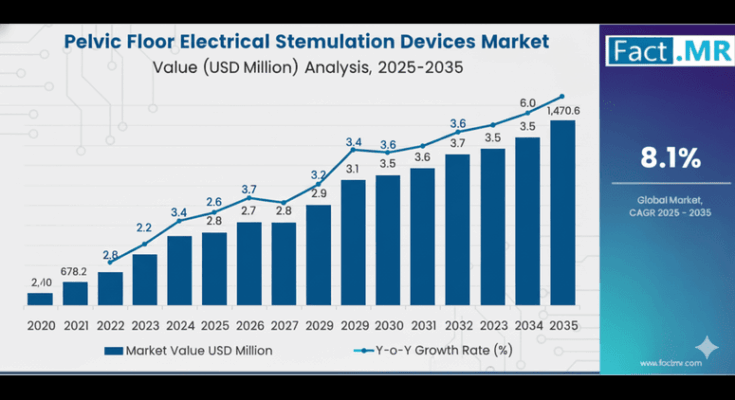

The global pelvic floor electrical stimulation devices market is projected to grow from USD 678.2 million in 2025 to USD 1,470.6 million by 2035, at a CAGR of 8.1%, according to Fact.MR. Rising prevalence of pelvic floor disorders—including urinary incontinence, fecal incontinence, and pelvic organ prolapse—among aging women and post-partum populations is a key driver of this growth.

Increased clinical awareness of non-surgical therapies, favorable reimbursement policies, and technological advancements in wireless, app-connected devices are fueling adoption, particularly in North America, Europe, and emerging Asia-Pacific markets.

Market Dynamics

-

Technological Advancements: Integration of wireless connectivity, variable intensities, biofeedback, and smartphone applications is enhancing patient compliance and enabling at-home therapy.

-

Rising Awareness & Government Initiatives: Maternal health programs in BRIC countries and women’s wellness initiatives are driving adoption.

-

Regulatory Support: Streamlined approvals in Asia and MDR compliance in Europe are facilitating market entry, while reimbursement schemes in mature economies boost accessibility.

-

Challenges: Regulatory hurdles, clinician training deficits, and unequal access in developing regions remain barriers.

Segment Overview

By Product Type:

-

Mobile Devices: 62.5% market share; favored for home use, convenience, and patient compliance.

-

Fixed Devices: 37.5% market share; predominantly used in clinics and hospitals for intensive therapy.

By Application:

-

Urinary Incontinence Treatment: 52.5% share; largest segment due to high prevalence among older and post-partum women.

-

Sexual Dysfunction: 32.5% share; growing adoption in both men and women seeking non-invasive therapy.

-

Neurodegenerative Diseases & Others: Emerging applications with increasing clinical attention.

By End User:

-

Hospitals, clinics, home care settings, and specialized pelvic health centers.

By Region:

| Country | CAGR (2025–2035) |

|---|---|

| U.S. | 7.4% |

| UK | 6.1% |

| France | 5.6% |

| Germany | 6.3% |

| Italy | 5.2% |

| South Korea | 6.6% |

| Japan | 5.8% |

| China | 7.9% |

| Australia & New Zealand | 6.0% |

Competitive Landscape

Leading players in the global market include:

| Company | Market Share (%) | Key Offerings & Activities |

|---|---|---|

| Atlantic Therapeutics | 18–22% | INNOVO® wearable stimulator with app integration, FDA & CE cleared |

| Laborie Inc. | 14–18% | Urodynamic and pelvic floor stim devices; acquired Prometheus Group |

| Zynex Medical | 12–15% | Portable, insurance-covered devices with telemonitoring support |

| TensCare Ltd. | 9–13% | CE-certified home-use devices; expanded European e-commerce footprint |

| UTAH Medical Products Inc. | 7–10% | OB/GYN-focused clinical devices for post-partum and surgical rehab |

| Other Players | 25–30% | Shenzhen XFT Medical, InControl Medical, Verity Medical, Tic Medizintechnik, KayCo2 Ltd. |

Strategic Focus: Companies are investing in digital therapeutics, smart apps, telemonitoring, and portable devices to enhance patient engagement and therapy adherence. Expansion into emerging markets and partnerships with clinicians and insurers are driving competitive advantage.

Browse Full Report : https://www.factmr.com/report/5245/pelvic-floor-electrical-stimulation-devices-market

Market Outlook

Fact.MR anticipates that market growth through 2035 will be anchored by:

-

Wireless and mobile-enabled device adoption supporting home-based therapy.

-

Integration with clinical evidence and digital health platforms for outcome monitoring.

-

Emerging markets penetration driven by government maternal health programs and rising awareness of pelvic floor disorders.

-

Product innovation and reimbursement strategies enabling wider access and patient compliance.

“The pelvic floor electrical stimulation devices market is evolving from niche clinical adoption to mainstream women’s health care,” said a Fact.MR analyst. “Firms combining technology, clinical evidence, and regulatory compliance will define the next decade of growth.”