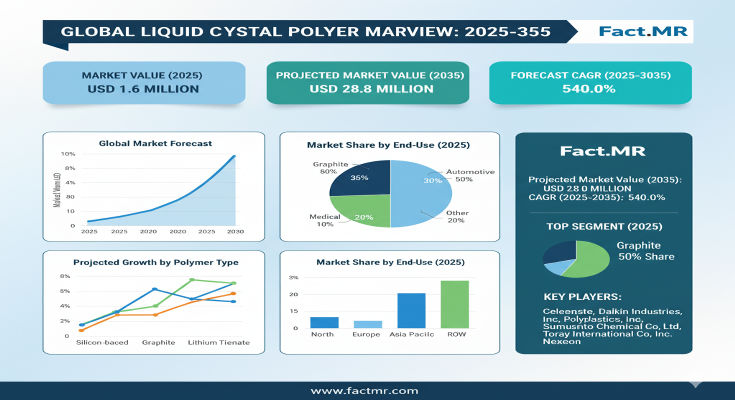

The global liquid crystal polymer market is gaining considerable traction as electronics, automotive, and industrial sectors demand materials that combine high thermal stability, dimensional accuracy, and excellent flow properties for precision molding. Analysts estimate the market was valued around USD 1.75 billion in 2024, with projections indicating that it could exceed USD 5.11 billion by 2033, implying a strong compound annual growth rate (CAGR) of about 12.9% over the forecast period.

Market Drivers & Growth Catalysts

Several factors are fueling demand for LCPs. In electronics and telecommunication industries, miniaturization and high-frequency performance requirements push designers to adopt materials with low dielectric constant, high dimensional stability, and excellent thermal resistance. LCPs offer very low melt viscosity, strong mechanical and chemical resistance, and rapid cycle molding, making them ideal for connectors, fine pitch components, high-density PCBs, and other precision parts.

In automotive and transportation sectors, the drive toward lightweight materials, higher temperature resistance (under-hood components or connectors exposed to harsh conditions), and durable composite solutions is increasing LCP adoption. These polymers help reduce weight, improve thermal stability, and enhance durability compared to many conventional engineering plastics.

Additionally, industries such as medical devices, consumer electronics, and industrial machinery are increasingly using LCP for parts that must withstand sterilization, high-temperature cycles, or harsh chemical exposure. This broad application base supports ongoing growth momentum.

Product & Technology Segmentation

LCPs are available in various grades, including thermotropic types that exhibit ordered molecular structure, enabling excellent flow and stiffness even at elevated temperatures. Some grades are reinforced or blended to enhance properties such as mechanical strength, chemical resistance, or dielectric performance.

Processing technologies include injection molding, thin film or laminate fabrication, and precision micro-molding for small, high-density components. LCP films and laminates are used in flexible electronics or multi-layer laminate systems; these film and laminate formats show promise with predicted growth of more than 5.5% CAGR during 2025-2030.

Regional Insights & Growth Opportunities

Asia-Pacific is a key growth engine due to strong electronics manufacturing, automotive production, and infrastructure for polymer compounding and molding. High local demand for consumer electronics, telecom equipment (including 5G and miniaturized components) supports LCP consumption.

In North America and Europe, established electronics, automotive, and medical precision manufacturing sectors drive demand for high-performance polymers. Requirements for stricter standards, higher reliability, and thermal or chemical resistance push adoption of premium LCP grades.

Emerging markets in Latin America, the Middle East, and Africa are also potential growth zones as industrialization, electronics manufacturing, and polymer import or local compounding capacities expand.

Competitive Landscape & Strategic Trends

Manufacturers of LCP resins are focusing on improving polymer chemistry—lowering melt viscosity, increasing strength, and improving chemical and thermal resistance. Key players are investing in new grades suited for high-frequency, high-temperature, harsh chemical environments, or sterilization cycles.

There is also growing collaboration between LCP resin suppliers, molding houses, component manufacturers (electronic connectors, micro-components, precision molds), and OEMs. This helps optimize part design, molding cycles, and material selection to leverage LCP advantages in miniaturization, distortion resistance, and high throughput.

Challenges & Market Restraints

Despite the promise, some challenges remain. The high cost of raw materials and specialized polymer synthesis can limit adoption in cost-sensitive applications or lower-price markets. Precision molding of thin or micro components requires specialized machinery and strict quality control, which increases cost and technical complexity.

Other constraints include scalability of high-performance grades, competition from other engineering plastics in certain cost-sensitive or less demanding applications, and regulatory or certification requirements—especially in automotive or medical uses.

Forecast & Strategic Recommendations

With an estimated market size of USD 1.75 billion in 2024, growing toward USD 5.11 billion by 2033, and a CAGR of about 12.9%, the outlook is very positive. Companies should prioritize development of advanced grades optimized for high-frequency electronics, automotive under-hood parts, micro-component molding, and film or laminate applications.

To succeed, focusing on local production and compounding in high-growth regions such as Asia-Pacific and emerging markets, forming partnerships with OEMs for co-developed components, and reducing costs via improved polymer synthesis or recycling of scrap will be key.

Browse Full Report: https://www.factmr.com/report/3968/liquid-crystal-polymer-market

Editorial Perspective

Liquid crystal polymers are far more than just another engineering plastic. They represent a class of materials that enable next-generation miniaturization, high-temperature stability, and lightweight design essential in electronics, automotive, medical, and industrial sectors. As industries push for smaller, faster, and more durable components, LCPs will become central materials in many high-precision, demanding applications. Those suppliers and manufacturers who master material grades, high-precision molding, and regional supply chain integration will likely emerge as leaders in a market projected to surpass USD 5.11 billion by 2033.