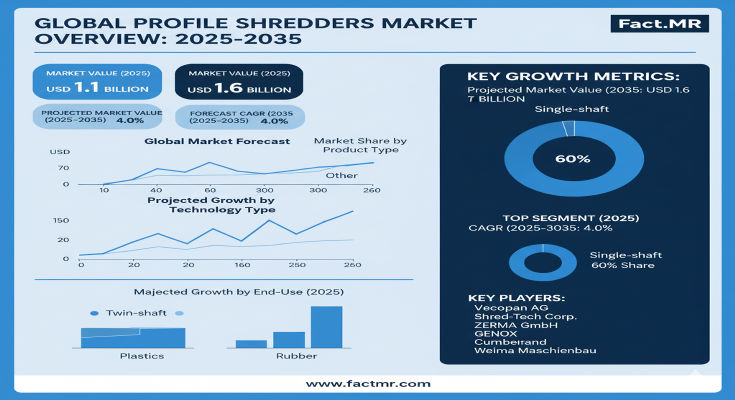

In an era where sustainable waste management is no longer optional but imperative, the profile shredders market is gaining momentum as a cornerstone of efficient material recovery, transforming industrial scraps into valuable resources. According to a comprehensive new report from Fact.MR, the global market, valued at US$ 1,050.0 million in 2025, is projected to surge to US$ 1,550.0 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.0%. This 47.6% total growth—representing an absolute dollar opportunity of US$ 500.0 million—highlights the sector’s critical role in advancing recycling technologies and resource optimization, with 48.0% of expansion (US$ 240.0 million) in the first half (2025-2030) and 52.0% (US$ 260.0 million) accelerating thereafter, propelled by stringent environmental regulations and the global shift toward circular economies.

As industries grapple with mounting waste from construction, automotive, and manufacturing, profile shredders—specialized machines for processing profiles like aluminum frames and plastic extrusions—are evolving into high-efficiency systems with automated controls and noise reduction features. The profile shredders market is expected to grow by nearly 1.5 times during the forecast period, supported by increasing demand for efficient waste processing solutions and rising adoption of recycling technologies worldwide, With single-shaft and dual-shaft models each capturing 40% market share, this sector is empowering manufacturers to turn waste into wealth while meeting global sustainability goals.

Click Here for Sample Report Before Buying: https://www.factmr.com/connectus/sample?flag=S&rep_id=8591

Click Here for Sample Report Before Buying:

Key Drivers: Recycling Revolution and Regulatory Imperatives

The market’s robust trajectory is underpinned by a perfect storm of environmental pressures and technological advancements. Foremost is the escalating demand for efficient waste processing, as industries worldwide face a 20-30% annual increase in profile waste from construction and renovation activities, such as aluminum window frames and door systems. The automotive sector’s focus on end-of-life vehicle processing further amplifies needs, with shredders enabling material recovery that supports a circular economy and reduces landfill burdens.

Stringent environmental regulations, including EU’s Waste Framework Directive and U.S. EPA guidelines, are mandating advanced recycling infrastructure, spurring investments in shredding technologies that minimize emissions and energy use. Innovations like variable speed controls, intelligent feeding mechanisms, and dust collection systems are slashing operational costs by 15-20%, making these machines indispensable for green manufacturing. “Growing focus on material recovery systems in industrial and waste management sectors” is a standout driver, per Fact.MR, alongside the expansion of advanced recycling facilities equipped with automated monitoring. Challenges such as complex integration processes and supply chain inconsistencies persist, particularly in emerging markets, but quality-by-design strategies and localized production are smoothing these hurdles, fostering broader adoption.

Segmentation Insights: Single-Shaft Models and Recycling Applications Dominate

Fact.MR’s in-depth segmentation reveals targeted growth vectors. By type, single-shaft and dual-shaft shredders each hold a commanding 40.0% market share in 2025, prized for their precision in handling diverse profiles and scalability in high-volume operations, with quad-shaft variants filling the remaining 20.0% for specialized heavy-duty tasks. These configurations offer revenue pools estimated at US$ 420.0-620.0 million each through 2035, driven by their versatility in plastic and metal processing.

