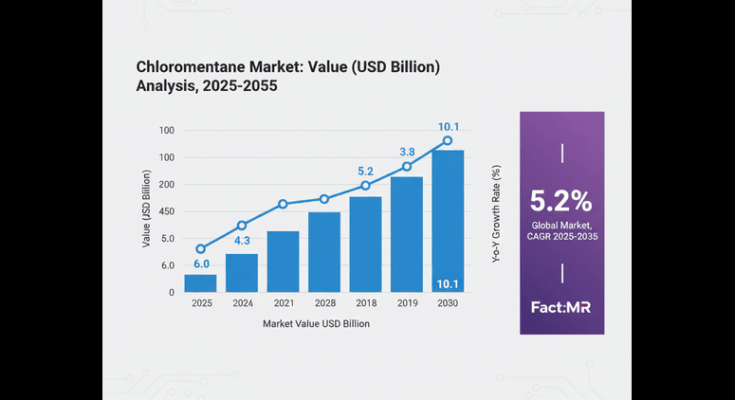

The global chloromethane market is valued at USD 6.0 billion in 2025. As per Fact.MR analysis, the market is projected to grow at a CAGR of 5.2%, reaching USD 10.1 billion by 2035.

Growth is primarily driven by the rising demand for silicone in electronics, construction, and personal care industries. Emerging markets like India and China lead expansion due to increasing industrialization, whereas stringent environmental regulations in developed regions moderate growth. Forward-looking trends indicate that pharmaceutical, agrochemical, and green innovation demand will sustain market expansion over the next decade.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 6.0 billion |

| Projected Market Size (2035) | USD 10.1 billion |

| CAGR (2025–2035) | 5.2% |

Industry Dynamics and Outlook

Key Growth Drivers

-

High demand from silicone production: Silicone polymers used in electronics, construction, personal care, and automotive industries drive consumption.

-

Pharmaceuticals: Methyl chloride derivatives are essential in the synthesis of active pharmaceutical ingredients (APIs).

-

Agrochemicals: Utilized in the production of herbicides, pesticides, and other crop protection chemicals.

Challenges

-

Stringent environmental regulations: Montreal and Kyoto Protocols limit emissions and phase out certain chlorinated chemicals.

-

Raw material volatility: Feedstocks like chlorine and methane are price-sensitive, influencing production costs.

-

Competition from greener alternatives: Bio-based and low-toxicity substitutes are emerging in regulated industries.

Opportunities

-

Cleaner production technologies: Low-emission chlorination methods and closed-loop systems reduce environmental impact.

-

Emerging markets: Asia-Pacific, Latin America, and Africa offer significant growth potential due to industrial expansion.

-

Industry partnerships: Collaborations with downstream industries enable tailored chloromethane applications and integrated value chains.

Stakeholder Insights

-

Producers: Must innovate cleaner production methods to comply with regulations and reduce costs. Key players include AkzoNobel, INEOS, Shin-Etsu Chemical Co., GACL.

-

End-users: Pharmaceutical, agrochemical, and silicone manufacturers drive product demand while emphasizing regulatory compliance and sustainability.

-

Investors: Favor companies with strong ESG policies, growth potential in emerging regions, and innovative production processes.

-

Technology Providers: Enable efficient, low-emission production, automation, and digital monitoring for emissions reduction and energy optimization.

-

Regulators: Strict environmental and chemical safety frameworks in Europe and North America shape operational practices.

Segmentation Analysis

By Product

| Product | Key Insights |

|---|---|

| Methyl Chloride | Largest and fastest-growing segment (CAGR 4.8%). Intermediate in silicone polymers, quaternary ammonium compounds, and butyl rubber production. |

| Methylene Chloride | Used in solvents and laboratory chemicals. |

| Carbon Tetrachloride | Gradually being phased out due to environmental concerns. |

| Chloroform | Niche industrial and pharmaceutical applications. |

| Others | Includes specialty chlorinated derivatives. |

By Application

| Application | CAGR (2025–2035) | Key Drivers |

|---|---|---|

| Silicone Polymers | 5.1% | Thermal stability, flexibility, chemical inertness; widely used in construction, electronics, automotive, and personal care. |

| Industrial Solvents | Moderate | Laboratory and chemical processing uses. |

| Refrigerants & Propellants | Moderate | Specialty applications in select regions. |

| Chemical Intermediates | 4.9% | For methylation and chlorination processes. |

| Others | – | Niche and specialty applications. |

By End-Use

| End-Use | CAGR (2025–2035) | Notes |

|---|---|---|

| Pharmaceuticals | 4.4% | Methyl chloride and derivatives are critical for APIs. |

| Agrochemicals | 5.0% | Production of herbicides and pesticides. |

| Silicone & Personal Care | 5.1% | High demand in global silicone industry. |

| Automotive & Construction | Moderate | Specialty adhesives and sealants. |

| Plastics & Rubber | Moderate | Industrial polymer applications. |

| Others | – | Textiles, paints, coatings, and niche industrial sectors. |

Regional Insights

| Region | Key Trends |

|---|---|

| USA | Silicone polymers dominate due to electronics, automotive, and construction demand. Pharmaceuticals and green innovation drive adoption. |

| Europe | Regulatory pressure encourages low-emission and eco-friendly processes. Silicone and pharmaceuticals are key growth sectors. |

| China | Second-largest market; emphasis on local production, self-reliance, and industrialization. |

| India | Fastest-growing market; strong electronics, construction, and chemical industries. |

| Australia & New Zealand | Pharmaceutical and personal care applications drive moderate CAGR (3.2%). |

| Asia-Pacific (Others) | Growing chemical manufacturing base and emerging pharma sector present medium- to long-term opportunities. |

Top Companies & Market Share

| Company | Market Share (2025E) | Key Strategies |

|---|---|---|

| INEOS Group | 18–20% | Global scale, sustainable production, and expansion strategy. |

| AkzoNobel N.V. | 15–18% | Green chemistry leadership, strong R&D, and global distribution. |

| Shin-Etsu Chemical Co. | 12–14% | Asia-Pacific dominance, high-quality derivatives, and vertical integration. |

| KEM ONE | 10–12% | Energy-efficient manufacturing, European market leadership. |

| Gujarat Alkalies & Chemical Ltd (GACL) | 7–10% | Low-cost production, strategic location in India. |

| Others | – | Solvay, Occidental Petroleum, Tokuyama, SRF Limited, Alfa Aesar, and regional players. |

Key Strategic Insights

-

Invest in Green Chemistry & Cleaner Production: Energy-efficient operations and low-emission methods will enhance regulatory compliance and competitiveness.

-

Focus on Emerging Markets: Asia-Pacific, Latin America, and Africa provide high growth potential due to industrialization and pharmaceutical sector expansion.

-

Innovation in Product Derivatives: Methyl chloride and specialty chlorinated intermediates must evolve to meet regulatory and sustainability requirements.

-

Integrated Supply Chain & ESG Alignment: Close collaboration between producers, end-users, investors, and technology providers ensures resilient operations and market leadership.

Browse Full Report : https://www.factmr.com/report/chloromethane-market

Conclusion

The chloromethane market is poised for steady growth (5.2% CAGR) through 2035, driven by pharmaceuticals, silicone polymers, and agrochemical demand. Companies with a focus on green manufacturing, regulatory compliance, and emerging market expansion are best positioned for success. Innovation in cleaner production and derivative development will be crucial for sustaining competitiveness while navigating environmental regulations and volatile raw material markets.