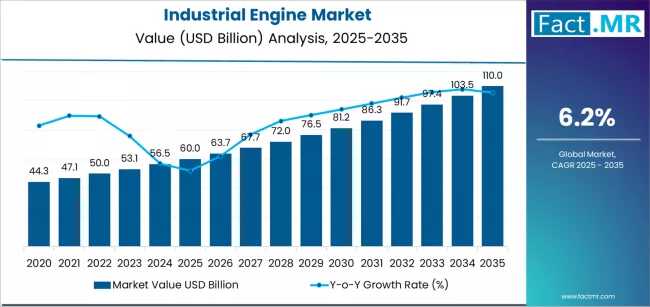

The global industrial engine market is entering a high-growth cycle fueled by rapid industrialization, rising infrastructure investment, and the global shift toward more efficient power solutions. New market assessments show the industry valued at approximately US $56.95 billion in 2024, with expectations to expand at a 6.4% CAGR and reach US $81.88 billion by 2030.

Industrial engines—ranging from mid-range power units to ultra-high-horsepower systems—remain critical across construction, mining, agriculture, manufacturing, power generation, marine applications, and oil & gas operations. As governments and enterprises increase capital expenditure in heavy industry, demand for robust, reliable engines continues to climb.

Asia-Pacific Dominates Global Demand

The Asia-Pacific region remains the largest and fastest-growing market, contributing more than one-third of global industrial engine revenues in 2024. The region’s surge is anchored by large-scale infrastructure expansion, accelerating industrial automation, and rising electricity needs across developing economies.

-

Asia-Pacific generated over US $22.5 billion in industrial engine revenue in 2024.

-

The region is projected to grow at a 7.4% CAGR through 2030.

-

China leads regional consumption, with its industrial engine market expected to reach US $16.47 billion by 2030, driven by construction megaprojects, heavy machinery deployments, and energy-sector investments.

Across Southeast Asia and South Asia, industrial modernization, manufacturing output growth, and agricultural mechanization are further accelerating adoption of mid- to high-horsepower engine systems.

Growing Preference for High-Horsepower Engines

Industrial buyers are increasingly shifting toward higher-output engine systems as project sizes and energy demands scale upward.

Market Breakdown by Horsepower Category

-

501–1,000 HP engines represented the largest share in 2024, accounting for over 37% of global revenues. These engines are widely used in construction machinery, mining vehicles, large agricultural equipment, and industrial compressors.

-

Engines above 1,000 HP are projected to be the fastest-growing segment, advancing at over 8% CAGR as sectors such as marine transport, oil & gas exploration, and heavy material handling modernize their fleets and operations.

This shift underscores a global trend toward more power-dense, fuel-efficient solutions engineered to withstand demanding operational environments.

Sustainability and Emissions Targets Reshape Engine Technology

The industrial engine sector is undergoing a major technological transformation as manufacturers respond to tightening emissions standards and rising operating cost pressures.

Emerging trends include:

-

Adoption of hybrid and alternative-fuel engines such as natural gas, biogas, and hydrogen-ready platforms

-

Development of low-emission diesel engines with advanced combustion optimization

-

Increased integration of IoT-based predictive maintenance systems, enabling real-time monitoring, reduced downtime, and optimized fuel usage

-

Advancements in aftertreatment technologies (DPF, SCR, EGR) to meet global emission norms

These innovations are not only compliance-driven but are also becoming central to long-term cost reduction and sustainability objectives across industrial sectors.

Manufacturing Sector Continues Steady Growth

The manufacturing application segment accounted for US $2.48 billion in revenue in 2024 and is projected to rise to nearly US $2.87 billion by 2030. Despite moderate CAGR compared to other sectors, this growth reflects rising automation, material-handling requirements, and increased deployment of stationary and mobile engine-powered equipment in industrial plants.

The strongest momentum is observed in:

-

Industrial machinery production

-

Heavy fabrication units

-

Automotive component manufacturing

-

Metal processing and engineering facilities

Growth in these segments is particularly significant in Asia-Pacific, supporting the region’s overall rise as the global manufacturing hub.

India Emerges as a Strategic High-Growth Market

India continues to exhibit rapid expansion in industrial engine demand, driven by economic development programs, infrastructure spending, and rural power needs.

Key data points:

-

India’s industrial engine market reached US $3.40 billion in 2024.

-

It is projected to reach US $5.29 billion by 2030, at a 7.8% CAGR.

-

Additional long-term market analyses indicate the sector may grow to more than US $6.28 billion by 2033.

Government-led initiatives—such as highway development, renewable energy expansion, heavy manufacturing incentives, and rural electrification—are increasing demand for engines across power generation equipment, farm machinery, earthmoving vehicles, and marine applications.

Market Challenges and Opportunities

Despite positive growth indicators, several challenges shape the competitive environment:

Key Challenges

-

High regulatory pressure on traditional diesel engines

-

Increasing demand for low-carbon, high-efficiency solutions

-

Volatility in fuel prices and procurement costs

-

Intensifying global competition among engine manufacturers

Opportunities for Market Leaders

Companies investing in the following areas are best positioned to gain market share:

-

High-horsepower engines (>1,000 HP)

-

Carbon-neutral or alternative-fuel technologies

-

Hybrid platforms for heavy-duty applications

-

Digitally smart engines enabling AI-based diagnostics

-

Expanded production capacity in Asia-Pacific

Leading Companies Shaping the Market

Prominent global manufacturers driving innovation include:

-

Caterpillar Inc.

-

Cummins Inc.

-

General Electric

-

John Deere

-

Volvo Penta

-

MAN Energy Solutions

-

Honda Motor Co.

-

Mitsubishi Heavy Industries

-

Yanmar Co.

-

Kubota Corporation

These companies are focusing on improved efficiency, lower emissions, and expanded portfolio lines to capture emerging opportunities in heavy-duty industries.

Browse Full Report : https://www.factmr.com/report/industrial-engine-market

Industry Outlook

Global industrialization, a surge in infrastructure megaprojects, and rising power demands position the industrial engine market for sustained, long-term expansion. Manufacturers capable of delivering high-performance, energy-efficient, and environmentally compliant engines will shape the next phase of industry evolution. As sectors worldwide accelerate modernization, the industrial engine market is set to remain an indispensable pillar of global economic growth.