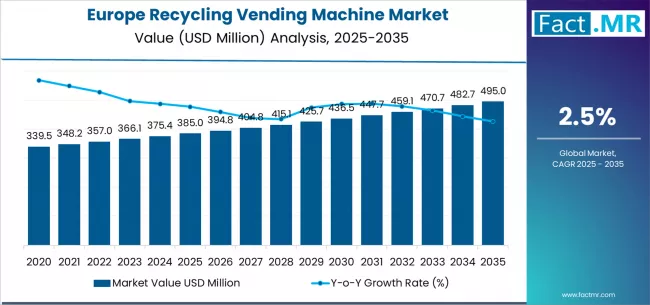

The Europe recycling vending machine market is set to witness steady expansion over the next decade, supported by growing environmental awareness, circular economy initiatives, and government-led waste management regulations. According to a new report by Fact.MR, demand for recycling vending machines in Europe is projected to rise from USD 385.0 million in 2025 to approximately USD 495.0 million by 2035, representing an absolute gain of USD 110.0 million over the ten-year period. This translates into a total growth of 28.6%, with the market forecast to expand at a CAGR of 2.5% from 2025 to 2035.

As Europe accelerates its transition toward sustainable waste collection and digitalized recycling systems, recycling vending machines (RVMs) are becoming vital tools for automated sorting, waste reduction, and consumer engagement.

Strategic Market Drivers

- Expanding Circular Economy and Sustainability Initiatives

Europe’s strong focus on the circular economy continues to propel the adoption of RVMs across retail chains, transport hubs, and public spaces. The European Green Deal and Extended Producer Responsibility (EPR) frameworks are pushing municipalities and corporations to adopt efficient, traceable recycling systems.

Recycling vending machines enable real-time material tracking, consumer incentives through deposit-return systems (DRS), and automated segregation of PET bottles, aluminum cans, and glass containers—improving recycling rates while reducing contamination. - Retail and Beverage Sector Partnerships

The beverage and FMCG sectors are key adopters of RVMs, using them to meet plastic collection targets and enhance brand reputation. Retailers are integrating smart recycling kiosks within store premises, encouraging customers to return used containers in exchange for coupons or digital rewards. This synergy between retail convenience and sustainability incentives is fostering strong market penetration across Western and Northern Europe. - Technological Advancements in Smart Collection Systems

Next-generation RVMs are equipped with AI-based material recognition, IoT-enabled monitoring, and contactless payment features. These advancements are transforming waste management into a data-driven ecosystem.

Machine learning algorithms are being utilized to identify material types, prevent fraud, and optimize collection routes, enhancing operational efficiency for waste management authorities and private recyclers alike.

Browse Full Report: https://www.factmr.com/report/europe-recycling-vending-machine-market

Regional Growth Highlights

Western Europe: The Innovation Hub

Countries like Germany, the U.K., and the Netherlands lead the region’s RVM adoption, driven by established deposit-return laws and corporate recycling mandates. Germany remains the benchmark for automated container collection systems, with dense RVM deployment across retail and public infrastructure.

Nordic Countries: Policy-Driven Expansion

Norway, Sweden, and Finland have among the highest beverage container recycling rates globally, supported by robust government policies and advanced RVM infrastructure. These nations are further investing in cloud-connected and energy-efficient vending systems to maintain sustainability leadership.

Southern and Eastern Europe: Emerging Opportunities

Rapid urbanization, rising waste volumes, and growing consumer awareness are stimulating demand in countries such as Spain, Italy, Poland, and the Czech Republic. EU funding for smart city and circular economy initiatives is expected to accelerate RVM deployment in these developing regions.

Market Segmentation Insights

By Machine Type

- Standalone Recycling Vending Machines – Ideal for high-traffic public spaces and transport terminals.

- Compact Reverse Vending Units – Preferred in retail and convenience store settings.

- Multifunctional Smart Kiosks – Offer integrated collection, data analytics, and consumer engagement tools.

By Material Type

- Plastic (PET)

- Metal (Aluminum Cans)

- Glass Containers

- Others (Paper Cups, Cartons)

By End Use

- Retail & Supermarkets

- Public Infrastructure (Airports, Stations, Malls)

- Corporate and Institutional Facilities

- Recycling and Waste Management Companies

Challenges and Market Considerations

- High Initial Setup and Maintenance Costs: Advanced RVMs require substantial investment in hardware, software, and maintenance infrastructure.

- Operational Downtime and Vandalism Risks: Continuous uptime and security remain key operational concerns in public installations.

- Regional Variability in Deposit-Return Systems: Differences in recycling legislation across European countries can hinder cross-border standardization.

- Technological Integration and Data Privacy: Growing use of connected systems demands strong cybersecurity and GDPR-compliant data management frameworks.

Competitive Landscape

The Europe recycling vending machine market is moderately consolidated, with key players investing in AI-enabled recognition systems, mobile app integration, and consumer reward platforms. Strategic collaborations with retail and beverage companies are defining the next phase of growth.

Key Players in Sales of Recycling Vending Machines in Europe:

- TOMRA Systems ASA

- Envipco Holding N.V.

- RVM Systems AS

- Sielaff GmbH & Co. KG

- Unison UK

- Air Link Systems Ltd.

- AKE Environmental Technologies

- Diebold Nixdorf Inc.

- Trautwein SB Technik GmbH

These companies are focusing on customized machine design, software integration, and service network expansion to meet country-specific recycling policies and consumer engagement models.

Future Outlook: Toward Connected, Smart, and Sustainable Recycling Systems

Over the next decade, the European recycling vending machine market is expected to evolve toward intelligent waste collection ecosystems, integrating AI, blockchain, and IoT for full traceability and transparency.

Governments and corporations alike are investing in digital deposit-return schemes to achieve higher recycling rates and circular resource utilization.

As sustainability becomes a core pillar of Europe’s industrial and consumer landscape, recycling vending machines will play a pivotal role in bridging technology with environmental responsibility—empowering consumers to participate actively in the region’s green transformation.