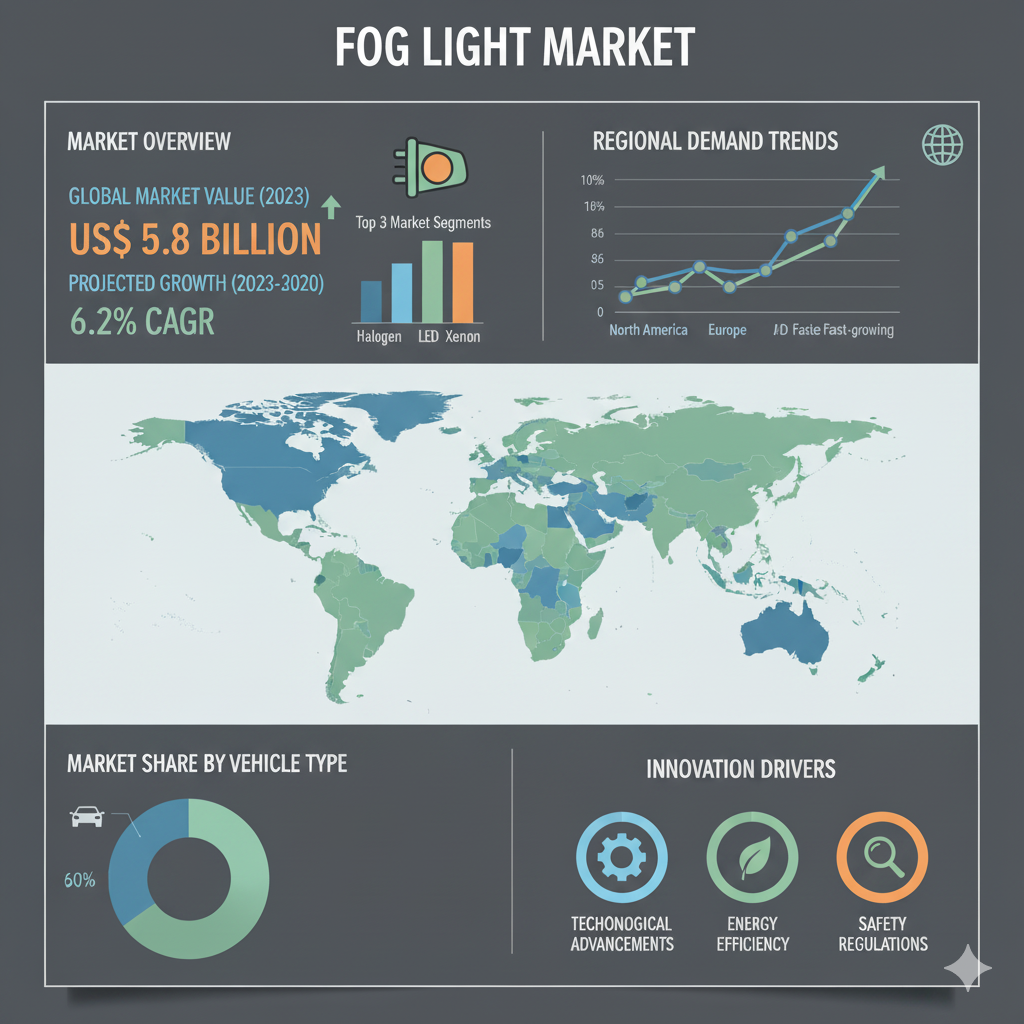

The global fog light market has experienced steady growth over recent years, supported by rising automotive production, growing safety awareness, and continuous innovation in lighting technology. The fog light market is projected to register a steady expansion at a moderate CAGR through 2022. The research report estimates the market to account for revenues worth US$ 2,130.2 million in 2017, and by 2022, this number is anticipated to reach US$ 2,699.2 million. This steady growth reflects the increasing importance of visibility and safety in modern vehicles, as well as technological advancements driving product performance and energy efficiency.

Market Growth and Outlook (2017–2022)

Between 2017 and 2022, the fog light market is expected to demonstrate moderate but consistent growth. The anticipated rise in revenues from US$ 2,130.2 million to US$ 2,699.2 million highlights the ongoing demand for reliable lighting solutions in vehicles operating under adverse weather conditions. Factors such as stricter safety regulations, the increasing production of passenger cars, and consumers’ preference for high-performance lighting systems continue to strengthen the market outlook. Additionally, innovations in LED and HID technologies have enhanced product lifespan and light intensity, further fueling demand across both OEM and aftermarket channels.

Segmental Analysis of the Fog Light Market

The fog light market is analyzed across multiple dimensions, including colour emission type, positioning type, sales channel, and technology. Each of these categories plays a critical role in shaping overall market dynamics.

By Colour Emission Type

Blue fog lights have gained popularity in specific regions where design and aesthetic differentiation are highly valued. However, white fog lights dominate the market and are expected to maintain their lead through 2022. Their popularity stems from superior visibility and reduced glare compared to other colors, making them a preferred choice for most vehicle models. Yellow fog lights, traditionally used in certain climates and regulatory environments, continue to hold a niche segment, offering effective illumination under dense fog and heavy rain but seeing slower overall growth compared to white and blue variants.

By Positioning Type

Front fog lights represent the largest share of the market and are projected to remain the most prominent segment through 2022. This dominance is driven by their crucial role in improving driver visibility during low-light or foggy conditions. Rear fog lights, on the other hand, are primarily mandated by safety regulations in certain regions. Although they play an important role in alerting other drivers during poor visibility, their demand growth remains more modest compared to front fog lights.

By Sales Channel

The fog light market is distributed across two key sales channels—OEM (Original Equipment Manufacturer) and aftermarket. OEM sales continue to contribute significantly as fog lights are an integral part of new vehicle assembly. However, the aftermarket segment is expected to grow at a faster rate during the forecast period. This is largely due to the replacement needs of fog lights, which have a limited operational life. The expansion of the automotive aftermarket in emerging economies also supports this trend, as vehicle owners increasingly opt for affordable and efficient replacement options.

By Technology

Technological innovation remains a central driver of the fog light market. Halogen fog lights, once the industry standard, are witnessing a gradual decline due to their lower efficiency and shorter lifespan compared to newer technologies. LED fog lights, in contrast, have emerged as the dominant technology and are expected to achieve substantial growth through 2022. They offer numerous advantages such as higher brightness, lower power consumption, and longer operational life. HID (High Intensity Discharge) fog lights also continue to hold a significant share of the market, providing strong light output and durability, although their higher cost limits wider adoption.

Recent Developments and Competitive Landscape

Recent years have seen several key developments within the fog light market. One of the most prominent trends is the growing adoption of LED technology. Manufacturers are investing heavily in research and development to create compact, energy-efficient, and adaptive lighting systems that adjust brightness and direction based on driving conditions. Such advancements are particularly beneficial for electric and autonomous vehicles, where energy efficiency and design integration are critical.

The competitive landscape of the fog light market is characterized by the presence of several major players, including General Electric Company, Valeo S.A., OSRAM Licht AG, HELLA KGaA Hueck & Co., Koninklijke Philips N.V., Magneti Marelli S.p.A., Warn Industries Inc., Robert Bosch GmbH, Phoenix Lamps Limited, and Flex-N-Gate Corporation. These companies compete on the basis of technological innovation, product reliability, pricing, and distribution reach. Many of them maintain close partnerships with automobile manufacturers, allowing them to integrate advanced fog light systems into vehicle designs at the OEM level.