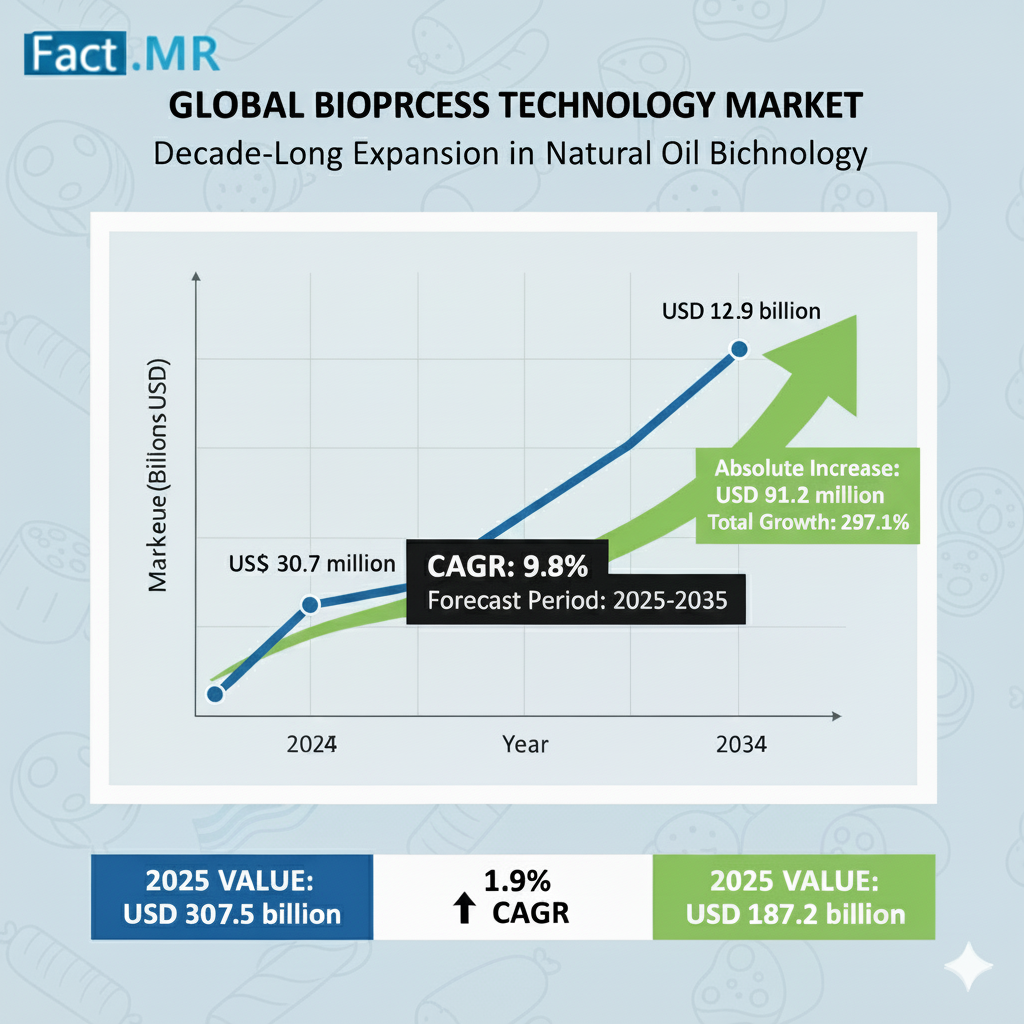

According to this detailed industry analysis done by experienced analysts at Fact.MR, the global bioprocess technology market size is estimated at US$ 30.7 billion in 2024. Worldwide demand for bioprocess technologies is projected to increase at a CAGR of 14.8% and reach a market value of US$ 121.9 billion by 2034.. This remarkable growth trajectory underscores the accelerating integration of biotechnology, digital innovation, and sustainable production practices across the life sciences industry.

As healthcare systems worldwide pivot toward preventive medicine, personalized therapeutics, and sustainable biomanufacturing, the adoption of advanced bioprocess technologies has become indispensable. These innovations form the backbone of modern drug development — from vaccines and recombinant proteins to stem cell therapies and gene editing platforms.

Industry Transformation Fueled by Demand for Bio-Based Therapeutics:

The evolution of the biopharmaceutical and biotechnology sectors is the primary catalyst behind the rapid market expansion. The increasing prevalence of chronic and lifestyle-related diseases — including cancer, diabetes, and cardiovascular disorders — has intensified the global demand for advanced drug production systems.

In addition, the shift toward bio-based and biodegradable products is creating new avenues for manufacturers investing in cell culture bioprocessing, which currently represents the most dominant technology segment. Cell culture enables researchers to study disease mechanisms and drug responses, making it integral to both therapeutic development and large-scale manufacturing.

