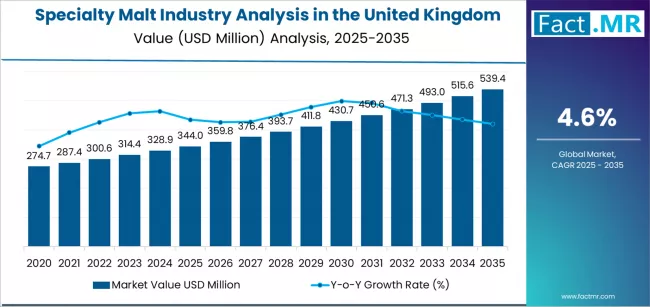

The United Kingdom specialty malt industry is poised for consistent growth over the next decade, supported by the booming craft brewing sector, rising consumer preference for premium and artisanal alcoholic beverages, and innovation in malt varieties designed for enhanced flavor, color, and aroma profiles. According to a new analysis by Fact.MR, the market is projected to grow from USD 344.0 million in 2025 to approximately USD 539.4 million by 2035, reflecting a solid CAGR of 4.6% and an absolute increase of USD 198.5 million during the assessment period.

Specialty malts—such as caramel, roasted, chocolate, and Vienna malts—are increasingly used to differentiate beer portfolios, support microbrewery experimentation, and elevate the organoleptic qualities of craft beverages. The caramel/crystal malt segment is expected to command 41.0% of total demand in 2025, making it the largest product category in the UK market.

Strategic Market Drivers

Craft Brewing Boom Fuels Specialty Malt Demand

The UK’s dynamic craft beer movement continues to serve as the backbone of specialty malt consumption. Thousands of microbreweries and independent craft producers are embracing flavor-rich and color-enhancing malts to improve beer complexity. Increasing consumer curiosity for variety—ranging from amber ales and stouts to porters, IPAs, and barrel-aged brews—is driving higher utilization of caramel, roasted, and smoked malt variants.

Growing interest in small-batch, limited-edition, and experimental brews further encourages manufacturers to diversify their malt offerings.

Premiumization and Artisanal Beverage Trends Strengthen Growth

The premium beer segment in the United Kingdom is undergoing rapid evolution as consumers seek beverages with authentic taste profiles, deeper flavors, and natural ingredients. Specialty malts, known for imparting rich aromas and deeper hues, are essential to meeting this preference shift.

Premiumization is also redefining non-alcoholic craft beverages, as many producers adopt specialty malts to create full-bodied alcohol-free beers with distinctive character and mouthfeel.

Rising Consumer Preference for Clean Labels and Natural Inputs

The movement toward clean, transparent, and natural ingredients is reinforcing the demand for minimally processed specialty malts. Producers are increasingly using non-GMO barley and emphasizing chemical-free malting processes to attract health-conscious and sustainability-minded consumers.

Organic specialty malt varieties are also gaining visibility in the UK retail landscape.

Innovation in Malt Profiles Enhances Brewery Capabilities

Advancements in malting techniques—such as precision roasting, controlled kilning, and hybrid malt development—are enabling brewers to achieve better consistency, unique flavor variations, and improved fermentation performance.

Flavor-forward malts such as honey malts, biscuit malts, and lightly smoked variants are gaining traction among innovative craft brewers.

Browse Full Report: https://www.factmr.com/report/united-kingdom-specialty-malt-industry-analysis

Regional & Market Landscape Insights

England: The Powerhouse of Craft Brewing

England leads the UK specialty malt demand due to the dense concentration of microbreweries, large-scale breweries, and craft beer producers. Rising consumer affinity for dark ales, bitters, and IPAs continues to elevate the need for caramel and roasted malt types.

Scotland: Tradition Meets Premium Innovation

Scotland’s traditional brewing culture, combined with its growing premium beer segment, supports strong specialty malt consumption. Producers here are increasingly exploring smoked and peated malts inspired by the country’s renowned distilling heritage.

Wales & Northern Ireland: Growing Craft Scene

Small but rapidly emerging craft breweries in Wales and Northern Ireland are contributing to rising specialty malt adoption. Increasing tourism and demand for local brews are further boosting regional consumption.

Market Segmentation Insights

By Malt Type

- Caramel / Crystal Malt – Largest Segment (41% share in 2025)

Popular for imparting color stability, sweetness, and rich flavor. - Roasted & Chocolate Malts

Preferred for stouts, porters, and dark ales. - Kilned Malts (Vienna, Munich)

Used to achieve malty sweetness, golden tones, and balanced flavor. - Smoked & Specialty Blends

Gaining traction among premium and experimental craft brewers.

By Application

- Brewing Industry – Dominant Segment

Supported by rising production of craft beers, ales, IPAs, and dark brews. - Distilling

Increasing usage in specialty malt whisky and craft spirits. - Food & Beverage

Used in bakery, confectionery, malted beverages, and cereals for flavor enhancement.

Challenges Impacting Market Growth

- Barley Price Volatility

Fluctuations in barley yields and agricultural conditions impact malt production costs. - Intense Competition from Large Maltsters

Smaller malt producers face margin pressure from multinational suppliers. - Shift in Alcohol Consumption Patterns

While premium craft beer demand is rising, overall beer consumption moderation may slow volume growth. - Regulatory and Sustainability Compliance Costs

Traceability, organic certifications, and sustainability mandates raise operating expenses.

Competitive Landscape

The UK specialty malt industry is moderately consolidated, with established maltsters and innovative craft-oriented producers shaping the competitive environment.

Key Companies Profiled:

- Crisp Malt

- Simpsons Malt

- Muntons Malt

- Bairds Malt

- The Swaen

- Weyermann Specialty Malts

- Viking Malt

- Castle Malting

- Thomas Fawcett & Sons

Manufacturers are focusing on:

- Expanding roasted and caramel malt portfolios

- Enhancing sustainability through carbon-reduced malting

- Strengthening craft brewery partnerships

- Developing organic and non-GMO malt lines

Recent Developments

2024:

Several UK maltsters increased production capacity for caramel and roasted malts to support surging craft brewery demand.

2023:

Launch of innovative hybrid malt types designed to provide deeper color intensity with lower sugar content.

2022:

Major investments in energy-efficient kilning technologies to reduce carbon emissions across UK malting facilities.

Future Outlook: A Decade of Flavor Innovation and Premium Brewing

The next decade is set to bring robust momentum to the UK specialty malt industry as craft breweries expand, premium beers gain popularity, and consumers seek beverages with authentic taste profiles. Companies that prioritize natural ingredients, sustainable malting processes, and advanced roasting techniques are expected to lead the market.

With rising adoption across both established breweries and emerging craft producers, the UK specialty malt industry is well-positioned for consistent, value-driven growth through 2035.