The Educational Technology market is no longer just supplementary—it’s central to how societies educate, train, and prepare for an increasingly digital, skills-driven future. From K-12 classrooms to corporate upskilling, from hybrid learning to immersive simulations, EdTech is transforming pedagogy, access, and outcomes. Current estimates put the 2024 global market size in the US$160-190 billion range, with expectations to more than double by the mid-2030s under strong growth scenarios.

Market Size, Forecast & Growth Trajectory

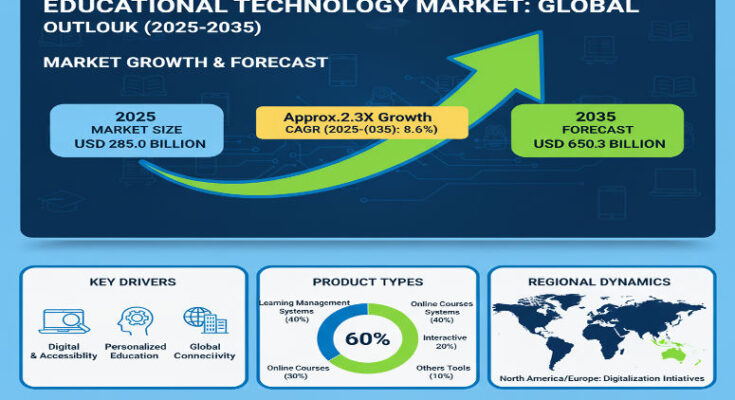

EdTech was estimated at around USD 163.5 billion in 2024, with projections climbing to USD 185-190 billion in 2025. Under multiple forecast models, the market is expected to continue growing at a compound annual growth rate (CAGR) of approximately 13-15% over the coming decade. By 2034 or 2035, some estimates suggest the market could reach USD 500–750 billion, depending on adoption of immersive technologies, AI/ML platforms, and expansion in emerging economies.

Key Drivers & Trends Shaping the Market

Several powerful forces are driving the EdTech market’s rapid evolution:

-

Demand for Personalized and Adaptive Learning: Learners and institutions increasingly expect platforms that adapt to individual learning pace, style, and performance. AI-powered tools, learning analytics, and adaptive systems are becoming central components in many EdTech offerings.

-

Hybrid & Remote Learning as a New Norm: The shift toward remote, hybrid, or blended learning models has become entrenched. Schools, universities, and corporate training programs are building infrastructure and workflows to support digital access, virtual classrooms, and asynchronous learning.

-

Increasing Use of Immersive Technologies: AR, VR, simulations, gamification, and interactive media are being adopted more widely to improve engagement, retention, and learning outcomes. These technologies are especially appealing in STEM, professional training, and experiential learning settings.

-

Corporate & Lifelong Learning: EdTech is expanding beyond formal education into corporate upskilling, continuing education, professional certification, and skill development. Many organizations are investing in digital platforms and content to reskill or upskill their workforce.

-

Policy & Infrastructure Support: Governments across major markets are investing in EdTech infrastructure, digital literacy, broadband access, and policy frameworks to promote equitable access, especially in K-12 and rural or underserved areas.

-

Device Proliferation and Internet Penetration: The increasing availability of smartphones, tablets, and low-cost devices, coupled with widespread internet access (including mobile broadband), is opening up EdTech’s reach, particularly in emerging economies.

Regional Insights: United States & Europe

United States:

The U.S. EdTech market is a major growth engine. Adoption in K-12 is strong, especially for learning management systems (LMS), interactive platforms, cloud-based solutions, and AI/adaptive tools. Corporate training and professional development are also significant contributors. U.S. growth is forecast around 10-11% CAGR through 2035, driven by strong investment, institutional demand, regulatory mandates for digital learning, and innovation hubs.

Europe:

In Europe, growth is similarly robust, albeit with slightly more moderated rates due to regulatory oversight, diversity of educational systems, and cost constraints in public institutions. Countries such as Germany, UK, France, Nordic nations are leading with strong adoption of EdTech in K-12 and higher education, emphasis on digital literacy, and increasing use of immersive and analytics-based learning tools. European markets emphasize privacy, content localization, language diversity, and regulatory compliance.

Recent Developments & Innovation Signals

-

Several EdTech companies have released AI-augmented features—intelligent tutoring, real-time feedback, automated assessment tools—to enhance adaptive learning and reduce teacher workload.

-

Gamification and immersive content have gained traction: virtual labs, AR/VR simulations, and interactive media are increasingly integrated into curricula to improve engagement and retention.

-

A surge of investment in EdTech startups focusing on underserved markets, multilingual content, or offline/low-bandwidth solutions shows growing recognition that access remains uneven globally.

-

Stronger emphasis on data privacy, learning outcomes, accreditation, and evidence of effectiveness: stakeholders desire measurable impact, not just flashy features.

-

Expansion of mobile learning platforms, micro-learning modules, and bite-sized content formats to cater to adult learners, corporate users, and learners in constrained time/resource settings.

Key Players & Competitive Landscape

Major established tech and education companies dominate with broad platforms and deep reach. Names one frequently sees include Google, Microsoft, Apple, and major LMS providers. Specialists and startups are also very active, especially in niche areas like assessment tools, immersive content, language learning, coding & STEM, and micro-credentials. Competitive differentiation is increasingly determined by content quality, UX, platform reliability, adaptive learning capabilities, localization, and ability to deliver equitable access.

Challenges & Restraints

While EdTech has strong tailwinds, it also faces meaningful constraints:

-

High infrastructure cost, especially for hardware, internet access, and device deployment, particularly in rural or low-income regions.

-

Digital divide: uneven internet connectivity, device ownership, and digital literacy remain major barriers in many countries.

-

Resistance or inertia in education systems: traditional pedagogy, regulatory constraints, accreditation processes, teacher training requirements can slow adoption.

-

Data privacy, security, and ethical concerns—especially with large scale use of AI, student data, and third-party platforms.

-

Cost and ROI pressures: institutions and users demand evidence of cost efficiency and learning outcome improvement before committing to expensive platforms.

Outlook & Strategic Insights

Looking ahead, several strategic priorities emerge for organizations participating in the EdTech market:

-

Build platforms that scale and localize: Localization of content (language, culture), low-bandwidth modes, offline access, and context-aware adaptation will be critical in regions beyond early adopters.

-

Focus on learning outcomes and evidence: Demonstrable impact on student performance, retention, engagement, and skills will become a differentiator.

-

Embrace AI, analytics & adaptive learning: Tools that tailor experiences, predict learning gaps, and automate feedback will gain wide adoption—provided they are trustworthy and transparent.

-

Improve affordability & access: Models that reduce cost through shared infrastructure, device leverage, public-private partnerships, and government support will extend market reach.

-

Prioritize privacy, ethics & regulatory standards: With growing concern around student data and AI fairness, platforms must ensure robust privacy, data security, and ethical design.

Browse Full Report: https://www.factmr.com/report/educational-technology-market

Editorial Take

The Educational Technology Market is no longer about novelty—it’s about essential infrastructure for learning in the 21st century. As digital access becomes a basic expectation, not a luxury, platforms that deliver meaningful, measurable value—especially in learning effectiveness, inclusion, personalization—will define leadership.

Innovation will come not only from technology but from models that reduce friction—device access, internet connectivity, teacher training. The next decade will reward those who solve for impact at scale, not just feature lists.