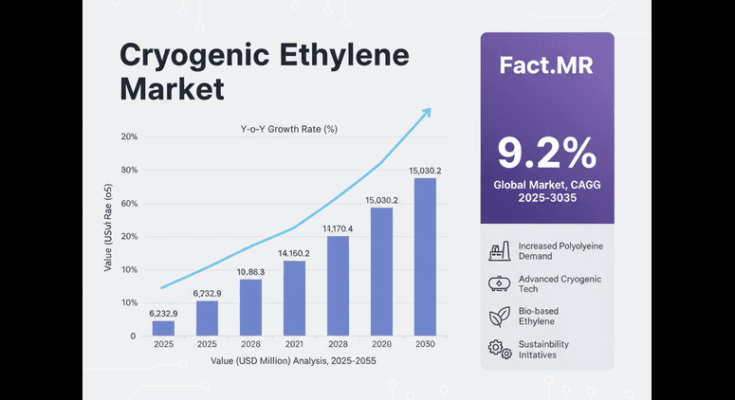

The global cryogenic ethylene market is projected to expand from USD 6,232.9 million in 2025 to USD 15,030.2 million by 2035, registering a CAGR of 9.2%. Growth is driven by increasing demand for polyethylene, technological advancements in cryogenic storage and transport, adoption of bio-based ethylene, and sustainability-focused innovations.

Cryogenic ethylene is critical in applications across polymer production, chemical derivatives, automotive, packaging, pharmaceuticals, and specialty chemicals, necessitating ultra-low-temperature storage and transport solutions. Enhanced infrastructure, AI-driven process optimization, and environmental regulations are shaping the market’s future trajectory.

Key Metrics

| Metric | Value |

|---|---|

| Global Market Size (2025E) | USD 6,232.9 Million |

| Projected Market Size (2035F) | USD 15,030.2 Million |

| CAGR (2025–2035) | 9.2% |

| Polymer Grade CAGR (2025–2035) | 6.4% |

| Polymer Production CAGR (2025–2035) | 6.6% |

| ISO Containers CAGR (2025–2035) | 6.3% |

Market Dynamics

Growth Drivers:

-

Polyethylene demand: Growth in packaging, construction, automotive, and consumer products drives demand for ethylene as a feedstock.

-

Technological advancement: AI-based process control, intelligent sensors, and cryogenic frost-protection systems improve operational efficiency and safety.

-

Sustainability trends: Adoption of bio-based ethylene, renewable feedstocks, and low-carbon cryogenic technologies.

-

Cryogenic infrastructure: Expansion in storage, ISO containers, and LNG vaporizer facilities enhances global logistics capability.

Challenges:

-

High infrastructure costs: Cryogenic storage, transport, and safety systems require substantial capital investment.

-

Raw material volatility: Ethylene production depends on crude oil and natural gas, making the industry sensitive to price fluctuations.

-

Regulatory complexity: Diverse global environmental and safety regulations impose compliance costs and operational constraints.

Opportunities:

-

Bio-based ethylene and renewable feedstocks.

-

Smart monitoring, predictive maintenance, and energy-efficient cryogenic storage solutions.

-

Partnerships and joint ventures to scale green production technologies.

Browse Full Report https://www.factmr.com/report/cryogenic-ethylene-market

Market Segmentation

By Grade:

-

Polymer Grade: High-purity ethylene for polymers like polyethylene, polyisobutylene, and butyl rubber (CAGR 6.4%).

-

Chemical Grade: Ethylene for chemical intermediates and specialty applications.

By Application:

-

Polymer Production: Largest segment, CAGR 6.6%, driven by polyethylene production for packaging, construction, and consumer goods.

-

Chemical Production

-

Alkylation and Refining

-

Solvent & Specialty Chemicals

-

Automotive

-

Construction

-

Medical & Pharmaceuticals

-

Textile & Fiber Production

By Transport Mode:

-

ISO Containers: Standardized for multimodal transport, CAGR 6.3%.

-

Tank Cars (Rail)

-

Cargo Tanks (Trucks)

-

High-Pressure Cylinders

By Region:

-

North America

-

Latin America

-

Western Europe

-

Eastern Europe

-

East Asia

-

South Asia

-

Middle East & Africa

Regional Insights

U.S.:

-

Market CAGR 9.3%, driven by polyethylene demand, advanced petrochemical infrastructure, AI-based cryogenic control, and adoption of bio-based ethylene.

China:

-

CAGR 9.2%, fueled by industrialization, urbanization, sustainability initiatives, and expansion of LNG and cryogenic infrastructure.

India:

-

Fastest-growing market in Asia-Pacific, supported by industrial growth, packaging demand, and emerging bio-ethylene production.

Europe (Germany, France, Italy, UK):

-

CAGR range 8.3–9.0%, led by sustainability-focused chemical production, regulatory incentives, and circular economy adoption.

South Korea & Japan:

-

CAGR ~9.0%, driven by chemical manufacturing, electronics, automotive sectors, and adoption of advanced cryogenic infrastructure.

Australia-New Zealand:

-

CAGR 8.6%, fueled by packaging, construction, and automotive demand, along with government-backed green initiatives.

Competitive Landscape

Leading Players & Estimated Market Shares:

-

Chevron Phillips Chemical: 13–15%

-

DOW: 25%

-

Air Liquide: 15%

-

Eastman: 8–10%

-

Borealis: 8%

-

Other key players: Exxon Mobil, Indorama, Lotte, LyondellBasell, BASF, Reliance Industries, Shell Global, SABIC, INEOS Group AG

Key Strategies:

-

Geographic expansion in emerging markets.

-

R&D for high-purity and bio-based ethylene production.

-

Adoption of AI and IoT in cryogenic storage, predictive maintenance, and safety systems.

-

Strategic partnerships and joint ventures to scale sustainable and circular technologies.

Market Outlook

The cryogenic ethylene market will continue to grow robustly due to the synergy of increasing polymer demand, infrastructure development, sustainability initiatives, and technological innovation. Success factors include:

-

Investment in advanced cryogenic and AI-enabled infrastructure.

-

Integration of bio-based feedstocks and renewable energy.

-

Regulatory compliance and circular economy adoption.

-

Collaboration across producers, investors, infrastructure developers, and technology providers to ensure scale, efficiency, and safety.