- Government and Policy Support: Tax incentives, R&D grants, and industrial development programs facilitate equipment adoption and local manufacturing.

Strategic Recommendations

Welding Equipment Market Industry stakeholders can capitalize on market growth by focusing on:

- Advanced Equipment Development – Enhance energy efficiency, automation capabilities, and application-specific features.

- Service and Support Networks – Strengthen technical training, equipment optimization, and global service capabilities.

- Technology Integration – Offer software-enabled predictive maintenance, real-time monitoring, and quality control solutions.

- Collaborative R&D – Partner with research institutions and industrial leaders to develop next-generation welding solutions.

Conclusion

As the global welding equipment market expands from USD 17.0 billion in 2025 to USD 24.8 billion by 2035, industry leaders have the opportunity to leverage technological innovation, advanced automation, and infrastructure growth to strengthen market presence. Companies that combine high-performance equipment, integrated services, and strategic partnerships will remain at the forefront of this evolving industrial landscape, enabling manufacturers worldwide to enhance production efficiency, precision, and compliance with global standards.