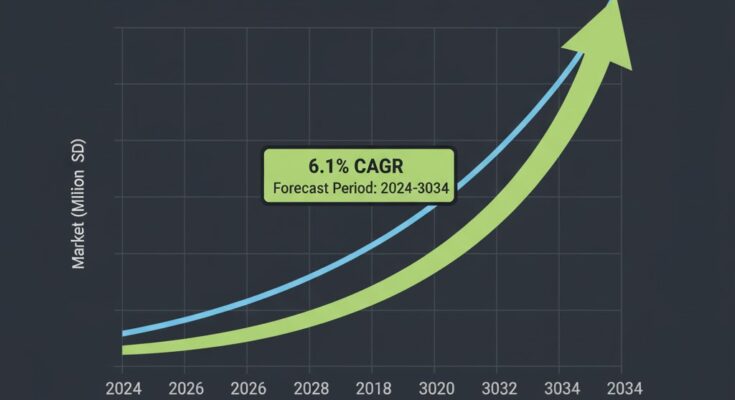

According to a recent report by Fact.MR, the global high content screening market is projected to grow significantly from USD 1,979.9 million in 2024 to USD 3,570.0 million by 2034, registering a CAGR of 6.1% over the forecast period. The market’s expansion is driven by growing applications in drug discovery, toxicology studies, and precision medicine, alongside the integration of automation and artificial intelligence (AI) technologies in cell-based imaging systems.

Strategic Market Drivers

The high content screening industry’s momentum stems from a convergence of technological advancements, pharmaceutical R&D investment, and demand for predictive cellular models:

- Accelerated Drug Discovery and Development:

High content screening plays a pivotal role in modern drug discovery workflows by combining advanced microscopy with quantitative image analysis. As pharmaceutical companies intensify their search for novel therapeutics, HCS systems enable rapid screening of thousands of compounds for efficacy and toxicity at the cellular level. - Integration of AI and Automation:

Artificial intelligence and machine learning are revolutionizing image analysis in HCS. Automated pattern recognition, deep learning-based segmentation, and AI-driven data interpretation enhance accuracy and reduce human error, enabling faster decision-making in early-stage drug development. - Advancements in Cell Biology and Personalized Medicine:

The adoption of 3D cell cultures, stem cell–based assays, and organ-on-chip technologies is boosting demand for high content screening platforms. These systems provide a realistic cellular microenvironment, supporting more predictive models for personalized drug testing and disease modeling. - Rising Toxicology and Safety Testing Needs:

With increasing regulatory focus on drug safety, HCS systems are being widely deployed for toxicity assessment. Automated high-content assays deliver precise, reproducible results critical for meeting preclinical regulatory requirements. - Academic and Research Expansion:

Growing funding in life sciences research and university-led initiatives is stimulating HCS adoption in genomics, proteomics, and cellular analysis projects.

Regional Growth Highlights

North America:

The United States dominates the global HCS market, supported by robust biopharmaceutical R&D infrastructure, high investment in automation, and strong presence of major players such as Thermo Fisher Scientific and Becton Dickinson and Company. The region’s focus on early drug screening and toxicology research continues to drive demand.

Europe:

European nations like Germany, the United Kingdom, and France are emphasizing advanced imaging systems and AI integration in biomedical research. EU-backed initiatives promoting drug safety and personalized medicine further boost regional market growth.

Asia-Pacific:

Countries such as China, Japan, and India are emerging as high-growth markets, propelled by expanding pharmaceutical manufacturing, increasing CRO (Contract Research Organization) activities, and government investments in life sciences research. Japan’s technological precision and China’s rapid biopharma expansion make the region a strategic growth hub.

Emerging Markets:

The Middle East and Latin America are witnessing growing adoption of HCS technologies as part of healthcare modernization and investments in biotechnology research infrastructure.

Market Segmentation Insights

Application:

- Drug Discovery remains the largest segment, driven by the demand for rapid compound profiling and phenotypic screening.

- Toxicology Studies are expanding at a steady pace, driven by stringent regulatory compliance and the shift from animal to cell-based models.

End Users:

- Pharmaceutical and Biotechnology Companies hold a dominant share due to heavy investment in automation and AI-based analytics.

- Academic and Research Institutes represent a growing segment with increased funding for translational and cellular research.

Technology Type:

- Cell Imaging and Analysis Systems are core components of the HCS ecosystem.

- Software and Image Analysis Platforms leveraging AI and cloud computing are gaining traction for real-time, high-throughput data processing.

Challenges and Market Considerations

While the HCS market holds significant promise, several challenges persist:

- High Equipment Costs: Advanced imaging systems and analysis software require substantial upfront investment, which can limit adoption among smaller research institutions.

- Complex Data Interpretation: Massive datasets generated by HCS necessitate specialized bioinformatics tools and skilled personnel for analysis.

- Integration Challenges: Seamless integration of HCS systems with existing laboratory information management systems (LIMS) remains a key operational hurdle.

Competitive Landscape

The high content screening market is moderately consolidated, with leading players focusing on innovation, automation, and AI-driven imaging technologies. Prominent companies include:

- Thermo Fisher Scientific Inc.

- Becton Dickinson and Company

- Danaher Corporation

- Yokogawa Electric Corporation

- BioTek Instruments Inc.

These companies are investing heavily in product development, strategic partnerships, and global expansion to strengthen their market footprint.

Recent Developments

- Olympus (2022): Introduced the SciLog SciPure FD System, an advanced cell imaging platform that delivers high-quality multicolor images with improved quantitative accuracy and speed.

- Particle Works (2022): Launched the Automated Library Synthesis (ALiS) System, a next-generation platform designed for rapid screening of lipid nanoparticle (LNP) formulations and mRNA candidates, emphasizing automation in early drug development.

Outlook and Market Leadership

The high content screening market is poised for robust growth over the next decade, driven by accelerating adoption of automation, artificial intelligence, and 3D cellular models in drug discovery and life sciences research.

As pharmaceutical and biotechnology companies intensify their focus on precision medicine, the role of high content screening in improving efficiency, reducing costs, and enhancing data accuracy becomes indispensable. With continued innovation and expanding applications, the market is on track to exceed USD 3,570 million by 2034, cementing its position as a cornerstone of modern biomedical research.