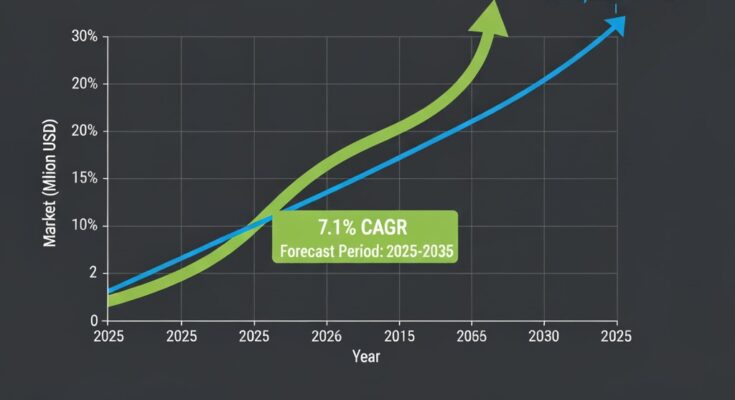

The global heel pressure Injury relieving device market is projected to increase from USD 1,745.5 million in 2025 to USD 3,465.8 million by 2035, with a CAGR of 7.1% during the forecast period

Strategic Market Drivers

The Heel Pressure Injury Relieving Device (HPIRD) market is witnessing rapid expansion driven by the growing global burden of chronic wounds, increased hospital admissions, and a rising elderly population prone to mobility-related ulcers. Demand for pressure injury prevention technologies is rising sharply across hospitals, nursing homes, and home care settings.

Rising Prevalence of Pressure Ulcers:

An increasing number of patients suffering from diabetes, obesity, and chronic illnesses are at high risk of developing pressure ulcers. Heel injuries account for a significant share of hospital-acquired pressure ulcers, propelling demand for targeted heel protection and relief devices.

Growing Geriatric and Bedridden Populations:

The expanding elderly demographic globally, combined with longer hospital stays and limited mobility, is creating a sustained need for effective heel offloading and support devices. Manufacturers are developing lightweight, adjustable, and ergonomically designed systems that enhance patient comfort and healing outcomes.

Advances in Material Science and Design:

Innovations such as medical-grade foams, air-based suspension systems, and fluidized technology are redefining comfort and performance in pressure-relieving products. Modern heel protectors are designed to evenly distribute pressure, minimize friction, and optimize airflow for faster recovery.

Infection Control and Hygiene Regulations:

Healthcare institutions are increasingly prioritizing infection prevention and hygiene compliance. Single-patient-use and antimicrobial-coated heel protectors are becoming the standard, reducing cross-contamination risks and aligning with hospital safety protocols.

Regional Growth Highlights

North America:

The U.S. dominates the global HPIRD market, backed by strong healthcare infrastructure, insurance coverage for wound care, and high awareness of pressure injury prevention. Continuous innovation by key players like Stryker and Hill-Rom Services Inc. supports the market’s steady growth.

Europe:

Europe follows closely, driven by regulatory initiatives emphasizing patient safety and chronic wound management. Germany, the U.K., and France lead adoption due to advanced healthcare systems and aging populations. Companies like Lohmann & Rauscher GmbH & Co. KG and Bort GmbH are focusing on high-quality, CE-certified products.

Asia-Pacific:

Asia-Pacific is emerging as a high-growth region, led by increasing healthcare expenditure, expanding hospital infrastructure, and growing awareness of advanced wound care technologies. Countries such as Japan, China, and India are adopting heel pressure relief devices across long-term care and acute hospital settings.

Emerging Markets:

Latin America and the Middle East show strong long-term potential due to healthcare modernization, rising chronic disease prevalence, and growing investments in hospital equipment and patient care systems.

Market Segmentation Insights

By Product Type:

- Heel suspension boots

- Heel protectors and cushions

- Pressure redistribution pads and wedges

- Foam and air-based offloading systems

By End User:

- Hospitals and clinics dominate due to institutional procurement and high patient turnover.

- Home care settings are expanding rapidly, driven by aging-in-place trends and home treatment for chronic wounds.

By Material Type:

- Foam-based devices hold a major share due to affordability and comfort.

- Air and fluid-filled systems are gaining traction for advanced, customizable pressure relief.

Challenges and Market Considerations

Cost Sensitivity:

While demand is growing, adoption in developing countries is challenged by the high cost of advanced heel protection systems. Manufacturers are focusing on cost-effective designs without compromising efficacy.

Product Standardization and Compliance:

Compliance with stringent medical device regulations, such as FDA and EU MDR standards, requires ongoing innovation and documentation, increasing time-to-market and R&D costs.

Patient Compliance and Awareness:

Limited awareness among patients and caregivers about the importance of pressure relief devices can slow adoption. Educational initiatives and clinical training are vital for improving utilization rates.

Competitive Landscape

The Heel Pressure Injury Relieving Device market is characterized by strong competition and innovation, with key players focusing on ergonomic design, material optimization, and expanded distribution networks.

Key Companies Profiled in the Heel Pressure Injury Relieving Device Market Report:

- Stryker

- McKesson Corporation

- Arjo

- EHOB

- Hill-Rom Services Inc.

- Bort GmbH

- A. Algeo Ltd.

- Lohmann & Rauscher GmbH & Co. KG

- Pelican Manufacturing

- Others

These players are investing in R&D for enhanced comfort, durability, and infection control. Collaborations with healthcare providers and distributors are strengthening their global reach.

Maufracture’s Strategic Positioning

Maufracture aims to position itself as a leader in advanced pressure injury management through:

- Innovative Product Design: Developing next-generation heel suspension systems that combine lightweight materials with maximum pressure relief.

- Patient-Centered Solutions: Focusing on comfort, mobility, and ease of use for both patients and caregivers.

- Global Expansion: Targeting high-growth regions such as Asia-Pacific and Latin America with region-specific products and distribution networks.

- Collaborations and Partnerships: Working with hospitals, wound care specialists, and distributors to promote awareness and drive adoption.

Outlook and Market Leadership

The global Heel Pressure Injury Relieving Device market represents a critical segment of the wound care ecosystem, addressing a rising healthcare challenge. With market valuation expected to nearly double by 2035, the sector offers vast opportunities for innovation, investment, and improved patient outcomes.

Companies like Maufracture and established leaders such as Stryker and Hill-Rom are set to redefine patient comfort and safety through technology-driven, patient-focused solutions. As the global population ages and healthcare systems prioritize prevention, heel pressure injury relief devices will remain essential tools in modern clinical care.