In an era defined by rapid response and interconnected risk, the Computer-Aided Dispatch (CAD) market is more than a back-end utility—it’s becoming the nervous system of public safety infrastructure. From emergency medical services to transportation and government, CAD systems are transforming the way we coordinate, respond, and manage crises.

Market Size, Share, and Forecast: A Runway of Double-Digit Growth

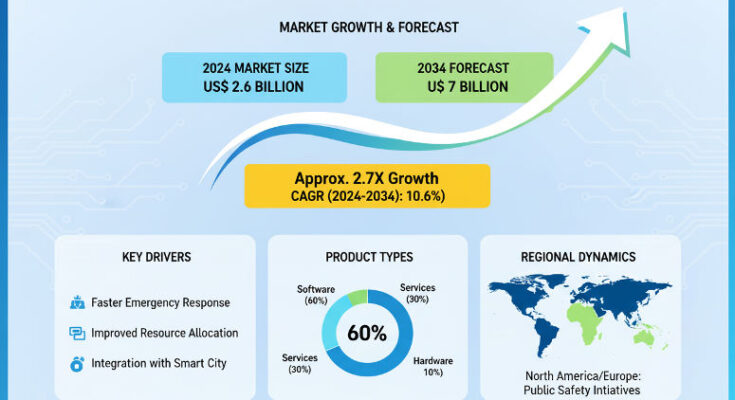

The CAD market has been growing steadily. In recent assessments, its size was estimated at around USD 2.0-2.5 billion in the early 2020s. Projections show this expanding to approximately USD 4.3 billion by 2030, under a CAGR in the range of 11-12%. Growth beyond 2030 looks promising as well, with regions like North America and East Asia leading the charge. Software components dominate much of the market; cloud-based deployment is rising rapidly, while services (support, maintenance, training) follow closely.

What’s Driving the Surge

Several interlocking trends are fueling growth in the CAD market:

-

Public Safety Pressures: Increasing natural disasters, higher urban density, rising crime rates, and expectations for swifter emergency responses are pushing governments and agencies toward upgraded dispatch systems.

-

Technology Enablement: The CAD systems of today are not just about routing calls—they integrate AI, GIS mapping, mobile applications, real-time analytics, automatic vehicle location (AVL), and predictive algorithms. These enhancements reduce response times, improve resource utilization, and allow dispatchers to make more informed decisions.

-

Cloud Transition & Digital Transformation: More public safety agencies are moving from on-premises CAD to cloud-hosted or hybrid systems. Cloud offers scalability, lower infrastructure costs, easier updates, and better cross-agency data sharing.

-

Regulatory & Policy Support: Governments are committing funds to modernize emergency communications infrastructure. Initiatives like “Next-Generation 9-1-1” in the United States, and equivalent policy pushes elsewhere, are driving adoption of next-level CAD capabilities.

US & Europe Insights: Leaders in Implementation

United States

In the US, CAD is maturing fast. As of 2024, investments in federal grants and state programs are accelerating upgrades to modern systems with GIS, mobile, cloud-native design, and predictive dispatch intelligence. The US CAD market is projected to grow at a strong CAGR—some estimates put that near 11–12% to 2030—with market value rising from several hundred million USD in the mid-2020s to approximately USD 800-900 million in select growth scenarios for a single country, depending on scope. Agencies are particularly focused on cloud-based CAD, response time reduction, integration with field units via mobile data terminals, and leveraging data analytics to optimize dispatch decisions.

Europe

In Europe, regulatory alignment, data protection standards, interoperability, and cross-border coordination are significant drivers. Countries like Germany, the UK, France, and the Nordic nations are investing in dispatch modernization, especially in relation to emergency call systems and traffic management. European CAD deployments are less aggressive in cloud adoption compared to the US in some markets, but there is strong growth in modular, interoperable platforms. Investments in integrating CAD with IoT sensors, surveillance, and smart city infrastructure are particularly visible. While growth CAGRs may be somewhat lower than in Asia-Pacific or the US, Europe remains a stable, high-value market share holder.

Segment Dynamics: Software, Services, Deployment, and Applications

The market is segmented along several axes:

-

Component: Software forms the lion’s share of revenue. There is increasing demand for advanced CAD software modules—mobile client access, AI-aided decision support, GIS integration.

-

Services: Support, maintenance, training, and customization are rising in value, especially for jurisdictions that lack in-house technical expertise.

-

Deployment Type: On-premises deployments still hold significant share, especially in established agencies with legacy systems. However, cloud-based CAD is the fastest growing segment due to lower capital expenditure, ease of scaling, and quicker upgrades.

-

Industry / End-User Verticals: Public safety (police, fire, EMS) remains the core vertical. Transportation, utilities, healthcare, and government & defense also increasingly adopt CAD for non-traditional dispatch needs (e.g., scheduled medical transport, incident management in utilities, etc.).

Key Players & Competitive Landscape

The market is moderately consolidated, with established vendors and newer entrants competing on software features, reliability, integrations, and cost. Prominent names include Motorola Solutions, CentralSquare Technologies, Priority Dispatch Corporation, Hexagon Safety & Infrastructure, RapidDeploy, Tyler Technologies, Zetron, Inc., Southern Software, Mark43, Inc., among others.

These vendors are enhancing their offerings: adding mobile dispatch apps, improving user-interfaces, GPU/AI modules for predictive dispatch, integrating with national emergency systems (e.g., NG-911 in the US), and improving cross-agency interoperability. Partnerships between tech startups and established providers, as well as acquisitions, are common as companies seek both innovation and scale.

Browse Full Report: https://www.factmr.com/report/3060/computer-aided-dispatch-cad-market

Challenges and Pain Points

No market is without friction. Key hurdles include:

-

Implementation and Maintenance Costs: High upfront expenses for deploying full-featured CAD platforms, especially when integrating GIS/AVL, mobile terminals, or AI modules. Maintenance, updates, and licensing add ongoing expense.

-

Skilled Workforce: Smaller agencies, and those in developing regions, often lack staff trained in modern dispatch technology, data management, and cross-system interoperability.

-

Security and Data Privacy: CAD systems handle sensitive information from emergency calls; they must comply with privacy laws, ensure secure communication, and safeguard against cyber threats.

-

Legacy Systems & Interoperability: Many dispatch centers are still using older systems; upgrading or integrating is complex. Ensuring compatibility across dispatch, records, AVL, and communication platforms is a perennial technical and organizational challenge.

The Road Ahead: Forecast & Strategic Outlook

Looking forward, the CAD market forecast to 2030 and beyond is robust. We can expect:

-

Continued rise in cloud-based CAD deployments.

-

Greater adoption of AI, predictive analytics, and GIS to improve dispatch routing, resource allocation, and situation visualization.

-

Increasing mobile CAD solutions enabling field access, remote data entry, and real-time situational awareness for first responders.

-

Expansion of CAD functionality beyond traditional emergency services into utilities, transportation, and public works for operational efficiency and incident management.

Vendor differentiation will come from capability in integration, ease of deployment, security, and cost efficiency. Regions investing heavily in public safety modernization (North America, Europe, parts of Asia-Pacific) will continue to dominate, but rapid growth from emerging markets is likely.