The freight wagons industry in the Middle East and Africa (MEA) is witnessing significant growth, driven by expanding trade, industrialization, and infrastructural development across the region. Freight wagons, essential for rail-based logistics, facilitate the bulk transport of goods such as minerals, petroleum products, agricultural commodities, and industrial materials. Increasing demand for efficient, cost-effective, and sustainable transportation solutions has positioned rail freight as a preferred option in several MEA countries.

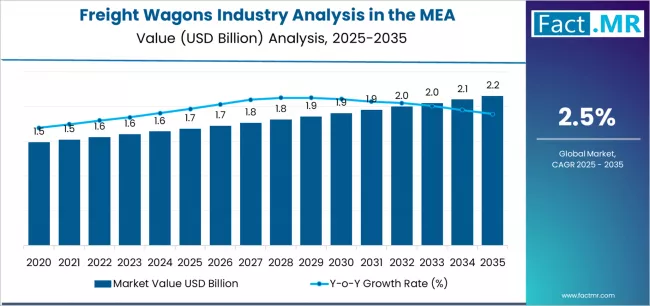

As of 2025, the MEA freight wagons market is estimated at approximately USD 1.8 billion. Projections indicate that the market will grow to around USD 3.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of about 5.5% over the next decade. Market expansion is fueled by government investments in rail infrastructure, adoption of modern wagon technologies, and rising demand for bulk cargo transportation.

Key Market Highlights (2025 Baseline)

-

Market Value (2025): ~ USD 1.8 billion

-

Forecast Value (2035): ~ USD 3.1 billion

-

Forecast CAGR (2025–2035): ~ 5.5%

-

Leading Wagon Type: Boxcars (~ 42% share in 2025)

-

Dominant Application Segment: Bulk cargo transportation (~ 55% share in 2025)

-

Top Regional Markets: Gulf Cooperation Council (GCC) countries, South Africa, Egypt

-

High-Growth Sub-Segments: Tank wagons, flatbed wagons, refrigerated wagons

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=11944

Growth Drivers & Market Momentum

Expansion of Rail Infrastructure

Government-led initiatives to develop and modernize rail networks are a key growth driver. Investments in high-capacity rail corridors, industrial freight links, and cross-border connectivity are increasing the adoption of freight wagons for bulk transportation, particularly in GCC nations and South Africa.

Rising Industrialization & Mining Activities

The MEA region is rich in natural resources, including minerals, metals, and hydrocarbons. Expanding mining, petrochemical, and industrial sectors necessitate efficient bulk transport solutions, which freight wagons provide. The ability to transport heavy loads economically over long distances makes wagons essential for supply chains.

Growth in Trade & Logistics

Increasing intra-regional trade and exports to global markets are driving demand for reliable and high-capacity freight wagons. Freight rail offers an efficient alternative to road transport, reducing congestion and lowering logistics costs, especially for long-distance and high-volume cargo movement.

Technological Advancements & Modernization

The adoption of modern wagon designs, enhanced braking systems, lightweight materials, and improved safety features enhances performance, operational efficiency, and durability. These innovations improve reliability, reduce maintenance costs, and extend wagon service life.

Regional Market Dynamics

GCC countries lead the market due to strategic investments in industrial zones and rail freight networks. South Africa’s mining and bulk commodity transport drives demand for specialized wagons, while North African countries like Egypt are expanding rail networks to support logistics and port connectivity.

Challenges & Market Constraints

-

High Capital Investment: Procurement of modern freight wagons and rail infrastructure requires substantial capital, which may limit adoption in budget-constrained regions.

-

Maintenance & Operational Challenges: Harsh climatic conditions, limited skilled personnel, and lack of spare parts in certain MEA regions can affect operational efficiency.

-

Competition from Road Freight: In regions with limited rail networks, road freight remains a dominant alternative, posing competitive challenges.

-

Regulatory & Standardization Issues: Variability in rail gauge, safety standards, and cross-border regulatory frameworks can impact wagon deployment and efficiency.

Strategic Recommendations

For Manufacturers & Suppliers

-

Invest in developing durable, high-capacity, and technologically advanced freight wagons suitable for diverse cargo types and regional conditions.

-

Establish local maintenance and service networks to support long-term operations and reliability.

-

Explore partnerships with government rail authorities and logistics operators to enhance market penetration.

For End-Use Industries & Rail Operators

-

Incorporate modern freight wagons to improve efficiency, reduce logistics costs, and ensure reliable bulk transport.

-

Optimize fleet composition with a mix of tank, flatbed, refrigerated, and box wagons to meet varying cargo needs.

-

Implement predictive maintenance programs and operator training to enhance service life and safety.

For Investors & Market Entrants

-

Recognize the MEA freight wagon market as a high-growth segment linked to industrialization, mining, and trade expansion.

-

Focus on regions with active rail infrastructure investments and rising demand for bulk cargo transport.

-

Leverage technological innovation, modular designs, and energy-efficient wagon solutions to differentiate from competitors.

Market Outlook to 2035

By 2035, the MEA freight wagons market is expected to reach approximately USD 3.1 billion, driven by ongoing investments in rail infrastructure, growing industrial and mining activities, and expanding intra-regional and international trade. Boxcars and bulk cargo wagons are expected to dominate the market due to their versatility and high demand for transporting minerals, raw materials, and industrial goods.

Countries investing in modern rail networks, technological upgrades, and fleet expansion will lead the growth trajectory. Manufacturers and operators focusing on innovation, operational efficiency, and maintenance support are poised to gain a competitive edge. With rising demand for sustainable, efficient, and cost-effective freight transportation, industrial wagons will remain a critical component of the MEA logistics and supply chain ecosystem over the next decade.

Browse Full Report: https://www.factmr.com/report/middle-east-and-africa-freight-wagons-industry-analysis