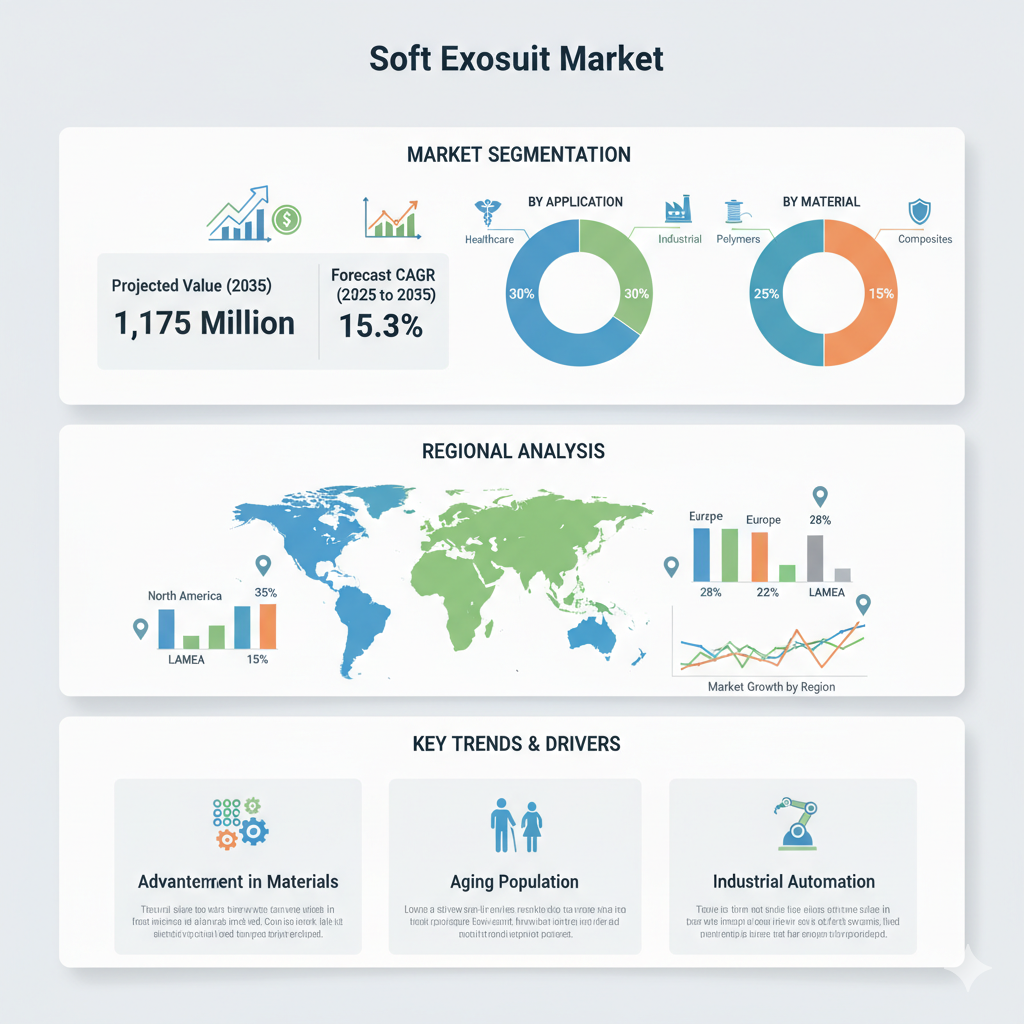

The global soft exosuit market is poised for significant growth in the coming decade. The market is projected to expand from USD 283 million in 2025 to USD 1,175 million by 2035, reflecting a compound annual growth rate (CAGR) of 15.3 % between 2025 and 2035.

This strong trajectory is driven by increasing demand for mobility assistance and rehabilitation solutions, particularly among aging populations and patients recovering from neurological or musculoskeletal conditions. Soft exosuits, with their lightweight, textile-based design and ability to integrate with sensors and AI systems, are emerging as a preferred alternative to rigid exoskeletons in therapeutic and assistive applications.

