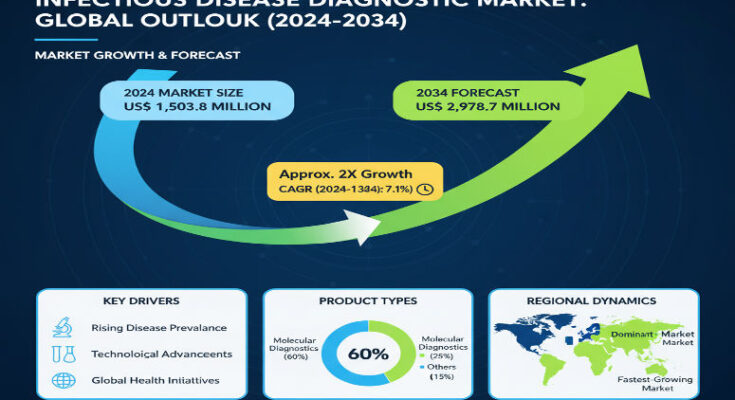

Infectious diseases continue to challenge global public health, with factors like emerging pathogens, antimicrobial resistance, and environmental change driving urgency for better diagnostics. The Infectious Disease Diagnostic Market is expanding rapidly, not just because of pandemics, but due to persistent endemic diseases, public health programs, and technological advances that allow earlier, faster, and more precise detection. In 2024, the market is estimated to be worth approximately US$ 1,503.8 million, and is forecast to reach about US$ 2,987.7 million by 2034, growing at a compound annual growth rate (CAGR) of around 7.1%.

Growth Drivers & Key Trends

Among the major forces fueling market growth are the adoption of Point-of-Care Testing (POCT), which shifts diagnosis closer to patients and speeds decision-making; advances in Next-Generation Sequencing (NGS) technologies that enable broader surveillance and richer pathogen profiling; and growing concern about antimicrobial resistance, demanding diagnostics that can identify drug-resistant strains quickly. There is also rising demand for Rapid Diagnostic Tests (RDTs) to meet needs in both resource-limited settings and urban healthcare systems. Preventive health strategies, zoonotic disease emergence, global health security priorities, and improved diagnostic instruments are also key momentum factors.

Segmentation & Leading Techniques

Among disease indications, sexually transmitted diseases (STDs) represent one of the fastest-growing segments, forecast to rise at a CAGR of about 8.3%, reflecting both improved testing access and greater awareness. Among diagnostic techniques, cell culture is projected to be highly significant, also growing at about 8.3% CAGR. Other techniques such as molecular diagnostics, immunoassays, and clinical microbiology continue to contribute strongly.

Regional Insights: North America & East Asia

North America holds a commanding share of the market, roughly 20.9% in 2024, with steady demand driven by well-established healthcare infrastructure, regulatory support, and strong R&D investment. In the U.S., emphasis on preventive healthcare, reimbursement policies favoring early diagnostics, and healthcare spending are helping sustain growth at a healthy pace.

East Asia is emerging as a high-growth region, accounting for about 17.7% of the 2024 market. Countries in this region are seeing strong interest in diagnostics driven by rising awareness, government programs, and increasing adoption of advanced diagnostic technologies. In particular, China is forecast to grow at a higher CAGR (≈ 8.7%) through 2034, reflecting both population scale and accelerating investment in healthcare infrastructure.

Key Players & Competitive Landscape

Major companies active in the infectious disease diagnostics market include Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific, bioMérieux, Becton, Dickinson & Company, Cepheid (Danaher), Hologic, QIAGEN, Bio-Rad Laboratories, Luminex, Ortho Clinical Diagnostics, DiaSorin, Meridian Bioscience, and GenMark Diagnostics. These firms are competing on the basis of test accuracy, speed, cost, usability (especially in POCT), regulatory compliance, and global distribution. Many are also investing in R&D to expand capabilities in NGS, multiplex diagnostics, and rapid/portable testing formats.

Recent Developments

Recent years have seen several noteworthy advances. The growth of rapid test panels, improved molecular assays, and multiplexed platforms is enabling faster detection of multiple pathogens from fewer samples. Some companies have introduced AI-enhanced diagnostic platforms that help in interpreting complex results and enabling real-time infectious disease surveillance. There has also been expansion of diagnostic capacity in emerging markets, with efforts to deploy more POCT, improve lab networks, and provide access to lower-cost, robust diagnostics. The focus on diagnostic tests that can identify and differentiate antibiotic-resistant strains is also increasing.

Challenges & Restraints

Despite the optimism, there are several challenges. Disparities in healthcare infrastructure globally mean access to high-end diagnostics remains uneven. Cost barriers, both in terms of product cost and cost of deployment (training, lab equipment, logistics), limit reach in lower-income regions. Regulatory requirements and approval pathways, which vary by country, can slow market entry. In addition, the evolving nature of pathogens (mutation, resistance) requires diagnostics to adapt continuously. There are also concerns around test specificity, false positives/negatives, supply chain reliability for reagents and consumables, and maintaining quality in decentralised settings.

Browse Full Report: https://www.factmr.com/report/infectious-disease-diagnostic-market

Outlook & Strategic Implications

Looking ahead, the Infectious Disease Diagnostic Market is positioned for sustained growth through 2034. Companies that emphasize rapid, accurate, portable diagnostics will likely lead. Investments in molecular testing platforms, multiplex assays, and diagnostics tailored for AMR and zoonotic threats will be competitive differentiators. For healthcare systems, integrating diagnostics into preventive care, improving surveillance systems, and expanding POCT availability will be critical. Also, regions such as East Asia, Latin America, and parts of Asia-Pacific are likely to exhibit higher growth rates compared to more mature markets, provided they address infrastructure and regulatory challenges.