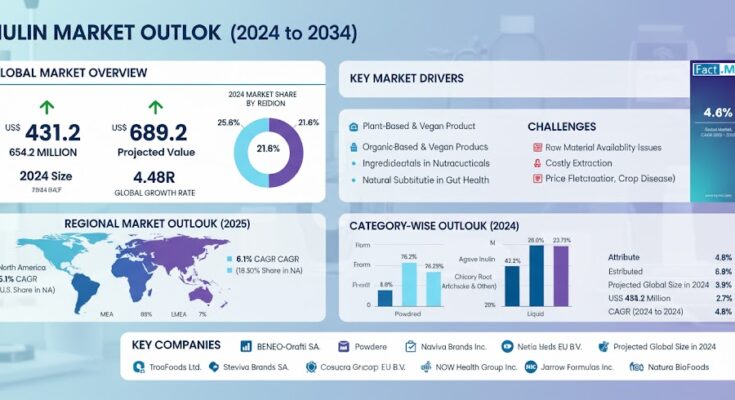

The global inulin market is on a strong growth trajectory as consumers increasingly prioritize digestive health, natural ingredients, and functional nutrition. According to a recent report by Fact.MR, the global inulin market revenue is estimated at US$ 431.2 million in 2024 and is projected to increase at a CAGR of 4.8%, reaching US$ 689.2 million by 2034.

The market’s steady expansion is underpinned by the growing adoption of prebiotic fibers in food & beverage formulations, pharmaceutical applications, and dietary supplements. With rising awareness of gut health, weight management, and immune function, inulin—a naturally occurring polysaccharide extracted mainly from chicory root—is gaining prominence as a multifunctional ingredient in clean-label and plant-based formulations.

Strategic Market Drivers

Growing Health Awareness and Prebiotic Demand

The rising prevalence of digestive disorders, obesity, and metabolic diseases has accelerated consumer interest in prebiotic dietary fibers. Inulin, known for promoting beneficial gut bacteria, improving mineral absorption, and enhancing digestive function, is increasingly featured in functional food and nutraceutical products. This trend is particularly prominent in developed markets such as North America and Europe.

Expansion in Functional Foods and Beverages

Food and beverage manufacturers are integrating inulin into a wide array of products, including yogurts, bakery items, beverages, and cereal bars, to enhance texture, sweetness, and fiber content without adding calories. The ingredient’s versatility in fat and sugar replacement makes it a preferred choice for clean-label, reduced-sugar formulations.

Rising Application in Pharmaceuticals and Nutraceuticals

The pharmaceutical sector is leveraging inulin’s prebiotic properties to develop supplements targeting gut microbiota modulation and immune support. Its compatibility with other active ingredients enhances formulation flexibility, driving innovation in capsules, powders, and functional blends.

Technological Advancements and Production Expansion

Innovations in chicory root extraction and fiber purification have improved yield efficiency and product quality. Manufacturers are expanding their production capacities through strategic investments and regional collaborations to meet growing global demand.

Regional Growth Highlights

Europe: The Global Leader

Europe dominates the global inulin market, supported by high consumer awareness of gut health and strong regulatory support for natural ingredients. Countries such as Belgium, Germany, and the Netherlands are major producers, with extensive chicory root cultivation and advanced processing infrastructure.

North America: Rising Demand for Functional Nutrition

The U.S. and Canada are witnessing increasing use of inulin in functional foods and beverages as consumers seek digestive wellness and plant-based solutions. The region also exhibits strong growth potential in dietary supplements and clean-label products.

Asia Pacific: Emerging Growth Frontier

Asia Pacific is poised to emerge as a lucrative market, driven by urbanization, growing middle-class income, and rising health consciousness in countries like China, India, and Japan. Expanding food processing industries and supportive government initiatives for healthy diets are further propelling market growth.

Latin America and the Middle East: Expanding Health and Wellness Trends

Growing adoption of Western dietary habits and rising awareness of gut health are fostering inulin demand in these regions. Manufacturers are exploring local sourcing opportunities and partnerships to strengthen market penetration.

Challenges and Market Considerations

Despite promising growth, the inulin market faces several challenges:

- Fluctuating Raw Material Prices: Dependence on seasonal chicory harvests can affect production stability.

- Supply Chain Disruptions: Transportation and export delays impact ingredient availability.

- Limited Consumer Awareness in Emerging Regions: While health trends are growing, education about prebiotic benefits remains limited in developing markets.

Competitive Landscape

The inulin market is moderately consolidated, with key players focusing on capacity expansion, product innovation, and diversification across end-use sectors. Prominent companies include:

BENEO-Orafti SA; TrooFoods Ltd.; Steviva Brands Inc.; PMV Nutrient Products Pvt. Ltd.; Sensus B.V.; Naturel West Corp EU B.V.; The Tierra Group; Cosucra Groupe Warcoing SA; NOW Health Group Inc.; THE IIDEA Company; Jarrow Formulas Inc.; Natura BioFoods; Nova-BioRubber Green Technologies Inc.; The Green Labs LLC; Nutriagaves de México SA de CV.

Manufacturers are emphasizing R&D to improve product quality and expand into pharmaceuticals, nutraceuticals, and dietary supplements—segments showing the strongest growth momentum.

- In November 2021, Beneo, a leading food ingredient manufacturer, announced an investment of US$ 31.72 million to expand prebiotic chicory root fiber production facilities in Belgium and Chile, reinforcing its global leadership in functional ingredients.

- In August 2022, ió fibrewater, a UK-based prebiotic water brand, launched fiber-infused water delivering 100% of the recommended daily prebiotic fiber intake, showcasing innovative applications of chicory root in consumer beverages.

Outlook

The inulin market’s future remains bright, driven by the convergence of nutrition science, clean-label product innovation, and consumer wellness trends. As global dietary habits evolve toward preventive healthcare and plant-based nutrition, inulin is positioned as a critical ingredient for the next generation of functional foods and supplements.