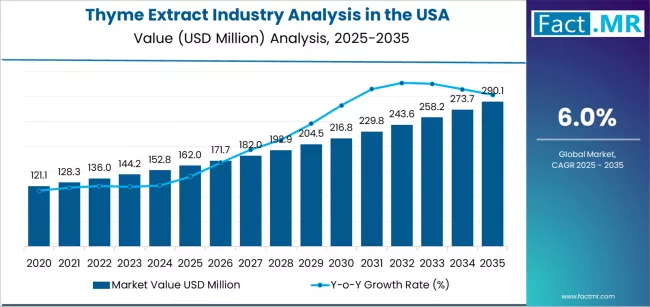

The USA thyme extract industry is witnessing robust growth as consumers and manufacturers increasingly shift toward natural, plant-derived, and functional ingredients. According to a new analysis by Fact.MR, the market is projected to rise from USD 162.0 million in 2025 to USD 291.0 million by 2035, reflecting a strong CAGR of 6.0% and an absolute increase of USD 129.0 million over the forecast period.

The essential oil segment—widely used across food, cosmetics, aromatherapy, and pharmaceuticals—is expected to dominate the market, accounting for 58.0% of total USA thyme extract demand in 2025.

As clean-label formulations, botanical extracts, and wellness-driven ingredients gain prominence, thyme extract is becoming a preferred choice for manufacturers seeking natural antimicrobials, antioxidants, and aromatic compounds.

Strategic Market Drivers

Natural, Clean-Label Ingredients Gain Mainstream Adoption

Rising consumer concern regarding synthetic additives, artificial flavors, and chemical preservatives is driving rapid adoption of natural extracts. Thyme extract—known for its antimicrobial, antioxidant, and anti-inflammatory properties—has emerged as a powerful clean-label ingredient preferred by food, beverage, nutraceutical, and personal care brands.

Manufacturers are increasingly formulating products with thyme-derived essential oils and oleoresins to align with the growing preference for minimally processed, naturally sourced ingredients.

Strong Momentum from Food, Beverage & Nutraceutical Industries

The food and beverage sector remains the largest application area for thyme extract due to its versatility as a natural flavoring agent and shelf-life enhancer. Its growing use in functional beverages, herbal teas, seasoning blends, and ready-to-eat meals continues to fuel demand.

Meanwhile, the nutraceutical and dietary supplement industries are leveraging thyme extract’s therapeutic benefits—especially for immunity, respiratory health, and digestive wellness—supporting continual market expansion.

Cosmetics & Personal Care: Demand for Botanical Actives Soars

The USA beauty and personal care industry is experiencing a clear shift toward botanicals and essential oils. Thyme extract is increasingly used in skincare, haircare, and aromatherapy formulations due to its cleansing, anti-acne, antimicrobial, and soothing applications.

The rise of premium natural beauty trends and aromatherapy-based wellness products is significantly bolstering thyme extract usage.

Browse Full Report: https://www.factmr.com/report/united-states-thyme-extract-industry-analysis

Regional & Sectoral Growth Highlights

Food & Beverage: Largest Demand Contributor

- Widely used as a natural flavor enhancer

• Increasing adoption in sauces, snacks, meat products, and bakery items

• Rising demand for natural preservatives supporting usage

Pharmaceutical & Nutraceuticals: Rapidly Growing Segment

- Leveraged for cold relief, cough formulations, and digestive supplements

• Expanding use in immunity-boosting herbal blends

• Growing presence in inhalers and herbal syrups

Cosmetic & Personal Care: High Value Growth

- Strong demand in natural skincare and haircare products

• Growing application in organic deodorants, soaps, and serums

• High preference for antimicrobial essential oils

Market Segmentation Insights

By Product Type

- Essential Oils – Dominant segment (58% share in 2025).

High demand due to purity, strong aromatic properties, and broad industrial application. - Oleoresins – Gaining traction for processed foods and savory flavors

• Powdered Extracts – Popular in supplements and herbal formulations

By Application

- Food & Beverage – Largest consumer base

• Pharmaceuticals & Nutraceuticals – Strong volume growth

• Cosmetics & Personal Care – High-value adoption

• Aromatherapy – Growing trend driven by holistic wellness

Challenges Impacting Market Performance

Price Sensitivity of Natural Ingredients

Fluctuations in herb yields, extraction costs, and supply chain complexities may influence pricing.

Availability of Synthetic Substitutes

Artificial flavors and chemical preservatives pose competitive pressure due to lower cost and longer shelf life.

Seasonal & Agricultural Dependency

Variability in thyme cultivation, climatic conditions, and raw material sourcing affects production consistency.

Competitive Landscape

The USA thyme extract market is moderately fragmented, with companies focusing on organic sourcing, advanced extraction technologies, and clean-label certification.

Key Companies Profiled

- doTERRA

• Young Living

• Nature’s Way

• Givaudan

• Symrise AG

• Firmenich

• Greenleaf Extracts

• Amoretti

• Mountain Rose Herbs

• NOW Foods

Manufacturers are investing in improved distillation methods, solvent-free extraction, and eco-friendly packaging to strengthen their position in a sustainability-driven market.

Recent Developments

2024:

Growing launches of thyme-based clean-label flavoring agents in USA food retail brands.

2023:

Expansion of organic thyme essential oils in natural cosmetics and aromatherapy markets.

2022:

Introduction of high-potency thyme extracts in herbal supplements and natural medicinal formulations.

Future Outlook: A Decade of Botanical Innovation

The next decade will witness strong momentum in the USA thyme extract industry driven by:

• rising focus on plant-based and botanical ingredients

• natural preservative demand in clean-label foods

• premium beauty & wellness innovations

• rapid expansion of aromatherapy and holistic health markets

Manufacturers that prioritize sustainable sourcing, natural formulations, and advanced extraction technologies will play a central role in shaping the future of thyme extract applications across the USA.

With expanding adoption across food, health, beauty, and wellness sectors, the thyme extract industry is positioned for steady, long-term growth through 2035.