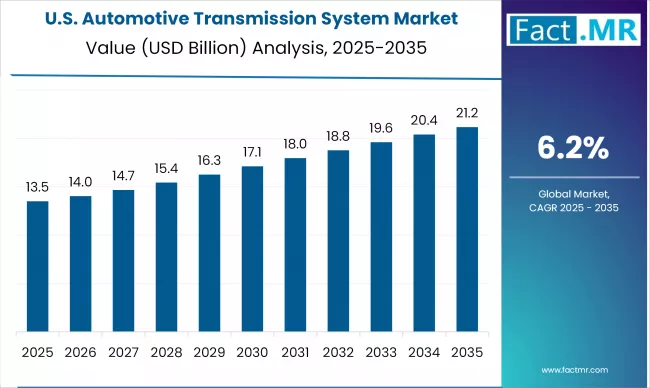

The global Automotive Transmission System Market is projected to expand from USD 47.3 billion in 2025 to USD 87.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.2%, according to Fact.MR, a market research and competitive intelligence provider. The market’s growth is propelled by stringent global emission norms, the rising adoption of automatic and dual-clutch systems, and the accelerating shift toward hybrid and electric powertrains.

As global governments enforce stricter fuel economy and emission standards such as Euro 6, BS6, and CAFE, automakers are investing heavily in transmission technologies that optimize performance and minimize carbon output. From continuously variable transmissions (CVTs) to dual-clutch (DCT) and e-CVT systems, advanced designs are enabling smoother power delivery, enhanced fuel economy, and lower maintenance costs.

Technological Advancements and Electrification Fuel Market Momentum

The global automotive transmission industry is at a pivotal transformation point. Rapid technological progress in electronics, software, and lightweight materials is allowing manufacturers to design compact, efficient, and durable systems that complement both internal combustion and hybrid powertrains.

“Modern transmission systems are no longer mechanical components—they’re intelligent, software-driven solutions that define vehicle efficiency,” said a Fact.MR senior analyst. “The future of the transmission market is tightly linked with electrification, digital integration, and sustainable mobility.”

Vehicle electrification is reshaping transmission system design. While electric vehicles (EVs) utilize simplified single-speed gearboxes, hybrid models demand complex architectures like multi-speed e-CVTs to balance power between internal combustion engines and electric motors. This shift is creating opportunities for transmission suppliers to develop EV-ready gearboxes and integrated e-axles, catering to emerging demands across passenger, commercial, and fleet vehicles.

Regional Overview: Asia-Pacific Leads the Market Transformation

Asia Pacific remains the largest and fastest-growing regional market, driven by robust automotive production in China, Japan, and India.

-

China leads global transmission innovation, supported by its extensive automotive manufacturing base and rapid EV transition. Domestic players such as Shanghai Automobile Gear Works and Shengrui Transmission are strengthening their R&D to meet the needs of both ICE and electric platforms.

-

India is witnessing a major shift toward automatic and automated manual transmissions, especially in compact passenger vehicles. Initiatives like Make in India and the Production Linked Incentive (PLI) scheme are encouraging localization of advanced transmission manufacturing.

-

Japan, a pioneer in hybrid technology, continues to advance e-CVT systems that optimize fuel efficiency and hybrid-electric powertrain performance.

In North America, the U.S. market is driven by regulatory targets under the Corporate Average Fuel Economy (CAFE) standards and growing consumer preference for automatic transmissions in SUVs and light trucks. Automakers such as Ford, General Motors, and Toyota are localizing production of hybrid-ready 8-speed and 10-speed transmissions to meet evolving efficiency demands.

Europe remains a hub of innovation, led by Germany, France, and the Nordic region. Automakers like Volkswagen, BMW, and Mercedes-Benz are integrating lightweight DCTs and CVTs that align with carbon-neutral goals. European suppliers are also pioneering modular multi-speed gearboxes tailored for electric vehicles, supported by regional commitments to emissions reduction under the EU Green Deal.

Emerging regions such as Latin America and the Middle East & Africa (MEA) are gradually transitioning toward automatic and AMT-equipped vehicles, driven by urbanization, ride-hailing growth, and increased consumer preference for driving comfort.

Segmental Insights

-

By Transmission Type: Automatic transmissions dominate global sales due to growing consumer preference for comfort and convenience. Dual-clutch transmissions (DCTs) represent the fastest-growing segment, offering seamless gear shifts, fuel efficiency, and high performance—especially in premium and hybrid vehicles.

-

By Vehicle Type: Passenger cars hold the largest share, while light commercial vehicles (LCVs) are the fastest-growing category, driven by last-mile delivery expansion and e-commerce logistics.

-

By Fuel Type: Gasoline vehicles maintain a dominant position globally, supported by widespread infrastructure and cleaner fuel adoption. Diesel transmissions continue to serve commercial and heavy-duty segments, while hybrid and electric transmissions are witnessing exponential growth.

Challenges: Cost, Complexity, and EV Disruption

Despite strong growth prospects, the market faces notable challenges. Advanced systems such as DCTs and CVTs are cost-intensive due to complex engineering and material requirements, limiting their adoption in cost-sensitive regions. Additionally, integration challenges with ADAS, ECUs, and hybrid platforms demand high R&D investment and technical expertise.

The rise of electric vehicles presents both opportunities and disruptions. Since most EVs use simplified single-speed gearboxes, traditional transmission manufacturers must diversify into EV-specific systems, such as e-axles and integrated drive units. This transition requires balancing investment between legacy ICE components and next-generation electrified architectures.

Competitive Landscape: Innovation and Integration Define Market Leaders

The global market is consolidated among key players including:

Aisin Corporation, ZF Friedrichshafen AG, Magna International, BorgWarner Inc., JATCO Ltd., Continental AG, Eaton Corporation PLC, Allison Transmission, GKN PLC, and Hyundai Transys.

Leading manufacturers are pursuing strategic investments in software integration, hybrid compatibility, and modular design. ZF Friedrichshafen’s launch of its 8HP evo 8-speed hybrid-ready transmission and Stellantis’ expansion of eDCT production in Italy exemplify this global shift.

Fact.MR’s analysis indicates that partnerships with EV startups, AI-driven software developers, and digital twin engineering firms will be central to maintaining competitiveness in the next decade.

Market Outlook: Driving Toward a Smarter, Sustainable Future

With increasing convergence between mechanical efficiency and digital intelligence, the next generation of transmission systems will be defined by smart control architectures, reduced weight, and electrification readiness.

“The automotive transmission industry is entering a new era of innovation where electronics, efficiency, and energy transition converge,” noted a Fact.MR analyst. “By 2035, market leaders will be those that successfully align advanced transmission design with global electrification goals.”

About Fact.MR

Fact.MR is a global market research and consulting firm providing actionable insights across more than 1,200 industries in over 100 countries. With a focus on data-driven strategy, competitive intelligence, and technology forecasting, Fact.MR supports leading enterprises and policymakers in navigating dynamic market transformations.