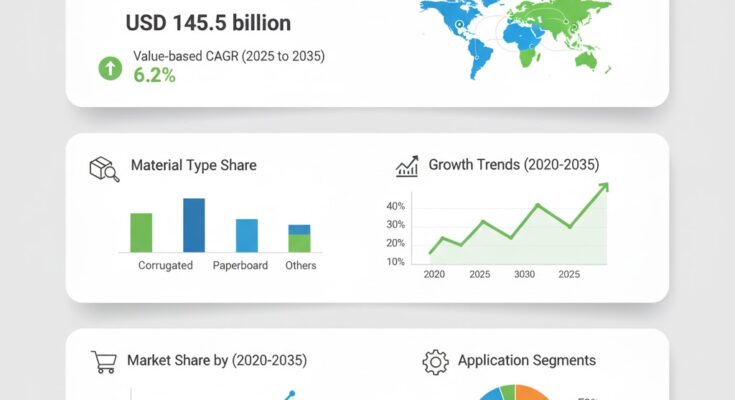

The global retail ready packaging market is on a strong upward trajectory, driven by the growing demand for efficient, shelf-ready, and sustainable packaging solutions across the retail and FMCG sectors. According to a recent report by Fact.MR, the market is expected to rise from USD 79.5 billion in 2025 to USD 145.5 billion by 2035, reflecting a robust CAGR of 6.2% during the forecast period.

As the retail landscape evolves with increasing focus on convenience, brand visibility, and waste reduction, retail ready packaging has emerged as a critical solution enabling streamlined logistics, quick shelf replenishment, and enhanced consumer appeal.

Strategic Market Drivers

- Rising Demand from Organized Retail and E-commerce

The global surge in organized retail, supermarkets, and hypermarkets continues to drive strong adoption of retail ready packaging. These packaging formats—designed for easy stocking, display, and disposal—are helping retailers reduce labor costs and improve shelf efficiency.

In addition, the growing penetration of e-commerce and omnichannel retailing is spurring demand for packaging that combines durability, branding, and ease of handling during transport and display.

- Sustainability and Circular Economy Initiatives

Sustainability remains a core growth catalyst in the RRP market. Manufacturers are increasingly developing recyclable, biodegradable, and lightweight packaging solutions aligned with circular economy goals.

Governments and retailers alike are promoting eco-friendly materials such as corrugated board, molded pulp, and recycled paper to reduce plastic dependency and carbon emissions across the value chain.

- Packaging Automation and Supply Chain Optimization

Advancements in automated packaging lines, digital printing, and smart labeling are optimizing RRP production and logistics. These innovations allow for faster customization, improved traceability, and enhanced aesthetic appeal—factors that directly influence retail competitiveness.

Automation also facilitates consistency in packaging quality and reduces waste during production, further improving cost efficiency for large-scale retailers.

Regional Growth Highlights

North America: Retail Modernization and Sustainability Integration

North America remains a key growth region for retail ready packaging, supported by the expansion of big-box retailers, warehouse clubs, and online grocery platforms.

The U.S. and Canada are investing heavily in sustainable packaging initiatives, prompting suppliers to innovate with fiber-based and recyclable packaging materials that align with corporate sustainability targets.

Europe: Strong Regulatory and Environmental Focus

Europe dominates the RRP landscape with advanced recycling infrastructure and stringent packaging waste regulations.

Countries such as Germany, the U.K., and France lead in the adoption of corrugated and paperboard-based retail ready packaging, driven by retailer-specific requirements and the EU’s Green Deal framework promoting waste minimization and resource efficiency.

East Asia: Expanding Manufacturing and Retail Footprint

East Asia is emerging as a dynamic market, led by China, Japan, and South Korea. Rapid urbanization, a rising middle-class consumer base, and robust retail infrastructure development are fueling the demand for high-quality, display-efficient packaging.

Local manufacturers are integrating automation and high-graphic printing technologies to cater to the growing demand for visually appealing and functional packaging.

Emerging Markets: Accelerating Retail Growth

Latin America, South Asia, and the Middle East are witnessing rapid expansion in modern trade formats, offering new opportunities for RRP adoption.

Government-backed retail development programs and increasing consumption of packaged goods are fostering strong regional demand for cost-effective and sustainable packaging formats.

Market Segmentation Insights

By Material Type

- Corrugated Board: Widely used for its strength, recyclability, and cost-effectiveness.

- Paper & Paperboard: Gaining traction in lightweight and eco-friendly packaging designs.

- Plastic: Used selectively for moisture resistance and transparency, though facing regulatory pressures.

By Packaging Type

- Die-Cut Display Boxes – Popular for easy product visibility and handling.

- Shrink-Wrapped Trays – Ensures compactness and protection during transit.

- Plastic Containers – Used for perishable and high-moisture products.

- Corrugated Cardboard Boxes – Preferred for heavy-duty applications.

By End Use Industry

- Food & Beverages – Dominates market share due to strong demand from supermarkets and convenience stores.

- Personal Care & Household Products – Growing need for visually distinctive packaging.

- Pharmaceuticals – Increasing adoption for organized display and hygiene compliance.

- Electronics & Consumer Goods – Rising use for compact and protective display packaging.

Challenges and Market Considerations

Despite optimistic growth prospects, the RRP market faces several challenges:

- Raw Material Price Fluctuations: Volatility in paper and pulp prices impacts cost structures.

- Environmental Regulations: Compliance with packaging waste and recycling mandates increases R&D expenditure.

- Supply Chain Complexity: Global disruptions can affect raw material availability and shipping efficiency.

- Competition from Traditional Packaging: Price-sensitive markets still rely on conventional packaging solutions.

Competitive Landscape

The global retail ready packaging market is highly competitive, with leading companies focusing on innovation, sustainability, and strategic expansion to capture evolving retail trends. Key market players are strengthening their production capabilities and adopting advanced printing and automation technologies to enhance performance and reduce environmental footprint.

Key Companies Profiled:

- Smurfit Kappa Group plc

- DS Smith plc

- Mondi

- Amcor Limited

- LINPAC Packaging

- Caps Cases Ltd.

- Orora Packaging Australia Pty Ltd.

- International Paper Company

- Creative Corrugated Designs Inc.

- i2i Europe Ltd

These companies are collaborating with retailers and FMCG manufacturers to design packaging that meets the dual goals of consumer convenience and sustainability, while offering strong brand visibility on shelves.

Recent Developments

- June 2023 – Smurfit Kappa Group introduced a fully recyclable corrugated retail ready packaging line optimized for automated shelf-filling systems in European supermarkets.

- March 2023 – DS Smith unveiled its “Circular Design Metrics” program to help retailers assess packaging sustainability performance.

- November 2022 – Mondi launched its “PerFORMing” paper-based tray solution, replacing plastic trays in food retail applications.

Future Outlook: Toward Smart, Sustainable, and Automated Retail Packaging

Over the next decade, the retail ready packaging industry will continue evolving toward automation, digital printing, and circular material design.

Manufacturers are expected to increasingly adopt smart packaging technologies, such as QR-coded designs for supply chain traceability and AI-driven quality control systems for precision manufacturing.

With sustainability and retail efficiency at the forefront, the market will witness widespread adoption of eco-friendly materials, digital design tools, and modular packaging structuresenabling retailers to optimize shelf space and reduce operational costs.

As consumer preferences shift toward convenience and responsible consumption, the retail ready packaging market is poised for sustained growth, innovation, and transformation—delivering packaging solutions that are smarter, greener, and retail-optimized.