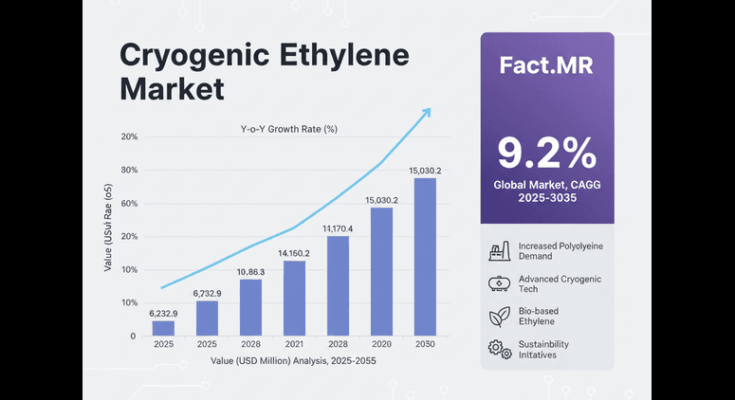

The global cryogenic ethylene market is valued at USD 6,232.9 million in 2025. According to Fact.MR analysis, the market is expected to grow at a CAGR of 9.2%, reaching USD 15,030.2 million by 2035.

In 2024, the cryogenic ethylene industry saw a notable rise due to increasing polyethylene production, expansion of chemical manufacturing, and growing adoption of bio-based ethylene. Fact.MR analysis revealed surging demand from industrial hubs, polymer manufacturers, and transportation sectors requiring ultra-low-temperature storage and transport solutions.

Key drivers include: rising polymer and chemical derivative demand, adoption of AI-driven cryogenic monitoring systems, and infrastructure development for energy-efficient cryogenic transport. Private sector uptake is also increasing, particularly in specialty chemicals, pharmaceuticals, and high-tech manufacturing requiring precision temperature management.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 6,232.9 Million |

| Projected Market Size (2035) | USD 15,030.2 Million |

| CAGR (2025–2035) | 9.2% |

| Polymer Grade CAGR | 6.4% |

| Chemical Grade CAGR | 7.1% |

| ISO Containers CAGR | 6.3% |

Stakeholder Perspectives (Survey Q4 2024, n=500)

Stakeholders: Manufacturers, distributors, facility managers, chemical plant operators, and logistics providers in the USA, Western Europe, China, and Japan.

Key Priorities:

-

Safety Compliance & Purity: 81% of stakeholders emphasized high-purity standards and adherence to industrial safety protocols as critical.

-

Transport Efficiency: 68% highlighted modular ISO container adoption for ease of transport and cost efficiency.

-

Sustainability: 54% globally preferred solutions integrating bio-based ethylene or low-carbon footprint practices.

Regional Variations:

-

USA: 72% favored AI-enabled monitoring for plant safety and storage optimization.

-

Western Europe: 61% prioritized eco-friendly cryogenic systems and renewable feedstocks.

-

China: 78% focused on scaling infrastructure to meet industrial megaproject demand.

-

Japan: 49% highlighted compact, energy-efficient storage for urban chemical facilities.

Material Preferences & Technology Trends

-

Storage Materials: Stainless steel and specialized alloys remain dominant (64%) for durability under extreme low temperatures.

-

Transport: ISO containers are widely used for multimodal logistics (CAGR 6.3%).

-

Emerging Tech: IoT-based monitoring and AI predictive systems are growing, with 41% of Western European plants adopting smart cryogenic solutions.

-

Sustainability: Bio-ethylene adoption is highest in Asia-Pacific due to renewable feedstock initiatives.

Market Segmentation

By Grade:

-

Polymer Grade (used in polyethylene, polypropylene) – CAGR 6.4%

-

Chemical Grade (used in ethylene oxide, ethylene dichloride, specialty chemicals) – CAGR 7.1%

By Application:

-

Polymer Production – largest share, CAGR 6.6%

-

Chemical Derivatives – includes solvents, antifreeze, adhesives

-

Specialty Chemicals – pharmaceuticals, coatings, high-tech materials

By Transport:

-

ISO Containers – CAGR 6.3%

-

Tank Cars (Rail)

-

Cargo Tanks (Truck)

-

Cryogenic Cylinders

By Region:

-

North America – CAGR 9.3%, driven by polymer demand and smart plant infrastructure

-

Western Europe – CAGR 8.8%, eco-friendly production and regulatory compliance

-

China – CAGR 15.1%, infrastructure expansion and megaproject demand

-

Japan – CAGR 11.2%, compact, energy-efficient storage

-

South Korea – CAGR 11.6%, dense urban industrial hubs

-

India – high growth potential due to rising polymer consumption

Country-Level Insights

-

USA: Strong municipal and private sector demand; adoption of AI-enabled monitoring; domestic production reduces supply chain risk.

-

Germany: Focus on sustainable cryogenic systems and modular ISO transport solutions.

-

China: Leading global expansion due to large-scale infrastructure, industrialization, and export potential.

-

Japan & South Korea: Prioritization of compact, energy-efficient solutions for high-density facilities; slower adoption of smart integrations due to cost.

Top Players & Market Share

| Company | Market Share (2025E) | Key Strategies |

|---|---|---|

| Chevron Phillips Chemical | 13–15% | Expand polymer-grade production and bio-ethylene initiatives |

| DOW | 25% | Smart plant integration, global supply chain optimization |

| Air Liquide | 15% | Advanced cryogenic transport and IoT monitoring |

| Eastman | 8–10% | Specialty chemical focus, high-purity ethylene |

| Borealis | 8% | Polymer production expansion, renewable feedstock adoption |

| Others | 19–21% | Regional suppliers and niche applications |

Other notable players: Exxon Mobil, LyondellBasell, Reliance Industries, SABIC, Shell, INEOS Group AG

Strategic Imperatives for Stakeholders

-

Invest in Smart Cryogenic Infrastructure: Incorporate IoT, AI monitoring, and predictive maintenance to enhance safety and reduce operational costs.

-

Expand Bio-Based and Sustainable Production: Align with global sustainability trends and renewable feedstock adoption.

-

Strengthen Multimodal Distribution: Leverage ISO containers and modular storage systems to reduce logistics constraints and cost.

Risks Stakeholders Should Monitor

| Risk | Probability & Impact |

|---|---|

| Raw Material Volatility – Ethylene feedstocks tied to crude oil and natural gas prices | High Probability, Medium Impact |

| Regulatory Compliance – Regional standards on storage, transport, and chemical purity | Medium Probability, High Impact |

| Technological Adoption Delay – Resistance to AI or IoT integration in traditional facilities | Medium Probability, Medium Impact |

Browse Full Report : https://www.factmr.com/report/crowd-control-barrier-market

Conclusion

The cryogenic ethylene market is poised for robust growth over 2025–2035, driven by polymer and chemical production demand, infrastructure expansion, and sustainability trends. Manufacturers and distributors must tailor offerings to regional industrial needs, prioritize smart monitoring and transport efficiency, and integrate renewable feedstock solutions to maintain market leadership.