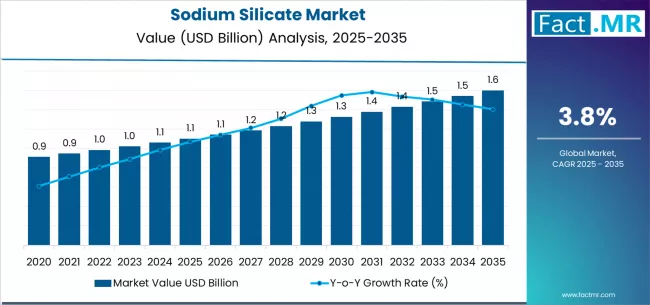

The global sodium silicate market is poised for steady expansion over the next decade, underpinned by increasing applications across construction, detergents, pulp and paper, and water treatment industries. According to a new study by Fact.MR, the market is valued at USD 1.1 billion in 2025 and is forecast to reach USD 1.6 billion by 2035, representing an absolute growth of USD 0.5 billion during the assessment period. This reflects a total increase of 45.5%, with the market advancing at a CAGR of 3.8% between 2025 and 2035.

As industries prioritize eco-friendly, cost-effective, and multi-functional raw materials, sodium silicate has emerged as a vital compound enabling sustainable innovation in diverse industrial and manufacturing applications.

Strategic Market Drivers

- Expanding Demand from the Construction and Building Materials Sector

Sodium silicate plays a critical role as a binding, adhesive, and sealing agent in construction materials such as cements, refractories, and concrete. Its capability to enhance mechanical strength, fire resistance, and durability makes it indispensable for infrastructure and housing projects. The global focus on resilient and energy-efficient structures is boosting the adoption of sodium silicate-based formulations in construction additives and coatings. - Rising Use in Water Treatment and Environmental Applications

The growing emphasis on sustainable water management is significantly driving demand for sodium silicate. It serves as an effective coagulating and corrosion-preventing agent in municipal and industrial water treatment systems. Moreover, its non-toxic and biodegradable nature aligns with the global shift toward green chemicals, further elevating its market appeal. - Surging Consumption in Detergents and Cleaning Products

Sodium silicate remains a key ingredient in detergent manufacturing due to its ability to enhance cleaning efficiency, stabilize peroxide compounds, and prevent corrosion of washing equipment. The increasing penetration of eco-friendly detergents across both residential and industrial markets continues to stimulate demand for the compound. - Industrial and Automotive Applications: Strengthening Demand for Performance Materials

In foundries, textiles, and automotive industries, sodium silicate is used for coating, binding, and deflocculating applications. Its versatility in adhesive formulations and chemical manufacturing processes positions it as a preferred raw material for performance-driven industrial uses.

Browse Full Report: https://www.factmr.com/report/sodium-silicate-market

Regional Growth Highlights

East Asia: The Manufacturing Powerhouse

East Asia holds the lion’s share of the global sodium silicate market, led by China, Japan, and South Korea. High manufacturing output, robust infrastructure investment, and growing demand for glass and detergents underpin the region’s dominance. Additionally, favorable government policies promoting green chemistry continue to drive production innovation.

North America: Focus on Sustainability and Advanced Materials

In the U.S. and Canada, increasing investment in sustainable water treatment and renewable energy technologies is bolstering sodium silicate demand. The chemical’s role in developing eco-friendly detergents and adhesives is further supported by stringent environmental standards.

Europe: Regulation-Driven Market Expansion

Europe’s growth trajectory is shaped by its strict sustainability mandates. The U.K., Germany, and France are focusing on circular economy initiatives and low-carbon manufacturing, promoting the use of sodium silicate in detergents, packaging, and construction materials that comply with environmental norms.

Emerging Markets: Accelerated Industrialization

Regions such as South Asia, Latin America, and the Middle East & Africa are witnessing rapid urbanization and industrial expansion. Growing construction activity and water infrastructure projects are catalyzing sodium silicate consumption, supported by government-led development programs and rising local manufacturing capacity.

Market Segmentation Insights

By Form:

- Solid Sodium Silicate: Predominantly used in refractories, cements, and adhesives.

- Liquid Sodium Silicate: Widely adopted in detergents, pulp & paper, and water treatment applications due to ease of handling and solubility.

By Application:

- Detergents & Cleaning Agents – The largest segment, supported by household and industrial cleaning demand.

- Construction & Building Materials – Increasing use in cement additives and fire-resistant coatings.

- Pulp & Paper – Enhances bleaching and de-inking efficiency.

- Water Treatment – Rising use as a corrosion inhibitor and flocculating agent.

- Automotive & Industrial Processes – Expanding use in foundries, coatings, and adhesives.

Market Challenges and Considerations

- Raw Material Price Fluctuations: Volatile silica and soda ash prices influence overall production costs.

- Environmental Regulations: Compliance with waste management and chemical disposal norms increases operational challenges.

- Competition from Substitute Materials: Alternatives like zeolites and phosphates in detergents may constrain growth in specific applications.

- Energy-Intensive Production: High energy requirements for sodium silicate synthesis push manufacturers toward energy-efficient technologies.

Competitive Landscape

The global sodium silicate market is moderately consolidated, characterized by innovation-driven strategies and expansion in high-demand regions. Major players are investing in capacity enhancement, process optimization, and environmentally sustainable production technologies.

Key Players in the Sodium Silicate Market:

- PQ Corporation

- Tata Chemicals Limited

- BASF SE

- Solvay S.A.

- W. R. Grace & Co.

- Nippon Chemical Industrial Co., Ltd.

- INEOS Group Holdings S.A.

- Pilkington Group Limited

- PQ Silicas UK Ltd.

- Tokuyama Corporation

Recent Developments

- January 2023 – PQ Corporation announced the expansion of its sodium silicate production capacity in North America to meet the growing demand from detergent and construction sectors.

- September 2022 – Tata Chemicals Limited unveiled a sustainability initiative aimed at reducing carbon emissions in silicate production through process electrification and renewable energy integration.

Future Outlook: Advancing Sustainability and Functional Innovation

The sodium silicate market is set to evolve toward sustainable production, material innovation, and circular economy integration. Manufacturers are investing in low-carbon manufacturing technologies, waste valorization, and AI-based process monitoring to optimize efficiency and reduce environmental footprints.

As industries increasingly embrace eco-friendly chemicals and advanced materials, sodium silicate will remain an essential enabler of cleaner production, durable construction, and efficient water management — positioning it as a cornerstone of the global industrial chemicals landscape through 2035.