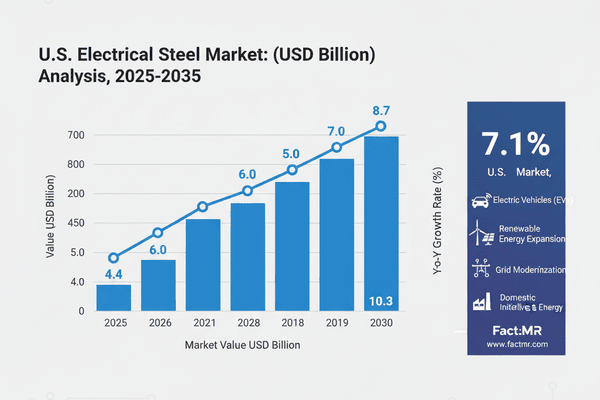

The U.S. electrical steel market is forecast to reach USD 8.7 billion by 2035, up from USD 4.4 billion in 2025, registering a CAGR of 7.1% during the forecast period. Growth is driven by electric vehicles (EVs), renewable energy expansion, and grid modernization projects, alongside domestic initiatives to reduce reliance on imports and meet federal clean energy incentives.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 4.4 billion |

| Projected Market Size (2035) | USD 8.7 billion |

| CAGR (2025–2035) | 7.1% |

Market Drivers

-

Electric Vehicle (EV) Expansion:

-

Electrical steel is essential for high-efficiency motors.

-

Non-grain-oriented (NGO) steel demand is rising as EV production increases domestically.

-

EV sales expected to account for >50% of new U.S. vehicle sales by 2030.

-

-

Grid Modernization & Renewable Integration:

-

Grain-oriented electrical steel (GOES) is critical for transformers and generators.

-

Federal incentives and infrastructure investment improve energy efficiency and reduce transmission losses.

-

-

Domestic Sourcing & Reshoring:

-

U.S. steelmakers expand capacity to meet rising performance standards and reduce import dependency.

-

Advanced, low-loss steel grades are increasingly produced to compete globally.

-

Regional Trends

| Region | Key Highlights |

|---|---|

| Midwest (OH, MI, PA) | Legacy mills modernizing to produce GOES and NGO steel; supplies EV and transformer components. |

| South (GA, KY, TN) | EV and battery manufacturing hubs; high demand for drive motors and charging infrastructure. |

| Southwest (TX, AZ, NM) | Leading market contributor; wind and solar expansion drives transformer demand; strong EV and semiconductor presence. |

| West Coast (CA) | Adoption of advanced steels for energy efficiency, public transit, and residential storage. |

| Northeast | Aging grid retrofits boost demand for specialty electrical steels. |

Challenges and Restraints

-

Limited domestic GOES producers: Cleveland-Cliffs is the primary supplier, creating potential supply bottlenecks.

-

Raw material and production competition: Global demand for electrical steel strains capacity and increases costs.

-

Regulatory and permitting delays: Slow infrastructure funding and permitting hinder expansion.

-

Skilled labor shortages: Specialized metallurgical and engineering roles are in short supply, affecting productivity.

Segmentation Analysis

By Product Type

| Product Type | Key Insights |

|---|---|

| Grain-Oriented (GOES) | Largest segment; essential for transformers and power distribution; low core loss and high permeability. |

| Non-Grain-Oriented (NGO) | High-efficiency motors, EV drive components; increasing demand from domestic EV production. |

| Fully-Processed | Ready-to-use steel for specialized applications. |

| Semi-Processed | Intermediate stage steel for downstream finishing. |

By Application

| Application | Key Insights |

|---|---|

| Transformers | Largest segment; critical for grid modernization and renewable energy integration. |

| Motors | Drives EV and industrial automation growth. |

| Transmission & Distribution | Supports efficient energy delivery. |

| Inductors & Portable | Specialized industrial and electronic applications. |

| Motors by Power Rating | 1hp–100hp, 101hp–200hp, 201hp–500hp, 501hp–1000hp, Above 1000hp. |

By End-Use Industry

| End-Use | Key Insights |

|---|---|

| Energy | Leading segment; transformers, generators, and motors rely on electrical steel. |

| Automotive | EVs and electrified vehicles increase demand for NGO steel. |

| Manufacturing | Drives industrial automation and motor production. |

| Household Appliances | Moderate segment; appliances require electrical steel for motors and transformers. |

| Others (Construction & Fabrication) | Niche applications in construction and precision engineering. |

By Region

| Region | Key Highlights |

|---|---|

| West U.S. | Energy efficiency regulations drive advanced steel adoption. |

| Southwest U.S. | Largest contributor; Texas, Arizona, NM lead renewable and EV infrastructure. |

| Midwest U.S. | Historical mills producing GOES/NGO steel; EV and transformer supply. |

| Northeast U.S. | Aging grid retrofits increase demand for specialty steels. |

| Southeast U.S. | Emerging EV and battery manufacturing hubs. |

Competitive Landscape

Key players include:

-

Cleveland-Cliffs, Inc. – Leading GOES producer; vertically integrated from mining to finished products.

-

AK Steel Holding Corporation – Now part of Cleveland-Cliffs; focuses on NGO steel.

-

Allegheny Technologies Inc. – Niche high-performance alloys for energy and industrial sectors.

-

United States Steel Corporation (Big River Steel) – Advanced flat-rolled steel production via EAF; supports EV and renewable energy growth.

-

Specialty Firms: Arnold Magnetic Technologies, Gibbs Wire & Steel – Precision-engineered laminations and strip solutions.

-

Distributors: Continental Steel & Tube Co., AAA Metals Company – Enhance accessibility with value-added processing.

Recent Developments

-

Oct 2023: U.S. Steel launched a 200,000-ton NGO steel production line at Big River Steel (Osceola, AR) — 70–80% CO₂ reduction, 90% scrap content.

-

July 2024: Cleveland-Cliffs invests $150M to convert Weirton, WV, facility into transformer manufacturing, leveraging GOES from Butler Works mill.

Browse Full Report : https://www.factmr.com/report/us-electrical-steel-market

Conclusion

The U.S. electrical steel market is set for robust growth (7.1% CAGR) through 2035, anchored by:

-

EV electrification and automotive demand

-

Grid modernization and renewable energy expansion

-

Domestic production and reshoring initiatives

Grain-oriented electrical steel (GOES) and transformers remain the dominant product and application segments, while the energy sector continues to anchor end-use demand. Strategic investment, workforce development, and adoption of low-loss steel technologies will be key to sustaining supply security and market growth.