The helical gear industry in the United States is witnessing steady growth, driven by rising industrial automation, expanding manufacturing sectors, and increasing demand for high-performance power transmission solutions. Helical gears, characterized by their angled teeth, provide smooth and efficient torque transmission with lower noise and vibration compared to spur gears. They are widely used across automotive, aerospace, industrial machinery, robotics, and energy sectors due to their durability, load-bearing capacity, and efficiency.

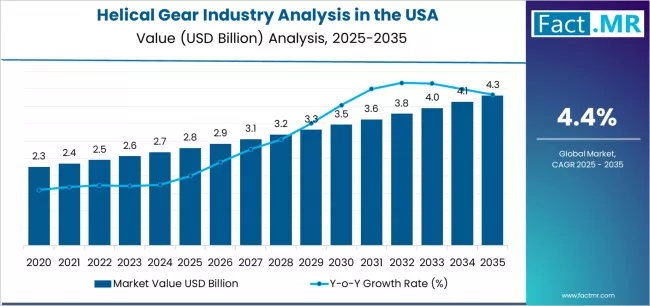

As of 2025, the U.S. helical gear market is estimated at approximately USD 3.7 billion, with projections suggesting growth to around USD 6.3 billion by 2035, reflecting a compound annual growth rate (CAGR) of about 5.3% over the next decade. Market growth is fueled by increasing automation, demand for precision machinery, and investments in energy-efficient industrial solutions.

Key Market Highlights (2025 Baseline)

-

Market Value (2025): ~ USD 3.7 billion

-

Forecast Value (2035): ~ USD 6.3 billion

-

Forecast CAGR (2025–2035): ~ 5.3%

-

Leading End-Use Segment: Automotive (~ 34% share in 2025)

-

Dominant Gear Type: Standard helical gears (~ 58% share in 2025)

-

High-Growth Applications: Industrial machinery, robotics, wind turbines

-

Top Regional Focus: United States

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=11956

Growth Drivers & Market Momentum

Rising Industrial Automation

The adoption of automated machinery and robotics in manufacturing is driving demand for precision power transmission components, including helical gears. These gears are crucial in ensuring reliable, smooth, and efficient operation of conveyor systems, robotic arms, and automated assembly lines.

Automotive Industry Demand

Helical gears are extensively used in automotive transmissions, powertrains, and differential systems due to their ability to handle high torque and minimize noise and vibration. Growth in the automotive sector, including electric vehicle (EV) production, is boosting demand for lightweight, high-efficiency gear solutions.

Advancements in Manufacturing Technology

Technological innovations in gear cutting, finishing, and heat treatment processes enhance gear strength, efficiency, and durability. The integration of CNC machining and additive manufacturing allows manufacturers to produce precise, high-quality helical gears tailored for complex industrial and automotive applications.

Renewable Energy & Wind Turbine Applications

The push toward renewable energy sources, particularly wind power, has increased demand for high-performance helical gears in wind turbines. These gears are critical for efficient energy transfer and reliability in large-scale wind applications.

Regional Market Dynamics

The United States remains a major market due to its established manufacturing base, advanced automotive industry, and investment in industrial automation. Growth is also supported by technological adoption, skilled labor availability, and government initiatives promoting advanced manufacturing.

Challenges & Market Constraints

-

High Manufacturing Costs: Precision helical gears require advanced machining, heat treatment, and quality control, which can increase production costs.

-

Skilled Labor Shortage: Specialized expertise is necessary for gear design, production, and maintenance, and shortages can limit production capacity.

-

Competition from Alternative Gear Types: In specific applications, bevel, planetary, or spur gears may compete with helical gears, particularly where lower noise and vibration are less critical.

-

Raw Material Price Fluctuations: Volatility in steel and alloy prices can impact manufacturing costs and overall market pricing.

Strategic Recommendations

For Gear Manufacturers

-

Invest in R&D for lightweight, high-strength, and energy-efficient helical gears tailored for automotive, industrial machinery, and renewable energy applications.

-

Expand production capabilities with advanced CNC machining, finishing, and heat-treatment technologies to ensure precision and quality.

-

Offer technical support and maintenance services to enhance customer satisfaction and gear lifespan.

For End-Use Industries

-

Integrate helical gears in automated machinery, EV transmissions, and wind turbine systems to improve efficiency and reliability.

-

Focus on preventive maintenance and quality inspection to maximize performance and minimize operational downtime.

For Investors & Market Entrants

-

Recognize helical gears as a high-demand segment within power transmission, automotive, and industrial automation markets.

-

Explore opportunities in electric vehicle transmissions, robotics, and renewable energy applications.

-

Leverage innovation in lightweight alloys, coatings, and precision machining to differentiate products in a competitive market.

Market Outlook to 2035

By 2035, the U.S. helical gear market is expected to reach approximately USD 6.3 billion, driven by growing automation, automotive electrification, and renewable energy adoption. Standard helical gears are projected to dominate the market, while specialty and precision gears will capture increasing shares in robotics, aerospace, and wind power applications.

Manufacturers that focus on technological innovation, energy efficiency, precision engineering, and strong customer support are expected to gain a competitive advantage. With rising demand for high-performance, reliable, and low-noise gear solutions, helical gears will remain a critical component of industrial and automotive power transmission systems in the United States over the next decade.

Browse Full Report: https://www.factmr.com/report/united-states-helical-gear-industry-analysis