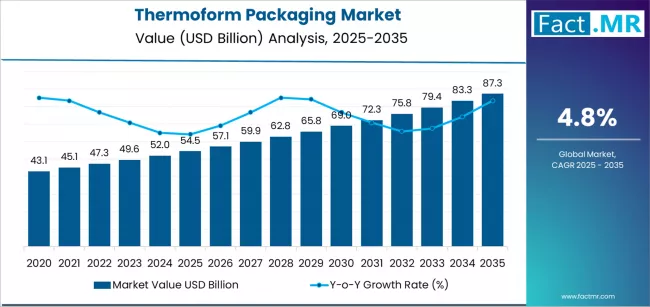

The global thermoform packaging market is currently witnessing robust growth, fuelled by surging demand for lightweight, cost-effective, and visually appealing packaging, especially in food & beverage, pharmaceuticals, and consumer goods sectors. Thermoform packaging—which involves heating plastic sheets to shape them into containers, trays, blisters, or clamshells—offers a strong mix of performance, design flexibility, and supply chain efficiency. According to recent intelligence, the market is expected to grow from USD 54.5 billion in 2025 to about USD 87.3 billion by 2035, achieving a CAGR of around 4.8%.

Key Market Highlights

-

2025 Market Size: USD 54.5 billion

-

2035 Forecast: USD 87.3 billion

-

Projected CAGR (2025–2035): ~ 4.8%

-

Dominant Material: PET (about 38% of the market)

-

Top End-Use Sector: Food & Beverage (approx. 48%)

-

Major Players: Pactiv, Amcor, Sonoco, Placon, Display Pack

-

Leading Regions: Asia Pacific, North America, Europe

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=8194

Major Growth Drivers

1. Changing Food & Beverage Consumption Patterns

The rise of on-the-go meals, ready-to-eat food, and single-serve portions is significantly driving demand for thermoformed trays and containers. These formats offer both protection and product visibility, making them highly compatible with modern retail and meal-kit channels.

2. Boom in E-commerce & Delivery Services

E-commerce expansion and a surge in home delivery services (especially for food and personal care) are pushing brands to adopt thermoform packaging. Its lightweight nature and capacity for secure, clear presentation make it ideal for transport and shelf visibility.

3. Sustainability & Recycling Pressure

As regulators and consumers demand greener packaging, thermoforming players are investing in recyclable materials like rPET and bio-based plastics. These eco-friendly innovations are helping brands reduce environmental footprint without sacrificing performance.

4. Technology Advances in Thermoforming

Automation, improved thermoforming machinery, and digitalization are enabling faster production, better precision, and lower material waste. This makes thermoform packaging more cost-efficient and scalable for large volumes.

5. Pharmaceutical & Healthcare Demand

Thermoform blister packaging remains a staple in the pharmaceutical world. The need for unit-dose packaging, sterility, and tamper-evidence continues to support growth in the blister and medical tray segments.

Challenges & Risks

-

Plastic Waste & Regulatory Scrutiny: Growing concerns about plastic pollution, coupled with tighter regulations, could restrict growth unless thermoformers accelerate recycling efforts.

-

Raw Material Price Fluctuations: Volatility in resins like PET and PP can squeeze margins, especially for producers relying on virgin polymers.

-

Energy-Intensive Manufacturing: Thermoforming processes consume substantial energy, making sustainability and cost-efficiency key challenges.

-

Design Limits vs. Alternatives: While thermoforming is very flexible, in some high-barrier or highly complex packaging applications, other technologies (like injection-molded or multi-layer packaging) could compete.

Competitive Landscape & Strategic Moves

Major global players in the thermoform packaging market are executing a range of strategies to strengthen their positions:

-

Sustainable Material Innovation: Leading firms are developing rPET, bio-based plastics, and recyclable mono-material thermoforms.

-

Process & Equipment Upgrades: Companies are investing in advanced thermoforming machines with better energy efficiency, higher automation, and improved cycle times.

-

Partnerships with Consumer Brands: Packaging companies are working closely with food, pharma, and consumer goods brands to co-design containers that balance protection, cost, and aesthetics.

-

Circular Economy Initiatives: There is a rising focus on collection and recycling systems, especially for thermoformed PET, to close the loop on packaging waste.

Strategic Recommendations

-

Accelerate Recycled and Bio-Based Usage: Prioritize R&D in high-performance recycled and bio-materials to meet sustainability goals without compromising quality.

-

Optimize for E-commerce: Design thermoform packaging to be robust, stackable, and protective for shipping, while still being lightweight.

-

Invest in Automation: Modernize thermoforming lines with automated trimming, stacking, and quality-control systems to reduce waste and labor costs.

-

Collaborate with Brands: Work with consumer-packaged goods (CPG) companies to create customized thermoform formats that improve visibility and align with brand identity.

-

Promote Recycling Infrastructure: Partner with waste management and recycling companies to improve take-back and recycling of thermoformed packaging, especially PET.

Market Outlook

The thermoform packaging market is well-positioned for healthy growth over the next decade. With an expected value of USD 87.3 billion by 2035, the market’s 4.8% CAGR points to a sustained opportunity driven by consumer convenience, packaging sustainability, and process innovation.

Companies that align with global sustainability trends, invest in next-generation materials, and scale efficient production will likely capture the most value. As the packaging landscape evolves, thermoforming is emerging as an essential technology—not just for protection and presentation, but as a backbone for modern, circular packaging ecosystems.

Browse Full Report: https://www.factmr.com/report/thermoform-packaging-market