Material-wise, plastic leads with 45.0% share (US$ 472.5-697.5 million opportunity), fueled by extrusion waste from packaging and construction, followed by metal (30.0%) for aluminum and steel profiles, and wood (25.0%) for sustainable timber recovery. End-user segmentation spotlights recycling at 60.0% share (US$ 630.0-930.0 million), integral to waste valorization, while manufacturing (25.0%) and waste management (15.0%) grow via industrial integrations. Distribution favors direct sales for customized systems, with online platforms emerging for mid-tier models.

Regional Dynamics: Asia-Pacific’s Industrial Boom vs. Europe’s Precision

Asia-Pacific commands the growth narrative, with India at a blistering 4.8% CAGR, propelled by rapid infrastructure development and waste management initiatives in hubs like Mumbai and Delhi, where domestic demand drives 25-30% annual utilization spikes. China follows at 4.4% CAGR, leveraging massive manufacturing expansions in Shanghai and Guangzhou to pioneer automated shredders for profile recycling.

Europe exemplifies maturity, valued at a significant portion with Germany leading at US$ 220.0 million in 2025 (3.6% CAGR, 31.4% regional share), innovating advanced systems in Ludwigshafen for compliant metal processing. The UK (US$ 160.0 million, 3.5% CAGR, 26.8% share) emphasizes construction waste, France (US$ 130.0 million, 23.1% share) advances manufacturing integrations, Italy (US$ 100.0 million) and Spain (US$ 90.0 million) focus on Mediterranean recycling, and the rest of Europe (US$ 250.0 million) gains from Nordic sustainability pushes.

North America advances steadily, led by the USA at 3.8% CAGR, anchored by EPA-driven recycling in Texas and California, achieving 20% efficiency gains through tech upgrades. South Korea (3.4% CAGR) and Japan (3.2% CAGR) prioritize precision in Seoul and Tokyo, with 40% outcome improvements in automated facilities. Latin America, Middle East & Africa present untapped potential via emerging green policies.

Recent Developments: Automation Waves and Facility Expansions

The shredder sector is grinding ahead with ingenuity. In 2024, WEIMA introduced noise-reduced dual-shaft models with AI monitoring, piloted in European recycling plants for 25% energy savings. SSI Shredding expanded U.S. facilities, integrating hydraulic systems for metal profiles and capturing 15% market share in automotive waste. Lindner partnered with Asian manufacturers for quad-shaft innovations, aligning with circular economy standards and boosting output 20% in Shanghai. These advancements, including dust control and safety features, signal a 2025 surge in ultra-high-efficiency shredders and real-time material management.

Key Players Insights: Tech Titans Shredding Barriers

A competitive landscape of 10-15 majors sees leaders like WEIMA (13.0% share) commanding 50-60% through R&D and global networks:

- WEIMA: Single-shaft pioneer, dominating recycling with German precision.

- SSI Shredding Systems: Dual-shaft specialist, innovating U.S. waste management.

- Lindner: Quad-shaft expert, expanding European manufacturing.

- UNTHA Shredding Technology: High-volume processor for Asia-Pacific.

- Vecoplan: Automated controls leader for plastics.

- Harden Machinery Ltd.: Cost-effective metal shredders.

- Shred-Tech: Safety-focused for construction.

- Forrec: Italian innovator in wood profiles.

- Erdwich Zerkleinerungstechnik: Compliance tech for EU markets.

- Genox Recycling Tech, CM Shredders, Brentwood, Satrind, Wiscon, Zeno: Niche challengers via partnerships.

Strategies include M&A for automation IP and certifications for eco-compliance.

Challenges and Opportunities: Integration Hurdles vs. Circular Gains

Complex system integrations and performance variances during maintenance challenge margins, particularly in supply-constrained regions.

Yet, opportunities abound: recycling unlocks US$ 630.0-930.0 million, plastic processing US$ 472.5-697.5 million, and Asia-Pacific US$ 210.0-310.0 million. Advanced systems add US$ 105.0-155.0 million—shredding paths to prosperity.

Browse Full Report: https://www.factmr.com/report/profile-shredders-market

Future Outlook: A $1.55 Billion Engine of Resource Recovery

By 2035, Fact.MR envisions profile shredders as a US$ 1.55 billion force, with recycling at 62% share and Asia-Pacific leading. The 4.0% CAGR will prioritize AI-driven efficiency. For industrial innovators, the cut is clear: shred sustainably to recycle success.