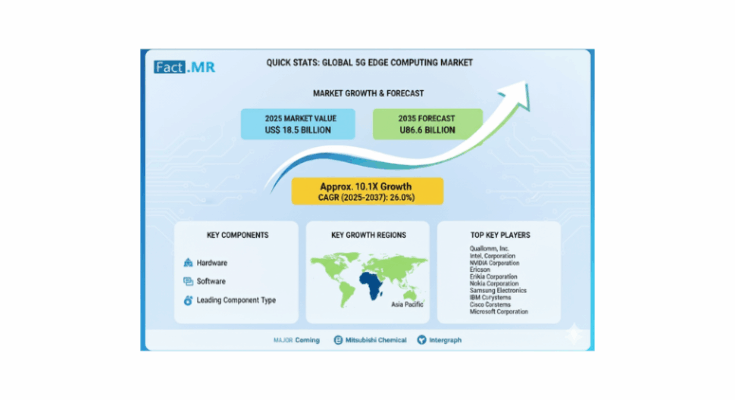

The global 5G edge computing market is poised for exponential growth, expected to surge from USD 18.5 billion in 2025 to USD 186.6 billion by 2035, reflecting a CAGR of 26.0%. This tenfold market expansion is being driven by rising demand for ultra-low latency applications, real-time processing systems, and intelligent connectivity platforms across industries worldwide.

Market Overview

5G edge computing empowers organizations to process data closer to the source, reducing latency and improving application performance without requiring extensive centralized infrastructure. Its applications span autonomous vehicles, smart cities, industrial IoT, AR/VR, and healthcare, enabling real-time decision-making, network efficiency, and operational safety. Investments in 5G network rollouts, distributed computing architectures, and AI-enhanced edge platforms are further accelerating market adoption.

Component Analysis

The market is segmented into hardware, software, and services. Hardware dominates with a 50% market share in 2025, driven by high-performance edge processing units, advanced chipsets, and intelligent infrastructure platforms. These systems enable superior data handling, network optimization, and multi-application processing, ensuring consistent performance across industries.

Software accounts for 30% market share, providing advanced analytics, edge orchestration, and network management capabilities, while services cover 20%, offering deployment support, technical consultation, and system integration expertise. The combined ecosystem ensures end-to-end solutions for telecommunications, manufacturing, healthcare, and other high-demand sectors.

Application Highlights

-

Autonomous Vehicles (25% share): Edge computing is critical for vehicle-to-everything communication, collision avoidance, and real-time navigation, supporting increasing automation and safety regulations.

-

Smart Cities (20%): Enables intelligent traffic management, urban infrastructure monitoring, and public safety systems, improving efficiency and sustainability.

-

Industrial IoT (20%): Facilitates predictive maintenance, automation, and quality control, transforming manufacturing operations.

-

AR/VR (15%): Supports immersive content delivery, real-time rendering, and interactive experiences with minimal latency.

-

Others (20%): Includes emergency services, retail analytics, and entertainment, reflecting diverse edge computing adoption.

Regional Insights

-

North America: Leading growth, driven by advanced 5G infrastructure, government support, and innovation hubs in Silicon Valley, Seattle, Austin, and Boston. CAGR: 28.5%

-

Asia-Pacific: South Korea and China are high-growth markets, fueled by smart city initiatives, 5G expansion, and industrial IoT adoption. South Korea CAGR: 27.8%

-

Europe: Germany maintains leadership with industrial automation and Industry 4.0 integration, while the U.K. and France focus on telecommunications modernization and smart infrastructure. Germany CAGR: 27.2%, U.K. 26.0%, France 25.4%

Market Drivers

-

Ultra-low latency requirements in autonomous systems, IoT, and smart infrastructure.

-

Integration with AI and distributed computing, enabling real-time analytics and intelligent automation.

-

Telecommunications modernization, improving service delivery, network performance, and scalability.

-

Digital transformation initiatives, promoting IoT integration, autonomous vehicle networks, and smart urban solutions.

Challenges and Constraints

High infrastructure deployment costs, complex integration with legacy networks, and regulatory compliance issues may hinder adoption, especially for smaller operators and emerging markets. Spectrum management, technical expertise requirements, and network interoperability further challenge widespread deployment.

Competitive Landscape

The 5G edge computing market features 25-35 significant players, with the top three capturing approximately 45-52% of global market share. Market leaders include Qualcomm, Intel, NVIDIA, Ericsson, Nokia, Huawei, Samsung, Cisco, IBM, and Microsoft.

-

Qualcomm, Intel, NVIDIA: Leverage AI-enabled edge platforms, hardware excellence, and global service networks.

-

Ericsson, Nokia: Compete via network integration, regional expertise, and specialized edge solutions.

-

Huawei, Samsung, Cisco: Focus on vertical applications and innovative infrastructure systems.

Emerging regional players provide cost-effective solutions and rapid deployment capabilities, especially in Asia-Pacific and Latin America, complementing global leaders with local market expertise and regulatory compliance.

Strategic Opportunities

-

Hardware Manufacturers: Invest in next-gen AI-integrated edge units with enhanced processing speed and application-specific optimizations.

-

Software Providers: Develop advanced orchestration and predictive analytics platforms for real-time network management.

-

Service Networks: Offer technical consultation, deployment support, and training programs for operators and enterprise clients.

-

Investors: Back startups and established technology providers to expand edge system production, AI platforms, and regional deployment capabilities.

Policy and Government Role

Governments can accelerate adoption through:

-

5G infrastructure programs including edge computing.

-

Tax incentives and R&D support for edge technology investment.

-

Regulatory frameworks ensuring interoperability and data governance.

-

Skills development for engineers and edge computing specialists.

Outlook and Market Potential

With demand projected to increase tenfold by 2035, 5G edge computing is a critical enabler of next-generation telecommunications, industrial automation, and urban infrastructure. Companies that invest in hardware innovation, AI-driven software, and strategic regional partnerships will capture the greatest value, driving competitive differentiation and technological leadership in a rapidly evolving global market.

Browse Full Report : https://www.factmr.com/report/5g-edge-computing-market