Decade of Dual-Phase Growth: From Fertilizer Optimization to Smart Nutrient Integration

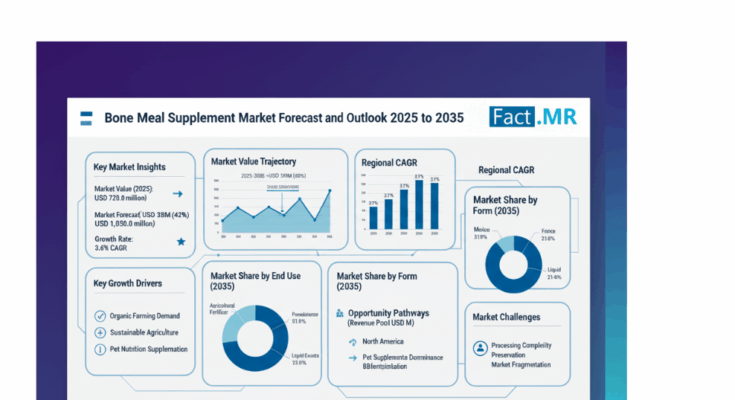

Between 2025 and 2030, the market is projected to advance from USD 720 million to USD 850 million, representing 42% of the decade’s total growth. This early phase will be characterized by the rapid transition from synthetic fertilizers to advanced bone meal systems that offer 95–98% nutrient availability and seamless integration with modern agricultural platforms.From 2030 to 2035, momentum is expected to accelerate, adding another USD 180 million in value as specialized bone meal systems become a mainstream nutrient source within automated agricultural networks, precision farming systems, and advanced fertilizer production ecosystems. Manufacturers investing in processing optimization and automation are expected to dominate, ensuring consistent nutrient performance, lower operating costs, and compliance with global organic standards.

Strategic Growth Pathways for Industry Leaders

Manufacturers across the value chain are pursuing six distinct pathways to strengthen their position in this evolving market:

- Agricultural Fertilizer Leadership – Accounting for over 51% of market revenue, the fertilizer segment remains the cornerstone of growth. Firms investing in enhanced phosphorus formulations, soil compatibility solutions, and high-efficiency nutrient delivery will command premium market share and technological leadership.

- North America Distribution Expansion – With the U.S. market demonstrating a 3.9% CAGR, North America presents the fastest growth opportunities. Strategic localization of distribution and partnerships with agricultural cooperatives are enabling faster adoption among organic farmers and agro-retailers.

- Powder and Granule Form Dominance – Representing 66% of total sales, this form factor provides scalability and flexibility for both bulk agricultural and retail applications. Companies enhancing product consistency and storage efficiency are achieving strong repeat procurement across farming networks.

- Pet Supplement Diversification – The 29% share of pet nutrition applications signals lucrative diversification potential. Manufacturers with bioavailability-focused processing and calcium stability innovations are capturing demand from premium pet food and supplement brands worldwide.

- B2B Agribusiness Distribution Models – With 57% market share, bulk agricultural and cooperative channels remain the primary distribution mode. Companies adopting digitalized B2B platforms, precision supply monitoring, and local warehouse networks are driving next-generation agribusiness efficiency.

- Sustainable Processing and Environmental Compliance – Firms adopting low-impact, traceable processing systems are achieving leadership in eco-certification programs and securing partnerships with sustainability-focused agricultural and food producers.

Regional Leaders: North America and Europe Anchor Market Growth

North America leads global adoption, supported by strong agricultural infrastructure and the expanding U.S. organic farming base. American producers are integrating precision nutrient systems and soil-adaptive formulations, emphasizing reliability, nutrient efficiency, and environmental compliance.Europe, projected to grow from USD 216 million in 2025 to USD 309 million by 2035 (3.7% CAGR), remains the second-largest region, with Germany, France, and the U.K. leading technological adoption. Germany’s agricultural engineering ecosystem supports premium installations and compliance with EU nutrient standards, while France’s agricultural modernization and organic farming incentives create sustained nutrient demand.Meanwhile, Asia Pacific markets—including Japan, South Korea, and China—show increasing adoption of advanced processing systems emphasizing nutrient precision, reliability, and integration with smart farming technologies. Mexico stands out among emerging markets, with 3.7% CAGR, driven by rapid modernization and agricultural policy support.

Market Drivers and Trends: Sustainability, Technology, and Nutrient Innovation

The transition to organic and regenerative agriculture remains the dominant driver, as bone meal supplements offer natural phosphorus and calcium delivery without synthetic additives—helping producers meet organic certification requirements while reducing environmental impact.Advanced processing technologies are enabling superior nutrient preservation, consistency, and automated dosing capabilities, creating new efficiencies in both fertilizer production and animal nutrition manufacturing.Growing environmental regulations and agricultural sustainability goals across North America, Europe, and Asia are incentivizing investments in eco-compliant nutrient systems. Manufacturers integrating digital nutrient monitoring, AI-driven soil analysis, and blockchain-enabled supply tracking are setting new industry benchmarks.

Competitive Landscape: Technology Integration Drives Market Differentiation

The global bone meal supplement market remains moderately consolidated, with the top 10 players holding approximately 35% of total market share. Leading suppliers—such as OCP Group, ICL Group, and Haifa Group—leverage advanced R&D capabilities, integrated nutrient platforms, and long-term agricultural partnerships to maintain competitive dominance.Meanwhile, innovators like Yara, Gavilon, and Cargill are reshaping competition through proprietary processing technologies and customized agricultural solutions, while regional specialists—such as Darling Ingredients and BioAg—capitalize on localized production and niche organic markets.The strategic focus for 2025–2035 will shift toward system integration, automated nutrient delivery, and digital quality assurance, positioning technology-driven manufacturers as key beneficiaries of the decade-long transformation.

Industry Outlook: A Decade of Sustainable Growth and Innovation

As the bone meal supplement market transitions into a new phase of maturity, the next decade promises unprecedented collaboration between manufacturers, agritech firms, and sustainability leaders. Companies that align production strategies with organic agriculture trends, precision farming integration, and environmental compliance will secure long-term growth and market leadership.With an expected rise to USD 1,030 million by 2035, the industry’s expansion underscores a clear message: the future of sustainable agriculture depends on nutrient innovation. Leading manufacturers are already moving decisively—transforming bone meal supplements from a traditional agricultural input into a cornerstone of the global sustainable food and farming ecosystem.