The biopharmaceutical segment, valued at US$ 10.4 billion in 2024, is expected to grow to US$ 40.1 billion by 2034, registering a CAGR of 14.5%. This growth reflects the industry’s heightened focus on innovative biologics, cell-based therapies, and personalized medicine.

Regional Insights: North America and East Asia Spearhead Growth:

North America remains the undisputed leader in bioprocess technology adoption, with the United States alone projected to reach US$ 13.5 billion by 2034, growing at 15.3% CAGR. The U.S. market is fueled by a strong concentration of biopharma giants, rising R&D investments, and high prevalence of chronic disorders demanding novel bio-based drugs.

East Asia, on the other hand, is emerging as a fast-growth hub, forecasted to command 23.1% of the global market share by 2034. Japan’s rapidly evolving pharmaceutical landscape — characterized by robust vaccine production and adoption of single-use bioprocess consumables — is expected to propel the region’s valuation to US$ 8.3 billion by 2034 at 15.4% CAGR.

In Europe, Germany leads the way in implementing bio-based medicines and sustainable bioprocessing practices. The nation’s strong research infrastructure and focus on waste reduction have positioned it as a profitable market for bioprocess technology providers.

Innovation and Start-Up Ecosystem: Reshaping Bioprocess Efficiency:

The global start-up landscape is fostering groundbreaking advancements in continuous bioprocessing and scalable manufacturing.

– SingCell (Singapore) is pioneering cost-efficient stem cell process development, bringing affordability to regenerative medicine.

– CellulaREvolution (UK) is transforming continuous bioprocessing with peptide coating and bioreactor technologies, enhancing scalability and real-time single-cell quality assurance.

Meanwhile, established market leaders are investing aggressively in innovation. For instance:

– Stämm Biotech secured US$ 17 million in Series A funding to develop a 3D-printed bioreactor for next-gen bioprocessing.

– Thermo Fisher Scientific launched its DynaSpin Single-Use Centrifuge System for large-scale cell culture harvesting.

– GOOD Meat and ABEC partnered to design and install high-capacity bioreactors for mammalian and avian cell cultures.

– GE Healthcare expanded its bioprocessing portfolio by acquiring Puridify, a start-up developing nanofiber-based purification technology for faster and scalable biopharmaceutical production.

These strategic developments highlight a strong synergy between innovation, sustainability, and biomanufacturing efficiency, creating a fertile ground for collaboration between established leaders and emerging biotech firms.

Market Dynamics: Opportunities and Challenges:

Growth Drivers

Rise in Chronic Diseases: The surging global burden of cancer, autoimmune disorders, and metabolic diseases is creating sustained demand for advanced biologics.

R&D Acceleration: Increased funding for biotechnology and pharmaceutical R&D is boosting the production of recombinant proteins, vaccines, and monoclonal antibodies.

Personalized Treatment Revolution: Expanding use of precision medicine and cell therapy is pushing the limits of bioprocess innovation.

Sustainable Manufacturing: The transition toward eco-friendly, bio-based production systems aligns with global decarbonization efforts, particularly in Europe and North America.

Challenges

Despite its strong growth potential, the market faces constraints from high production costs, stringent regulatory frameworks, and labor-intensive operations. Large-scale bio production often demands significant capital investment, especially in protein purification and downstream processing.

Moreover, safety regulations for handling biological materials remain tight, compelling manufacturers to adopt advanced containment and automation solutions to maintain compliance and operational efficiency.

Competitive Landscape: Consolidation and Technological Advancement:

The global market is highly competitive, with a blend of legacy players and new entrants striving for market share through strategic mergers, acquisitions, and R&D collaborations. Key industry leaders include:

MilliporeSigma, Danaher Life Sciences, GE Healthcare, Roche Holding AG, Fujifilm Healthcare, Catalent, Lonza Pharma & Biotech, Thermo Fisher Scientific, Sartorius Stedim Biotech, Asahi Kasei Medical, Boehringer Ingelheim, Bio-Rad Laboratories, Charles River Laboratories, Eppendorf, Repligen, and Rentschler Biopharma SE.

These companies are not only expanding production capacities but are also investing in digital transformation — including AI-driven process optimization, real-time monitoring, and automation — to enhance yield, reproducibility, and scalability.

Future Outlook: The Road to 2034:

The bioprocess technology market is set to redefine the future of biomanufacturing, bridging the gap between scientific innovation and commercial scalability. Short-term growth (2024–2027) will be characterized by investment surges in next-gen equipment, while mid-term (2027–2030) growth will focus on the global demand for bio-based therapeutics.

By the long term (2030–2034), bioprocess technologies will be central to the production of advanced vaccines, recombinant proteins, and regenerative medicines — marking a transformative shift toward precision, sustainability, and efficiency in global healthcare manufacturing.

Browse Full Report-https://www.factmr.com/report/bioprocess-technology-market