The nano-ceramic coatings market in the United States is poised for strong growth, driven by increasing demand for high-performance surface protection, technological innovation in coatings, and broadening applications across automotive, industrial, and aerospace sectors. As U.S. manufacturers and consumers push for greater durability, thermal resistance, and sustainability, nano-ceramic coatings are emerging as a critical enabling technology.

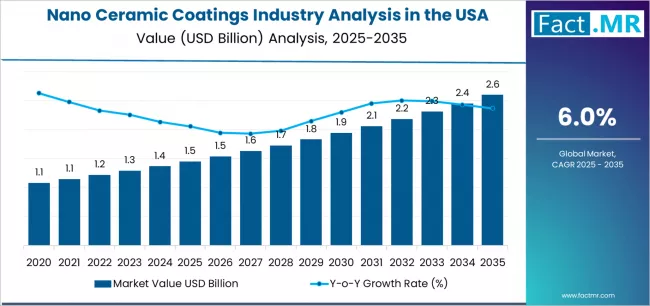

According to recent market intelligence, global nano-ceramic coatings revenues are expected to nearly double over the next decade, with strong contributions from the U.S. market. Several factors, including the need for longer equipment lifetimes, cost reductions in maintenance, and premium protection for consumer and industrial assets, are powering this momentum.

Key Market Highlights for the U.S.

-

Market Growth Outlook: The U.S. nano-ceramic coatings segment is growing rapidly, reflecting the broader North American trend in advanced nanocoatings.

-

CAGR Expectations: Estimates for U.S.-specific growth put the sector at a double-digit CAGR through the late 2020s, especially driven by demand in automotive, aerospace, and industrial markets.

-

Leading Applications:

-

Automotive: Aftermarket protection, engine components, trim parts

-

Industrial / Manufacturing: Machinery, tools, wear-resistant parts

-

Aerospace: Thermal barrier coatings and protection of high-temperature parts

-

-

Key Drivers: Thermal resistance, corrosion protection, hydrophobic (self-cleaning) surfaces, scratch resistance

-

Regulatory & Sustainability Trends: Growing adoption of low-VOC, environmentally friendly coating solutions aligns with regulatory pressures.

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=11844

Growth Drivers & Market Catalysts

1. Automotive Aftermarket & OEM Demand

In the United States, the automotive aftermarket is a major driver for nano-ceramic coatings. Car owners increasingly prefer ceramic layers to protect paint, reduce micro-scratches, and maintain gloss. Meanwhile, OEMs are exploring these coatings for under-the-hood components, helping increase thermal stability and reduce wear.

2. Industrial Equipment Longevity

U.S. manufacturers are under strong pressure to optimize equipment uptime and reduce total cost of ownership. Nano-ceramic coatings—because of their high hardness, wear resistance, and chemical stability—are being used on cutting tools, gears, and other components. The result: fewer replacements, less downtime, and better lifecycle cost control.

3. Aerospace & High-Temperature Applications

The aerospace industry, particularly in the U.S., is a significant end user of nano-ceramic coatings for thermal barrier applications. These coatings help protect turbine components, exhaust systems, and high-heat structures, offering both durability and thermal insulation.

4. Electronics & Miniaturization

Miniaturized electronics, high-frequency devices, and sensitive components require coatings that are ultra-thin yet protective. Nano-ceramic coatings offer dielectric, thermal, and protective properties without adding bulk, making them attractive for advanced electronics and semiconductor applications.

5. Sustainability & Regulatory Pressure

Consumers and industry players are increasingly prioritizing eco-friendly coatings. Nano-ceramic coatings that are water-based or low in volatile organic compounds (VOCs) are gaining favor, especially because of tighter environmental regulations in the U.S.

Challenges & Risks

-

High Cost of Materials & Application: Producing and applying nano-ceramic coatings requires specialized equipment, precision, and skilled labor, making costs significantly higher than for conventional coatings.

-

Process Complexity: Maintaining consistent nano-scale structure and uniform application over complex surfaces is technically demanding, which could limit adoption among smaller players.

-

Health & Safety Considerations: Nanoparticles pose potential safety risks during manufacture and application. Regulatory oversight and safe handling protocols are essential, but may increase operational costs.

-

Technology Awareness & Adoption: Not all end-users fully appreciate the long-term value of nano-ceramic coatings, particularly where upfront cost is significantly higher than traditional paint or polymer coatings.

Competitive Landscape & Strategic Positioning

Key coating manufacturers, nanomaterial companies, and surface treatment firms in the U.S. are positioning themselves aggressively:

-

R&D Investments: Companies are developing newer formulations that combine ceramic nanoparticles with other materials to enhance performance and reduce cost.

-

Application Partnerships: Coating firms are collaborating with OEMs in automotive, aerospace, and industrial machinery sectors to embed nano-ceramic coatings into design and manufacturing.

-

Sustainable Product Lines: There is a push toward low-VOC, water-based, or eco-friendly nano-ceramic coatings to satisfy regulatory and consumer-driven sustainability priorities.

-

Service-Based Models: Some companies are offering “coating-as-a-service” — applying coatings for customers on parts rather than selling only the coating materials.

Strategic Recommendations

-

Promote Cost-Performance Value: Educate OEMs and large industrial users about the long-term cost savings (lifetime, maintenance) of nano-ceramic coatings compared to traditional alternatives.

-

Invest in Application Infrastructure: Build or partner with specialist coating facilities in the U.S. capable of handling nano-scale ceramic deposition for large and complex parts.

-

Develop Green Coatings: Accelerate R&D on low-VOC, water-based nano-ceramic coatings to align with U.S. regulatory trends and sustainability goals.

-

Enhance Safety Protocols: Establish robust health and safety guidelines for nanoparticle handling, application, and disposal to build trust in coatings among manufacturers and regulators.

-

Target High-Value Segments: Focus on applications like aerospace thermal barriers, industrial wear parts, and specialty automotive components where performance benefits justify premium price.

Market Outlook

The nano-ceramic coatings market in the U.S. is well-positioned for strong growth over the next decade. With rising demand in automotive, aerospace, and industrial sectors, and increasing regulatory and consumer emphasis on durability and sustainability, nano-ceramic coatings are emerging as a technology of choice.

Companies that can combine material innovation, application expertise, and a sustainability-first philosophy are likely to lead the U.S. market. As the adoption of nano-ceramic coatings expands, they will closely inform manufacturing resilience, equipment lifespan, and performance standards across multiple industries.

Browse Full Report: https://www.factmr.com/report/united-states-nano-ceramic-coatings-industry-analysis