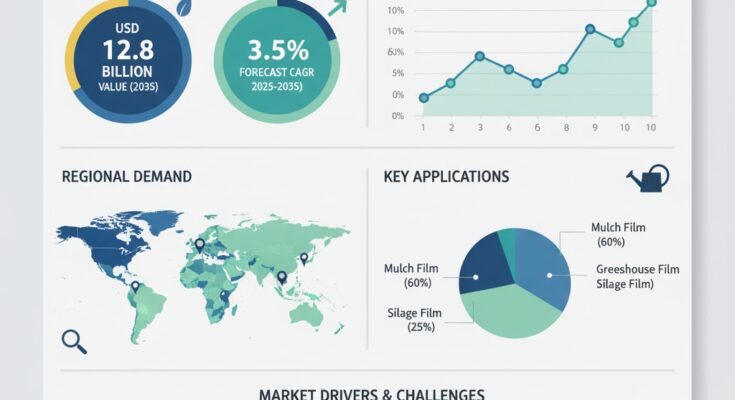

The global agricultural film market stands at the threshold of a decade-long expansion trajectory that promises to reshape crop protection technology and farming optimization solutions. According to the latest report by Fact.MR, the market is projected to rise from USD 9.1 billion in 2025 to USD 12.8 billion by 2035, expanding at a CAGR of 3.5% over the forecast period.

Agricultural films have become indispensable in modern agriculture, offering benefits such as enhanced crop yield, soil moisture retention, and weed control. As global food demand surges and farmers face pressure to maximize productivity on limited arable land, the adoption of high-performance films—such as mulch films, greenhouse films, and silage filmsis gaining momentum across regions.

Market Drivers: Sustainability, Efficiency, and Technological Innovation

Rising Need for Crop Protection and Yield Enhancement

Global population growth and the rising demand for food are pushing agricultural innovation. Farmers are increasingly turning to films that improve soil microclimates, protect crops from UV radiation, and reduce water evaporation. This trend is particularly strong in developing economies, where the need to optimize agricultural output with limited resources is critical.

Shift Toward Biodegradable and Recyclable Films

Sustainability is a defining trend in the agricultural film market. With growing awareness about plastic waste and stringent environmental regulations, manufacturers are investing heavily in biodegradable films made from bio-based polymers. These films offer comparable durability to traditional polyethylene (PE) films but decompose naturally after use, minimizing environmental impact.

Technological Advancements in Polymer Materials

Advances in polymer chemistry, nanotechnology, and multilayer extrusion are enabling the production of films with improved tensile strength, light transmission, and UV resistance. Companies are focusing on next-generation films that can withstand extreme climatic conditions while reducing the need for chemical fertilizers and pesticides. Additionally, UV-stabilized and infrared-blocking films are gaining popularity for their ability to regulate temperature and humidity in greenhouses, thus supporting year-round cultivation.

Growing Demand from Precision and Smart Agriculture

As agriculture transitions toward digital and data-driven practices, agricultural films are increasingly integrated with smart farming systems. These technologies enhance resource efficiency, allowing farmers to use data insights to adjust irrigation, temperature, and soil conditions for optimal yields. Furthermore, governments worldwide are offering subsidies and incentives for adopting sustainable agricultural practices, boosting market expansion.

Competitive Landscape

The agricultural film market is moderately consolidated, with global and regional players competing through innovation, material development, and expansion into high-growth agricultural economies.

Key Players in the Agricultural Film Market

- Berry Global

- BASF

- RPC/Berry

- Novamont

- Shell Polymers

- DuPont

- FKuR

- Trioplast

- Solvay

- RKW Group

These companies are investing in eco-friendly polymer development, recycling technologies, and product differentiation strategies to align with sustainability goals. Mergers, acquisitions, and partnerships with agritech firms are also accelerating technological adoption and market reach.

Recent Developments

- June 2025 – BASF launched a new line of biodegradable mulch films designed for small and medium-scale farms, reducing soil contamination and improving biodegradability under field conditions.

- February 2024 – Berry Global introduced multilayer greenhouse films incorporating advanced UV filters and anti-drip coatings, aimed at enhancing crop growth efficiency and extending film lifespan.

- October 2024 – DuPont announced collaboration with agritech startups to develop recyclable silage films embedded with temperature and moisture sensors for smart farming applications.

Market Segmentation

The agricultural film market is categorized by product type, material, application, and region to reflect the diversity of agricultural needs worldwide.

By Product Type:

- Greenhouse Films

- Mulch Films

- Silage Films

By Material Type:

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- High-Density Polyethylene (HDPE)

- Ethylene-Vinyl Acetate (EVA)

- Biodegradable Polymers

By Application:

- Crop Protection

- Soil Stabilization

- Silage Preservation

- Greenhouse Farming

By Region:

- North America: Advanced adoption of precision agriculture and sustainable farming practices.

- Europe: Strong regulatory framework encouraging biodegradable and recyclable films.

- Asia-Pacific: Fastest-growing region driven by population growth, urbanization, and agricultural modernization in China, India, and Southeast Asia.

- Latin America and MEA: Increasing greenhouse farming and government support for high-yield cultivation techniques.

Future Outlook: Toward Circular and Climate-Smart Agriculture

The next decade will witness the emergence of circular economy practices in agriculture, where film waste is collected, recycled, and reused efficiently. The focus will shift toward biopolymer films, sensor-embedded materials, and climate-resilient solutions that can help farmers adapt to changing weather conditions and resource constraints.

By 2035, agricultural films will play a pivotal role in shaping climate-smart, resource-efficient, and sustainable food production systems worldwide.