The vegan baking ingredients market in the Middle East & Africa (MEA) region is poised for steady growth over the next decade, fueled by expanding interest in plant‑based diets, rising health and wellness awareness, and growing demand for sustainable and ethical food products. As consumer preferences shift toward dairy‑free, egg‑free, and clean‑label baked goods, vegan baking ingredients are increasingly adopted by commercial bakeries, food manufacturers, retailers, and foodservice operators across the region.

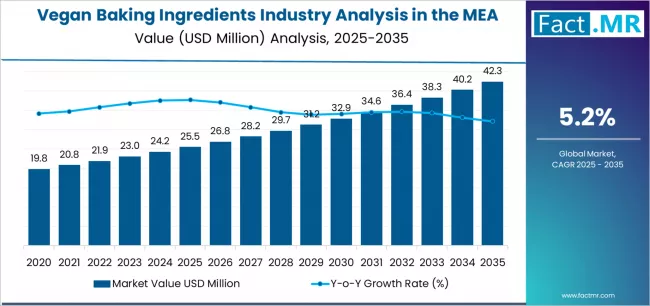

The MEA vegan baking ingredients market is forecast to grow from USD 25.5 million in 2025 to approximately USD 42.3 million by 2035, reflecting a compound annual growth rate (CAGR) of about 5.2% over the period.

Key Market Highlights (2025 baseline)

-

2025 Market Size: ~ USD 25.5 million

-

2035 Forecast Value: ~ USD 42.3 million

-

Forecast CAGR (2025–2035): ~ 5.2%

-

Leading Product Type (2025): Egg replacers & binders — ~ 38.0% share

-

Primary Demand Channel (2025): Industrial bakery customers — ~ 58.0% share

-

Top Geographies (demand centre): Countries such as Saudi Arabia, South Africa, and United Arab Emirates are identified as key growth markets within MEA

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=11910

What’s Fueling Growth

Growing Adoption of Plant-Based & Ethical Diets

Across the MEA region, awareness of plant‑based diets, vegan lifestyles, and ethical consumption is increasing. This shift is encouraging consumers to opt for baked goods that avoid animal-derived ingredients, such as eggs, dairy fats, and conventional dairy-based shortenings. As veganism, flexitarianism, lactose intolerance awareness, and ethical food choices grow, demand for reliable vegan baking ingredients rises accordingly.

Expansion of Commercial Bakeries, Foodservice & Retail Channels

Industrial bakeries, large-scale food producers, modern retail supermarkets, and foodservice operators in urban and semi‑urban centres across MEA are increasingly exploring vegan baking formulations to cater to evolving consumer preferences. The industrial bakery segment — due to its scale and consistent volume needs — leads demand for vegan baking ingredients by a substantial margin, which underlines how commercial adoption is driving this market.

Demand for Functional & Reliable Alternatives (Egg Replacers, Plant‑based Fats, Dairy Replacers)

Egg replacers and binders currently dominate the product mix, reflecting their functional importance in replacing animal-derived eggs — which are central to conventional bakery recipes. Their dominance shows that vegan ingredient solutions are achieving sufficient technical performance to support texture, binding, leavening and structural properties needed for baked goods, making them an attractive substitute for conventional formulations.

Moreover, plant-based fats, shortenings, dairy replacers and other functional ingredients provide alternative solutions for butter and dairy-based components, helping bakers produce vegan breads, cakes, pastries, and confectionery that meet consumer expectations around taste, texture, and appearance.

Rising Health & Wellness Consciousness, Clean‑Label Preference

Health‑conscious consumers in MEA are increasingly aware of dietary health, food safety, and the benefits of plant-based nutrition. Vegan baking ingredients — being free of cholesterol, animal-derived fats, and often lower in saturated fat — align with these wellness trends. Clean-label demand (minimal additives, allergen‑free, transparent sourcing) is also boosting adoption of vegan baking ingredients in both retail-focused and premium bakery products.

Urbanization, Changing Lifestyles & Diverse Consumer Base

Rapid urbanization, rising disposable incomes, multicultural populations, and exposure to global food trends in many MEA countries — especially in urban centres — are prompting evolving dietary habits. As western‑style bakery products, cafés, and foodservice outlets expand, demand grows for versatile vegan baking solutions to cater to diverse tastes and dietary requirements. This structural change supports long-term growth for the vegan baking ingredients market.

