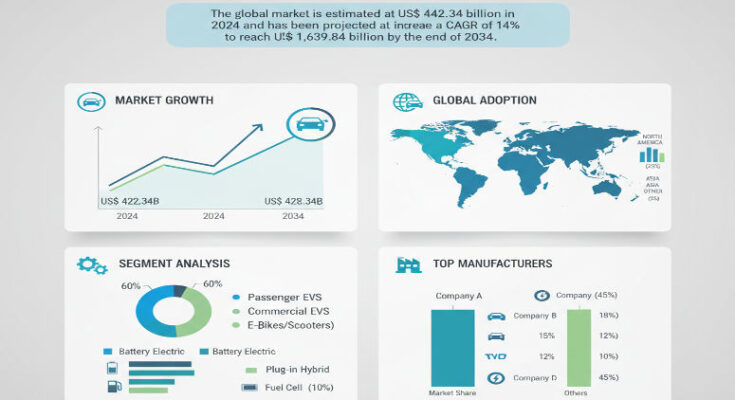

The global electric vehicle (EV) market is in the fast lane. In 2024, market revenues are estimated at approximately US$ 442.34 billion, and over the next decade the industry is forecast to grow at a compound annual growth rate (CAGR) of roughly 14%, reaching about US$ 1,639.84 billion by 2034. This remarkable trajectory reflects accelerating consumer demand, evolving environmental regulation, major investments in charging infrastructure, advances in battery and propulsion technology, and rising awareness of sustainable mobility solutions across both developed and emerging economies.

Key Drivers Shaping the Market

Several powerful forces are fueling this sustained growth. Regulatory frameworks are tightening worldwide: emission standards, zero-emission vehicle mandates, and incentives for low-carbon transportation are making EVs a central pillar of national climate strategies. Battery technology improvements—especially in energy density, cost, lifespan, and safety—are making EVs more competitive in total cost of ownership. Meanwhile, infrastructure expansion (public and private charging stations), government subsidies, tax rebates, and ecosystem investments are lowering entry barriers. Consumer preferences are also shifting: urbanization, environmental consciousness, and rising fuel costs are pushing adoption upward. Additional momentum comes from automakers committing to EV portfolios, and two-wheelers as well as commercial vehicles increasingly being electrified, especially in Asia.

Segmentation & Propulsion Mix

The market is diversified in terms of vehicle type and propulsion system. Battery Electric Vehicles (BEVs) represent a significant and growing share, as consumers and regulators alike favor zero tailpipe emissions and simpler drivetrain maintenance. Plug-in Hybrids (PHEVs) remain valuable in transition phases or in regions where charging infra is still scaling. Commercial vehicles, passenger cars, and two-/three-wheelers each contribute meaningfully to growth—particularly in Asia where two-wheelers are a major mode of transport. EVs for passenger transportation dominate revenue in many mature markets, while growth in electric buses, light trucks, and last-mile commercial use is picking up fast driven by policy incentives and fleet renewals.

Regional Dynamics: U.S., China, Europe & Asia-Pacific

United States: The U.S. is one of the largest and most influential markets. Strong federal and state incentives, regulatory pressure on emissions, and a maturing charging infrastructure underpin an aggressive growth path. Automakers are investing heavily in domestic EV production, battery gigafactories, and partnering with utilities to deploy charging networks. By 2034, North America is expected to command a large share of global EV revenues, with the U.S. being a key driver of innovation and mass adoption.

China / Asia-Pacific: China is already among the leaders globally in both EV supply and demand. Government policy, consumer subsidies, rapidly expanding charging networks, domestic battery and component production, and brands that are increasingly competitive internationally all contribute. Other Asia-Pacific nations (India, Southeast Asia, Japan, Korea) are accelerating adoption, driven by urban pollution concerns, import substitution strategies, and rising income levels. The forecast shows that East Asia (including China) will hold a substantial portion of global EV market revenue by 2034.

Europe: Europe remains a critical battleground for EV growth. European nations are enforcing stringent tailpipe emission regulations, setting ambitious CO₂ targets, and pushing for vehicle fleet electrification. Consumer behavior in Western Europe increasingly favors EVs, especially luxury and premium models, as infrastructure expands and operational costs drop. Government incentives, clean mobility zones, and restrictive policies for internal combustion engines (ICE) all contribute to accelerating EV uptake.

Recent Developments & Innovation Signals

Recent years have produced several notable developments. Battery costs have continued to decline, helping EVs approach price parity with ICE vehicles in many segments. Charging infrastructure deployment has scaled up significantly, with fast-charging networks becoming more widespread, especially in urban corridors and along major transport routes. Automakers are competing aggressively with expanded product portfolios, including more affordable EV models, to penetrate mass markets. In addition, electrification of commercial fleets, delivery vehicles, and two-wheelers is increasing. Advances in battery chemistries, solid-state batteries, and energy management systems are helping to improve range, charging time, safety, and operating stability. Fresh policy pushes in many countries to ban or limit sales of ICE vehicles in future years are also spurring accelerated planning among manufacturers and consumers alike.

Challenges & Barriers

Despite positive momentum, challenges remain. Upfront purchase cost of EVs is still higher than comparable ICE vehicles in many markets, particularly when subsidies taper off. Range anxiety, charging infrastructure gaps (especially in rural or under-served regions), and insufficient fast chargers slow adoption. Battery supply chain issues—availability of raw materials, cost volatility, safety concerns—remain risks. Also, residual value, charging times, cold-weather performance, and consumer perception are hurdles. Regulatory uncertainty in some markets, tariff or import-tax pressures, and evolving standards (e.g., safety, battery recycling, grid impact) add complexity for manufacturers and policymakers.

Browse Full Report: https://www.factmr.com/report/electric-vehicle-market

Outlook & Strategic Takeaways

Over the next decade, the EV market is expected to more than triple in value, with growth especially strong in BEV segments, in Asia-Pacific, and in commercial vehicle electrification. Companies that prioritize battery innovation, affordable models, robust charging infrastructure, local component supply, and scalable production will likely lead. Brands that can deliver batteries with better energy density, lower cost, and safety credentials will win consumer confidence. Governments that align policy, incentive design, infrastructure funding, and regulation will enable markets to accelerate in adoption. Charging infrastructure expansion, grid readiness, and sustainable battery lifecycle management will be critical enablers.