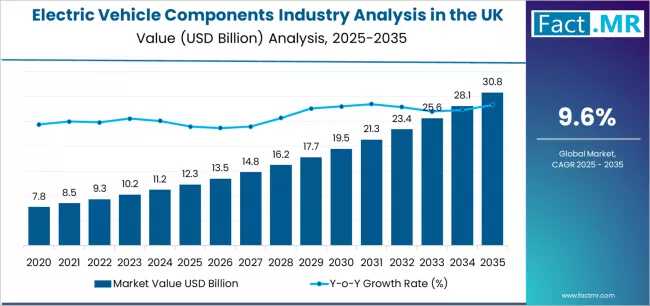

The UK electric vehicle (EV) components industry is on track for remarkable growth, with market revenue expected to increase from USD 12.3 billion in 2025 to USD 30.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 9.6% over the next decade.

This expansion is fueled by surging demand for battery packs, power electronics, and e-drivetrain systems, driven by record-breaking EV adoption across the UK and supportive regulatory policies aimed at phasing out internal combustion engine vehicles by 2030.

EV Adoption Driving Component Demand

EV registrations in the UK reached 381,970 units in 2024, representing a 19.6% share of new car sales, up from 14.5% in 2023, according to S&P Global. Monthly data for early 2025 shows battery electric vehicles (BEVs) capturing 20.4% of new-car registrations, up from 16.9% in April 2024.

Consumer intent further supports long-term growth: 70% of UK respondents indicated plans to purchase an electric vehicle within the next five years This growing EV fleet is translating into rising demand for key components, including:

-

Battery systems & packs – largest category, projected to account for 44% of component market share in 2025.

-

Power electronics/inverters – essential for EV efficiency, expected to grow at CAGR 10.2% through 2035.

-

Electric motors and e-axles – representing 18% of total component demand in 2025, with continued growth as vehicle electrification accelerates.

Segment and Application Insights

Passenger EVs dominate component demand, contributing 72% of total UK EV component revenue in 2025, while commercial vehicles account for 28%.

Regionally, England is the leading market, projected at 10% CAGR from 2025–2035, followed by Scotland (9.2%), Wales (8.8%), and Northern Ireland (8.2%). This regional spread reflects both concentrated EV adoption and local manufacturing investments.

Industry Drivers

-

Policy Support – The UK government’s zero-emission vehicle targets, including the ban on petrol and diesel new car sales by 2030, continue to drive component demand.

-

Technology Innovation – Advances in battery chemistry, inverter efficiency, and e-motor designs are creating demand for next-generation components.

-

Fleet Electrification – Growing public and private fleet electrification supports aftermarket and replacement component markets.

-

Infrastructure Expansion – Increased charging stations and incentives for residential and workplace charging contribute to EV adoption.

Challenges in Supply Chain and Cost Management

Despite strong growth, the UK EV component sector faces hurdles:

-

Supply chain dependency – Lithium, cobalt, and rare-earth imports remain critical; domestic production of battery cells covers less than 15% of UK demand.

-

Raw material volatility – Lithium carbonate prices increased by 23% year-on-year in 2024, impacting production costs.

-

Manufacturing capacity constraints – Scaling local production of e-axles, inverters, and battery packs is essential to meet projected demand.

Opportunities for Stakeholders

-

Manufacturers – Opportunities to invest in domestic battery assembly, e-motor production, and advanced power electronics.

-

Investors – Potential returns from the fastest-growing segments: battery packs and inverters, projected to collectively represent 62% of revenue by 2030.

-

Policymakers – Data indicates that supportive industrial policy and supply chain incentives can accelerate domestic component production, reduce imports, and create jobs.

Forecast: 2025–2035

-

Total market size: USD 12.3 billion → USD 30.8 billion

-

CAGR: 9.6%

-

Battery packs market share: 44% in 2025, 46% in 2030

-

Passenger EV component demand: 72% of total in 2025

-

Regional CAGR: England 10.0%, Scotland 9.2%, Wales 8.8%, Northern Ireland 8.2%

This decade-long growth trajectory confirms that the UK EV components industry is entering a transformative phase, with substantial opportunities for investors, manufacturers, and policymakers to benefit from the shift toward zero-emission transport.

Browse Full Report : https://www.factmr.com/report/united-kingdom-electric-vehicle-components-industry-analysis