Challenges & Market Constraints

Limited Consumer Awareness & Taste/Texture Perception Barriers

Though the vegan segment is growing, many consumers in MEA may still be unfamiliar with vegan baked goods or have reservations about taste, texture, and quality compared to traditional bakery products. Overcoming these perceptions requires focused product development, consumer education, and demonstrations — which can add cost and time for manufacturers.

Raw Material / Ingredient Supply Complexity & Cost Considerations

Producing high-quality vegan baking ingredients (e.g., egg replacers, specialized plant-based fats) requires reliable sourcing of raw materials such as plant proteins, vegetable oils, hydrocolloids, etc. Ensuring consistent supply, quality, and functional performance — especially for large-scale bakery production — can be challenging. Additionally, these ingredients may come at a premium compared to conventional ones, which can limit adoption in cost-sensitive segments.

Technical & Formulation Challenges

Replicating the functional qualities of eggs, dairy fats, and traditional bakery ingredients (emulsification, leavening, moisture retention, shelf life) with plant‑based substitutes involves technical complexity. Not all vegan ingredient substitutes deliver identical results; baking processes may need reformulation and testing. For some bakers or manufacturers — especially smaller scale or traditional ones — this presents a barrier to transition.

Market Fragmentation & Regulatory / Cultural Diversity Across MEA

MEA is a diverse region with varying dietary habits, religious and cultural preferences, regulatory environments, and consumer awareness levels. Developing appropriate ingredient formulations, certification (e.g., halal, clean-label), and supply-chain compliance across different markets adds complexity for ingredient suppliers and manufacturers.

Strategic Outlook & Recommendations for Stakeholders

For Ingredient Producers & Suppliers

-

Focus on developing high-performing vegan ingredient blends (egg replacers, plant-based fats, dairy substitutes) that deliver reliable functional performance, texture, taste, and shelf stability — attractive to industrial bakeries and food manufacturers.

-

Invest in regional supply-chain development and sourcing: establishing local or regional sourcing hubs to reduce dependency on imports and manage raw-material variability and costs.

-

Offer product and formulation support to bakery customers (recipes, technical backing, pilot tests) to encourage adoption and retraining of traditional baking processes.

For Industrial Bakeries & Food Manufacturers

-

Begin with hybrid or partially vegan product lines to test consumer response; use vegan baking ingredients to reformulate popular products (breads, cakes, pastries) while controlling cost and maintaining quality.

-

Target retail, foodservice, and modern-trade channels in urban areas where consumer awareness and purchasing power are rising.

-

Position vegan baked goods not just as “vegan/ethical,” but as “health-focused,” “clean-label,” and “allergen-friendly,” to appeal beyond vegan-only consumers.

For Retailers, Café Chains & Foodservice Operators

-

Add vegan-label bakery items to menus — breads, cakes, pastries — to cater to diverse dietary preferences (vegetarian, lactose-intolerant, health-conscious, ethical consumers).

-

Promote awareness through labeling, product information, and clean-label messaging, highlighting nutrition, sustainability, and ethical sourcing.

For Policy Makers & Food-Industry Bodies

-

Encourage standards for vegan ingredient production, labeling, and quality assurance to build consumer trust and support industry growth.

-

Support local industry development, ingredient-sourcing infrastructure, and supply-chain capacity — especially in growing economies across MEA — to reduce dependency on imports and ensure affordability.

Market Outlook 2035

By 2035, the MEA vegan baking ingredients industry is projected to reach around USD 42.3 million, marking strong growth from 2025. The long-term trajectory is supported by rising plant-based, health- and wellness-driven consumption trends; expanding commercial bakery and food-manufacturing infrastructure; growing retail modernization; and increasing acceptance of vegan and clean-label baked products.

If stakeholders — ingredient suppliers, bakers, distributors — align strategy with regional consumer preferences, invest in quality, formulation, and supply-chain robustness, the vegan baking ingredients sector can evolve from a niche offering into a mainstream, valued segment in MEA’s food industry ecosystem by the mid-2030s.

Browse Full Report: https://www.factmr.com/report/middle-east-and-africa-vegan-baking-ingredients-industry-analysis