Market Segmentation by Body Part Assisted, Material, Application, Technology, and End-Use

By Body Part Assisted: Upper, Lower, and Full Body

Among the three assisted zones, lower-body exosuits dominate the market, especially for rehabilitation and gait-training applications. These devices help restore walking ability and balance and strengthen lower-limb muscles, making them highly valuable in clinical and home-care settings.

The upper-body segment—covering the arms, shoulders, and torso—is also expanding steadily, mainly in stroke recovery and upper-limb rehabilitation. Meanwhile, full-body exosuits are designed to deliver comprehensive assistance but remain at an early stage due to their higher complexity and cost.

By Material

Materials play a crucial role in defining flexibility, comfort, and performance. The leading materials used in soft exosuits include nylon and spandex fabrics, self-healing silicones, soft hydrogels, electroactive polymers (EAPs), and sensor-embedded textiles. Textile-based materials are widely favored for their breathability and adaptability, while newer composites enhance durability and responsiveness.

By Application

Rehabilitation is the largest application segment, as soft exosuits are widely adopted in stroke recovery, spinal injury therapy, and neuromuscular rehabilitation. These systems assist in motor relearning and muscle reactivation during therapy sessions.

Mobility assistance and gait training applications are growing as well. These segments target individuals with partial mobility loss or elderly users who need additional physical support in daily activities.

By Technology

The technological components of soft exosuits are divided into:

- Actuation systems (motors or soft actuators that provide motion support)

- Sensing technology (motion, pressure, and force sensors)

- Control systems (microcontrollers and real-time motion analysis)

- Machine learning integration (adaptive response based on user feedback)

Among these, actuation and sensing technologies are leading drivers of market advancement, enabling lightweight yet powerful assistance that enhances mobility and safety.

By End-Use

Key end-use sectors include hospitals and rehabilitation centers, home care environments, and physical therapy clinics. Hospitals dominate usage due to advanced infrastructure and patient access, but home-based applications are rapidly increasing as designs become more compact and user-friendly.

By Region

The global market is regionally segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

- North America leads the market, driven by strong healthcare investment and rapid adoption of assistive technologies.

- Europe, particularly Germany and the Nordic countries, shows steady growth supported by public healthcare funding and advanced rehabilitation research.

- Asia-Pacific is the fastest-growing region, with countries such as Japan, China, and South Korea investing heavily in aging-population care and robotic rehabilitation technologies.

Recent Developments and Competitive Landscape

Recent Developments

The soft exosuit industry has seen major advancements in research, product design, and collaboration:

- In late 2023, healthcare developers introduced wearable exosuits aimed at supporting medical staff during physically demanding work, helping reduce fatigue and injury.

- In 2025, academic and industry researchers unveiled new air-actuated soft exosuits, which rely on pneumatic systems rather than rigid motors. These designs promise greater flexibility, lighter weight, and reduced strain for users.

- Several leading manufacturers are conducting extensive clinical trials and integrating AI-driven adaptive control systems, improving safety and responsiveness in real-world environments.

Key Players and Competitive Analysis

The market features a mix of established robotics manufacturers and emerging startups. Major companies include SuitX (Ottobock), ReWalk Robotics, Ekso Bionics, CYBERDYNE, Myomo, B-Temia, Bioservo Technologies, ExoAtlet, and Wearable Robotics Srl.

Competition centers on four major strategic areas:

- Clinical validation and regulatory approval – proving therapeutic effectiveness through trials.

- Partnerships with rehabilitation centers and hospitals – ensuring adoption and integration into treatment workflows.

- Technological innovation – improving actuators, sensors, ergonomics, and AI-based control systems.

- Cost reduction and accessibility – creating scalable models suitable for both hospitals and individual users.

Companies like SuitX (Ottobock) focus on modular exosuit systems that can be adapted to multiple use cases. Ekso Bionics continues to expand its rehabilitation portfolio with lighter, patient-friendly designs. ReWalk Robotics emphasizes clinically tested systems for neurological rehabilitation, while B-Temia and Bioservo pursue specialized wearable technologies for industrial and defense markets.

The industry is also witnessing an increase in strategic collaborations between research institutes, healthcare providers, and robotic firms, promoting faster innovation and commercialization.