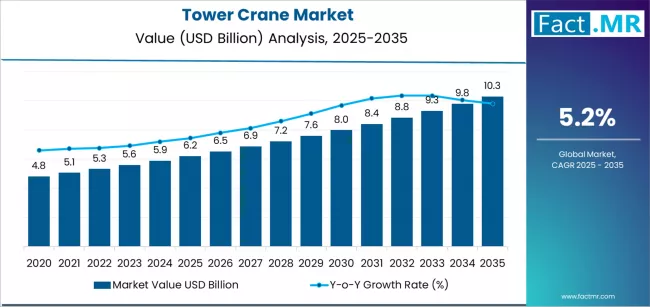

The global tower crane market is poised for robust expansion over the next decade, driven by rapid urbanization, increasing investment in large-scale infrastructure projects, and the rising adoption of technologically advanced construction solutions. According to a new analysis by Fact.MR, the market is projected to grow from USD 6.2 billion in 2025 to USD 10.3 billion by 2035, registering a CAGR of 5.2% and an absolute growth of USD 4.2 billion during the forecast period.

As governments and private developers accelerate real estate development, transportation infrastructure, industrial construction, and energy projects, the demand for high-capacity, efficient, and safe lifting equipment continues to surge. Tower cranes remain indispensable in high-rise construction, bridge development, and large commercial complexes, offering superior lifting height, precision, and operational stability.

Strategic Market Drivers

Global Construction Boom Fuels Equipment Demand

Rapid urban migration, especially in developing economies across Asia, Africa, and the Middle East, is propelling significant construction activity. High-rise residential complexes, smart cities, metro rail projects, and industrial hubs are contributing to increased deployment of tower cranes. Growing focus on safety, productivity, and operational efficiency further supports market expansion.

Technological Advancements Transform Crane Capabilities

The integration of telematics, anti-collision devices, remote monitoring, and automation is revolutionizing tower crane operations. Modern cranes now offer real-time load tracking, predictive maintenance, advanced stability control, and energy-efficient motors. These innovations are reducing downtime, improving safety, and elevating performance standards across global construction sites.

Shift Toward Modular & Prefabricated Construction

Prefabrication and modular building trends are reshaping construction workflows, increasing reliance on heavy lifting solutions. Tower cranes enable efficient handling of large prefabricated components, accelerating project timelines and improving cost-effectiveness.

Rental Market Expansion Boosts Accessibility

The growing preference for renting over owning construction equipment is significantly boosting the tower crane rental ecosystem. Rental companies are expanding fleets with modern, high-capacity cranes to meet rising short- and long-term project demands.

Browse Full Report: https://www.factmr.com/report/tower-crane-market

Regional Growth Highlights

North America: Technology-Driven Construction Market

North America continues to adopt high-performance tower cranes across commercial, residential, and industrial construction sectors. Smart construction practices, strong regulatory compliance, and investment in urban redevelopment fuel market demand.

Europe: Sustainability and Modernization Shape Market Demand

Europe exhibits a strong focus on sustainable construction, energy-efficient equipment, and safety-compliant lifting technologies. The region is witnessing increased demand for flat-top and self-erecting tower cranes, particularly in Germany, France, and the Nordics.

East Asia: World’s Fastest-Growing Construction Landscape

China, Japan, and South Korea dominate regional demand, supported by rapid urban expansion, mega infrastructure projects, and strong manufacturing bases for cranes. China remains a global leader in crane production and deployment.

South Asia & Oceania: Infrastructure and Industrial Expansion Boost Growth

India, Indonesia, and Australia are seeing substantial investments in highways, ports, metros, renewable projects, and logistics facilities—driving adoption of high-capacity tower cranes.

Middle East & Africa: Mega Projects Drive High-Capacity Crane Deployment

Saudi Arabia’s NEOM, UAE skyscraper expansions, Qatar infrastructure developments, and Africa’s growing urban centers are key demand contributors.

Market Segmentation Insights

By Type

- Self-Erecting Tower Cranes – Gaining popularity for small to mid-sized projects.

- Hammerhead Tower Cranes – Dominant due to versatility and load-handling efficiency.

- Flat-Top Tower Cranes – Increasing usage in urban areas due to minimal height interference.

- Luffing Jib Tower Cranes – Preferred for congested city construction and limited swing space.

By Capacity

- Up to 5 Tons – Ideal for residential and light commercial projects.

- 6–20 Tons – Widely used in mid-rise buildings and infrastructure.

- Above 20 Tons – High-capacity cranes for industrial, metro, and mega project applications.

By End Use

- Residential Construction – Growing demand from high-rise housing.

- Commercial Construction – Strong uptake for malls, corporate towers, and hotels.

- Infrastructure Projects – Fastest-growing segment driven by public megaprojects.

- Industrial Facilities – Increasing use in factories and energy plants.

Challenges Impacting Market Growth

- High Initial Investment – Purchasing and maintaining cranes requires significant capital.

- Skilled Labor Shortage – Operating advanced cranes demands trained professionals.

- Supply Chain Fluctuations – Steel price volatility affects crane manufacturing costs.

- Regulatory Complexity – Strict safety and environmental standards increase compliance costs.

Competitive Landscape

The tower crane market is moderately consolidated, with manufacturers focusing on advanced technologies, safety features, and project-specific crane customization. Companies are expanding production capacities and strengthening dealer networks to meet rising construction demand.

Key Companies Profiled

- Liebherr Group

• Zoomlion Heavy Industry

• Terex Corporation

• XCMG Construction Machinery

• Manitowoc Company

• Yongmao Holdings

• Raimondi Cranes

• Comansa

• POTAIN (Manitowoc)

• FM Gru

Manufacturers are increasingly adopting telematics, IoT-enabled components, energy-efficient drives, and enhanced safety systems to achieve differentiation in a competitive market.

Recent Developments

2024:

Manufacturers introduced cranes with AI-based anti-collision systems, energy-saving hoisting mechanisms, and advanced operator cabins with digital interfaces.

2023:

Rental companies expanded high-capacity crane fleets to meet growing infrastructure project demand across Asia and the Middle East.

2022:

Europe witnessed major upgrades in flat-top and luffing jib cranes tailored for urban megaprojects, featuring eco-friendly designs and reduced noise emissions.

Future Outlook: A Decade of Smart, Sustainable Construction Equipment

The next decade will see tower cranes evolve into more intelligent, connected, and energy-efficient machines. Innovations in automation, remote operations, digital twins, and predictive maintenance will redefine modern construction workflows. As global infrastructure development accelerates, the tower crane market is poised for strong and sustained growth through 2035.