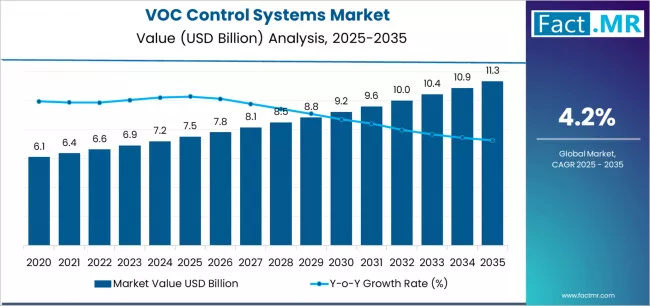

Fact.MR, a leading global market intelligence firm, today published its VOC Control Systems Market Outlook 2025–2035, forecasting that the global market for volatile organic compound (VOC) control systems will grow from USD 7.5 billion in 2025 to USD 11.3 billion by 2035, at a compound annual growth rate (CAGR) of 4.2% over the decade.

This strong growth trajectory underscores rising industrial emission compliance demands, increasing corporate sustainability commitments, and accelerating adoption of advanced air pollution control solutions across chemical, automotive, electronics, and other key sectors.

“VOC control systems are now a strategic cornerstone for industries operating under stricter environmental scrutiny,” said Dr. Meera Kapoor, Lead Analyst at Fact.MR. “Our research shows that companies are no longer just meeting regulatory requirements — they are proactively investing in scalable, modular, and intelligent solutions that integrate with their manufacturing platforms.”

Market Overview

The Fact.MR report reveals that the market’s value of USD 7.5 billion in 2025 reflects widespread deployment of VOC control technologies across major industrial geographies. Over the first half of the forecast period (2025–2030), the market is expected to grow to USD 8.8 billion, adding approximately USD 1.3 billion, driven by strong uptake of foundational systems like regenerative thermal oxidizers (RTO).

In the second half (2030–2035), the market is projected to accelerate further to USD 11.3 billion, with 66% of the decade’s incremental growth coming during this period. This phase is anticipated to be characterized by deeper integration of emission control into industrial platforms and broader penetration of advanced, specialized control technologies.

Key Growth Drivers

-

Intensifying Regulatory Pressure

Governments worldwide — particularly in North America, Europe, and Asia-Pacific — are tightening VOC emission limits, compelling companies to deploy more efficient control systems. -

Sustainability Commitments

Corporations are increasingly prioritizing VOC reduction as part of their ESG (environmental, social, governance) strategies, using control systems to lower their carbon footprint and improve environmental credentials. -

Technological Innovation

Advances in catalyst design, real-time emission monitoring, and energy-efficient oxidation technologies are making VOC control more effective, reliable, and cost-efficient. -

Modular and Scalable Deployment

Demand is rising for modular, plug-and-play control systems that can be retrofitted into existing operations — allowing companies to scale continuously without massive downtime. -

IoT & Automation Trends

Digitalized VOC control systems with IoT-enabled diagnostics and predictive maintenance capabilities are reducing downtime and cutting operational risk, making them more attractive to modern industrial operators.

Technology Segments: What’s Leading

-

RTO (Regenerative Thermal Oxidizer) systems are expected to remain dominant, commanding approximately 45% market share. Their superior VOC destruction efficiency and energy recovery capabilities make them a preferred choice for heavy polluters.

-

RCO (Regenerative Catalytic Oxidizer) solutions also play a crucial role, offering catalytic oxidation with lower temperature operation and efficient energy use.

-

Catalytic oxidation and adsorption/scrubbing technologies are gaining ground in specialized or retrofit applications, especially where space constraints or specific VOC profiles make them more practical.

End-Use Industries Driving Demand

-

Chemical and Petrochemical: This segment is projected to represent around 35% of the VOC control systems market. The need for high-emission management in chemical processing plants makes this a core application.

-

Automotive & Coatings: Accounting for roughly 25%, this segment is driven by stringent VOC emissions in paint shops and solvent-based manufacturing.

-

Electronics: The electronics sector is increasingly deploying VOC control systems to comply with air quality standards and protect sensitive production environments.

-

Food & Printing: These industries are also adopting VOC control, especially for volatile solvents in inks, packaging, and processing operations.

Capacity & Lifecycle Trends

Fact.MR’s report segments the market based on system capacity and lifecycle stage:

-

Capacity Range: Control systems are segmented into below 25k Nm³/h, 25k–100k Nm³/h, and above 100k Nm³/h. Medium-capacity systems (25k–100k Nm³/h) are increasingly popular, balancing performance and cost-efficiency.

-

Lifecycle Stage: The market is split between new installations, retrofits/upgrades, and service (maintenance). Retrofits and upgrade projects represent a significant opportunity as companies modernize aging infrastructure and retrofit older plants for enhanced emission control.

Regional Outlook

-

Asia-Pacific is poised to be among the fastest-growing regions, driven by industrial modernization, stricter local environmental regulations, and expansion in chemical and manufacturing capacity.

-

North America continues to be a major market, supported by strong regulatory frameworks, well-established environmental technology firms, and rising demand for high-performance VOC control systems.

-

Europe remains a hub for advanced emission control due to stringent EU environmental standards, increasing retrofits, and demand for sustainable manufacturing.

Competitive Landscape

Fact.MR identifies several leading players in the global VOC control systems market including Dürr, Anguil Environmental, John Zink, CECO Environmental, Munters, and others. These companies compete heavily on:

-

Emission control efficiency

-

System modularity and scalability

-

Integration with automated industrial systems

-

Aftermarket support, service, and monitoring

The market is moderately consolidated: while established environmental technology firms hold strong positions, innovation-driven newcomers are entering with niche solutions tailored for fast-growing industries.

Challenges & Strategic Opportunities

Challenges:

-

High capital expenditure for VOC control systems — especially advanced or modular ones — may deter smaller enterprises.

-

Maintenance complexity, particularly for systems involving thermal or catalytic oxidation, demands skilled labor and technical expertise.

-

Integration risk when installing advanced control systems in legacy plants, which may involve downtime and capital restructuring.

Opportunities:

-

Retrofit/upgrade projects offer significant potential, as companies modernize their older infrastructure for better emission control and efficiency.

-

Industrial sustainability programs present new business cases for VOC control as ESG goals become central to corporate operations.

-

Service-based models, including remote diagnostics, predictive maintenance, and performance monitoring, can build recurring revenue streams.

-

Innovations in low-temperature catalysis, energy recovery, and IoT-enabled systems will enable next-gen control solutions that are more cost-effective, scalable, and environmentally friendly.

Executive Insight

“In a world where environmental compliance is no longer optional, VOC control systems are evolving from regulatory necessities into strategic assets,” said Dr. Meera Kapoor. “Companies that integrate these solutions today are not just managing emissions — they’re investing in operational resilience, energy efficiency, and long-term sustainability.”

Browse Full Report : https://www.factmr.com/report/voc-control-systems-market

About Fact.MR

Fact.MR is a globally recognized market research and consulting firm specializing in industrial, environmental, and emerging technology sectors. Operating in over 150 countries, Fact.MR provides data-driven insights, strategic advice, and forward-looking market intelligence to help businesses make informed decisions and stay ahead in rapidly evolving markets.