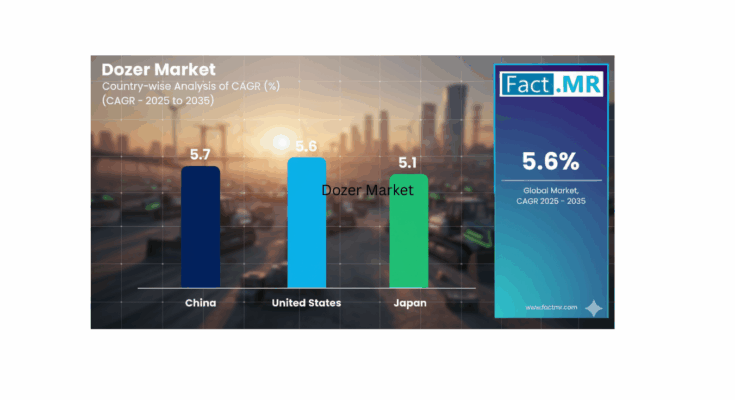

global dozer market is on a steady growth trajectory, forecasted to rise from USD 6.3 billion in 2025 to USD 10.9 billion by 2035, reflecting a CAGR of 5.6%, according to the latest analysis by Fact.MR, a leading market research and competitive intelligence provider. The surge in infrastructure investment, sustainable construction, and adoption of advanced machine technologies are driving this transformation across key industrial regions.

Infrastructure Renaissance Fuels Demand for Earthmoving Equipment

The report highlights that the current decade marks a new era of infrastructure acceleration, with major economies expanding projects in transportation, energy, and urban development. Governments across the U.S., India, and China are deploying multi-billion-dollar budgets to modernize public infrastructure, which has directly elevated the demand for powerful and versatile dozers—key machinery for grading, land clearing, and excavation.

The U.S. Bipartisan Infrastructure Law (BIL), authorizing USD 1.2 trillion in public works funding, is one of the largest growth catalysts. Similarly, India’s infrastructure boom, supported by USD 35.24 billion in Foreign Direct Investment (FDI) in infrastructure between 2000 and 2024, has bolstered equipment requirements across the construction sector. These investments are expected to sustain a long-term demand cycle for heavy-duty earthmoving equipment.

“Dozers continue to be the backbone of infrastructure development. As global construction pipelines expand, manufacturers are witnessing a renewed demand for intelligent, efficient, and low-emission equipment,” said a senior research analyst at Fact.MR.

Technological Advancements Driving Next-Generation Dozers

The dozer industry is transitioning rapidly toward smart and sustainable operations. Integration of GPS, telematics, and autonomous navigation systems has revolutionized machine control, safety, and fuel efficiency. These innovations not only reduce operational costs but also align with the sustainability mandates reshaping the global construction and mining sectors.

Recent developments highlight this momentum:

-

Fortescue and Liebherr’s USD 2.8 billion partnership to deploy 475 zero-emission mining machines, including battery-powered PR 776 dozers, is redefining eco-friendly mining practices.

-

John Deere’s 850 X-Tier E-Drive dozer, launched in March 2025, enhances productivity with electric powertrains and SmartGrade technology.

-

Liebherr’s Generation 8 PR 776 dozers, delivered to Canada’s Gibraltar mine in April 2025, emphasize low emissions and operator comfort through AI-powered assistance systems.

Such advancements underscore how digitization, automation, and electrification are becoming key differentiators for market leaders.

Asia Pacific Leads Global Demand; North America and Europe Embrace Green Construction

According to Fact.MR’s analysis, Asia Pacific remains the largest regional market for dozers, driven by fast-paced urbanization, mining expansion, and government-backed mega projects in China, India, and Southeast Asia.

-

India’s mining and construction equipment (MCE) sector is projected to grow at a 19% CAGR, reaching USD 45 billion by 2030, fueled by industrial expansion and smart city initiatives.

-

China continues to dominate with investments in automation and digitalized construction, exemplified by the world’s first autonomous unmanned bulldozer introduced by Shantui and Huazhong University in 2022.

Meanwhile, North America and Europe are emerging as lucrative regions focusing on low-emission and hybrid construction equipment. European contractors are actively adopting hybrid and electric dozers to meet stringent environmental norms, particularly in Germany, France, and the U.K.. North America’s modernization of transport networks and renewable energy infrastructure is reinforcing demand for high-efficiency dozers across public and private projects.

Market Segmentation Insights: Construction Remains the Powerhouse End-Use Sector

Fact.MR’s segmentation analysis reveals that the construction industry continues to dominate global dozer consumption, followed by mining, which is the fastest-growing end-use segment. The surge in mineral extraction activities in Africa, Australia, and Latin America is boosting the adoption of heavy-duty and electric dozers designed for rugged terrains.

By product type, crawler dozers lead the market due to their robust capabilities in handling large-scale earthmoving operations.

-

The 20,000 to 60,000 lb operating weight category remains the most preferred, balancing power and maneuverability.

-

In terms of flywheel power, the 126–250 HP segment dominates, while demand for above 250 HP machines is growing rapidly in mega projects and mining operations.

-

The 2,251 to 4,500-watt systems represent the core wattage range, aligning with medium-duty dozers widely used in public infrastructure.

The under 20,000 lb and electric-powered segments are expanding quickly, reflecting urban construction trends and sustainability targets.

Competitive Landscape: Industry Leaders Invest in Innovation and Sustainability

The competitive environment remains intense, with key players emphasizing technology leadership, cost efficiency, and strategic regional expansion. Major companies shaping the global dozer market include:

Caterpillar Inc., Komatsu Ltd., Liebherr Group, Deere & Company, CNH Industrial, Zoomlion, Shantui Construction Machinery, Guangxi Liugong Machinery Co., and Bell Equipment Co. SA.

-

Caterpillar continues to set industry standards with its smart dozers featuring advanced grade control and hybrid powertrains.

-

Komatsu focuses on sustainability with electrified and semi-autonomous models tailored for emission-free construction zones.

-

Leica Geosystems and Shantui’s collaboration on machine control kits for the DH20M dozer demonstrates the industry’s growing emphasis on digital precision and fleet optimization.

Challenges: High Initial Costs and Economic Cyclicality

Despite strong market prospects, challenges persist. High capital costs—ranging from USD 30,000 to USD 900,000 for advanced models—remain a barrier for small and mid-sized contractors. Market fluctuations, such as rising raw material prices, interest rates, and economic slowdowns, can also delay equipment purchases or push buyers toward rental options.

Manufacturers are responding with flexible financing models, rental solutions, and modular upgrade packages to enhance affordability and accessibility, particularly in emerging markets.

Future Outlook: Toward a Smarter, Greener, and More Efficient Dozer Ecosystem

As the world transitions toward carbon-neutral construction and industrial operations, dozer manufacturers are prioritizing green powertrains, AI-driven automation, and connected fleet ecosystems. The combination of government-backed infrastructure projects, smart construction technologies, and sustainable innovation positions the dozer market for robust expansion over the next decade.

“The next phase of growth in the dozer industry will be defined by digital intelligence, electrification, and ecosystem partnerships. Manufacturers who align with these trends will lead the next wave of infrastructure transformation,” concludes Fact.MR’s report.

About Fact.MR:

Fact.MR is a global market research and consulting firm specializing in industrial and technology-driven sectors. The company provides actionable insights that enable business leaders to make informed decisions, accelerate innovation, and drive long-term growth.

Browse Full Report : https://www.factmr.com/report/385/dozer-market