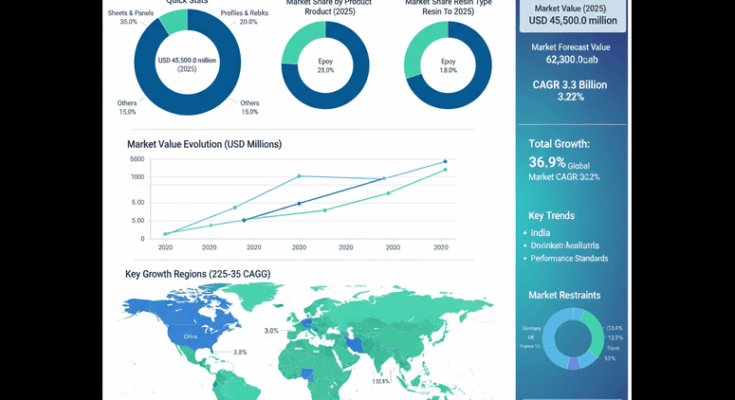

The global Glass Fibre Reinforced Plastic (GFRP) Products Market is set to enter a transformative decade of expansion, with total market value forecast to rise from USD 45.5 billion in 2025 to approximately USD 62.3 billion by 2035, reflecting a 36.9% absolute growth and a compound annual growth rate (CAGR) of 3.2%. This trajectory positions the GFRP industry at the heart of modern engineering, construction, and transportation transformation initiatives across global markets.

Rising Demand for Lightweight, High-Strength Materials

Driven by the global push toward lightweight construction materials and advanced composite adoption in infrastructure and transportation, GFRP products are increasingly being recognized as essential to next-generation industrial design. With their unique balance of strength-to-weight performance, corrosion resistance, and long-term durability, these products are reshaping performance standards in civil engineering, industrial manufacturing, and mobility solutions.

By 2035, the market is expected to grow by nearly 1.4 times, fueled by widespread modernization of construction systems, the integration of advanced composite processing technologies, and heightened demand for high-efficiency materials in both public and private infrastructure projects.

Key Market Highlights and Strategic Insights

- Market Size (2025): USD 45.5 billion

- Forecast Value (2035): USD 62.3 billion

- Forecast CAGR (2025–2035): 3.2%

- Leading Product Segment: Sheets & Panels (35%)

- Leading Resin Type: Polyester (45%)

- Top End-Use Segment: Construction (40%)

- Key Growth Regions: Asia Pacific, North America, and Europe

- Market Leaders: Owens Corning, Jushi Group, and Saint-Gobain Vetrotex

Construction and Infrastructure Lead Market Expansion

Construction remains the cornerstone of the GFRP market, accounting for 40% of total demand in 2025. The material’s superior load-bearing capacity, design flexibility, and environmental resilience are making it the go-to solution for infrastructure modernization, architectural panels, and structural reinforcements. As nations invest in sustainable urban development and resilient infrastructure, demand for high-performance composite materials is set to surge across public works and private sector projects alike.

Asia Pacific, led by India and China, represents the strongest growth region, projected to outpace global averages with CAGRs of 4.5% and 3.8%, respectively. India’s infrastructure expansion—through industrial corridors, urban modernization, and smart city initiatives—is expected to catalyze large-scale GFRP adoption across structural, transport, and industrial applications.

Technological Edge: Polyester and Epoxy Resins Drive Versatility and Performance

Polyester resins continue to dominate with a 45% share, offering cost-effective performance and broad application across construction and industrial segments. However, Epoxy-based composites are witnessing robust traction in high-stress environments such as automotive, aerospace, and marine sectors, where durability, fatigue resistance, and high mechanical strength are paramount.

Innovations in Vinyl Ester and hybrid resin formulations are further enhancing chemical resistance and extending GFRP’s application potential into marine, wastewater, and chemical processing sectors, supporting a broader industrial base for manufacturers.

Transportation Sector Accelerates with Lightweighting Trend

Transportation is emerging as a key growth vertical, contributing approximately 30% of total GFRP demand. As global automakers and aerospace companies pursue weight reduction, fuel efficiency, and performance optimization, GFRP’s superior strength-to-weight ratio positions it as a strategic alternative to metals and higher-cost carbon composites.

In the automotive sector, the rise of electric vehicles (EVs) and hybrid platforms is amplifying the need for lightweight yet robust materials. GFRP panels, reinforcements, and interior components are expected to see double-digit growth within this category through 2035.

Regional Dynamics: Innovation, Efficiency, and Market Leadership

North America and Europe continue to dominate high-performance composite development, with the United States leveraging its advanced composite manufacturing ecosystem to support next-generation industrial and transportation infrastructure. Germany remains Europe’s technical leader, driving adoption of performance-grade composites through stringent engineering standards and innovation in manufacturing automation.

Meanwhile, South Korea and Japan are strengthening their footholds in precision composite manufacturing. South Korea’s focus on export-oriented composite excellence and Japan’s emphasis on quality and traceability standards ensure both nations remain vital hubs for GFRP innovation and high-value applications.

Brazil, with its expanding industrial base and emphasis on local manufacturing, is also emerging as a strategic regional growth market, particularly in construction, marine, and industrial processing applications.

Industry Challenges and Competitive Shifts

Despite favorable demand conditions, the market faces challenges including raw material price volatility, technical qualification barriers, and competition from alternative materials such as carbon fiber and advanced metals. Regulatory compliance—particularly in Europe and East Asia—continues to shape manufacturing investments and product development priorities.

To remain competitive, leading manufacturers are investing in vertical integration, digitalized production, and custom-engineered composite solutions. Supply chain consolidation is accelerating as global producers such as Owens Corning, Saint-Gobain Vetrotex, and Jushi Group pursue economies of scale, process automation, and technical co-development partnerships.

Opportunities for Industry Leaders

The future of GFRP manufacturing lies in advanced composite engineering, performance innovation, and sustainable material science. Companies positioned to integrate automation, intelligent processing, and high-grade resin systems into production will capture the lion’s share of upcoming infrastructure and industrial contracts.

Opportunities are emerging in:

- Smart infrastructure projects requiring corrosion-resistant reinforcement systems

- Next-generation mobility platforms leveraging weight-optimized composites

- Renewable energy and industrial applications demanding superior mechanical reliability

The market shift toward application-specific formulations and performance-certified composite systems underscores the growing importance of engineering expertise and material science leadership in shaping the decade ahead.

Browse Full Report : https://www.factmr.com/report/glass-fibre-reinforced-plastic-products-market

About the Report

The Glass Fibre Reinforced Plastic Products Market Forecast and Outlook 2025–2035 provides comprehensive analysis across product categories, resin types, end-use industries, and geographic markets. The study covers quantitative forecasts, competitive benchmarking, and regional demand projections for 45+ countries across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.