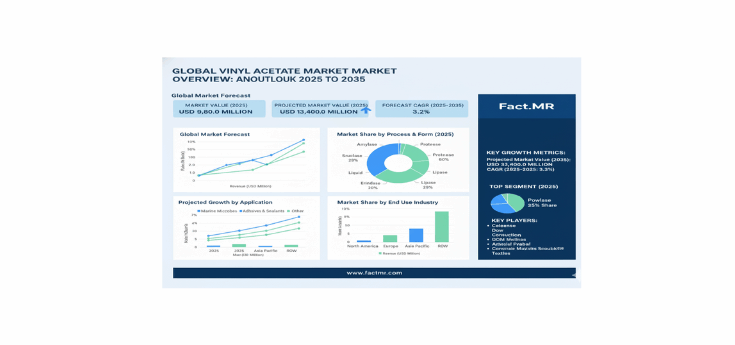

The global Vinyl Acetate Market is projected to rise from USD 9,800.0 million in 2025 to approximately USD 13,400.0 million by 2035, marking an absolute increase of USD 3,600.0 million over the forecast period. This represents a 36.7% total growth, translating into a compound annual growth rate (CAGR) of 3.2%. The market’s expansion is supported by robust industrial manufacturing, increasing demand for polyvinyl acetate (PVA) and emulsion applications, and the growing importance of high-performance chemical intermediates in adhesives, coatings, packaging, and construction sectors.

The Vinyl Acetate Market is positioned as a core pillar in global industrial supply chains, offering high-value chemical intermediates that enhance performance, reliability, and durability across a wide range of industrial applications. Its flexibility in polymerization, adhesion, and film-forming properties continues to make it indispensable in modern chemical formulations and advanced material production.

Industrial Performance Fuels Market Demand

Rapid industrialization and the modernization of chemical manufacturing are creating sustained demand for high-purity vinyl acetate monomers. These compounds are essential in producing PVA emulsions, adhesives, textile finishes, and coatings, providing consistent film integrity, durability, and moisture resistance.

The Vinyl Acetate Market is further propelled by the global shift toward performance-driven construction materials, eco-efficient packaging solutions, and technically optimized manufacturing. Vinyl acetate’s versatility enables it to perform across diverse conditions, supporting premium processing control and environmental compliance standards required by large-scale industrial producers.

Market Segmentation Highlights

Among applications, PVA and emulsions lead the Vinyl Acetate Market with a commanding 45% share in 2025, maintaining dominance through 2035 due to their widespread use in coatings, adhesives, and film applications. The adhesives segment holds a strong 30% share, reflecting rising demand for industrial bonding agents in the construction and packaging industries. Meanwhile, the coatings segment, at 15%, continues to benefit from growing demand for high-performance surface solutions across industrial and architectural applications.

By process, the gas-phase route accounts for approximately 60% of total production, favored for its operational efficiency and cost-effectiveness in large-scale facilities. The liquid-phase process, with around 40% share, serves specialized applications requiring customized formulations and controlled polymerization conditions. Across both segments, manufacturers are emphasizing advanced catalytic systems to optimize energy use, yield, and purity.

In terms of end use, packaging remains the leading sector, representing 35% of total demand in 2025, supported by the rapid rise in e-commerce and global logistics. Construction accounts for 30%, driven by infrastructure development, while textiles capture 20%, reflecting their critical role in coatings and fiber treatment. Other specialized end uses comprise the remaining 15%, including automotive, electronics, and specialty chemical manufacturing.

Regional Outlook: Asia Pacific Leads Global Growth

Geographically, the Vinyl Acetate Market is led by Asia Pacific, followed by North America and Europe. Asia Pacific’s industrial expansion—especially in India and China—is expected to drive the fastest growth through 2035. India’s Vinyl Acetate Market is forecast to record a 4.2% CAGR, driven by expanding manufacturing infrastructure, construction growth, and strong demand from packaging and chemical industries.

China follows with a 3.5% CAGR, supported by industrial modernization and chemical production capacity expansion. North America, led by the United States (3.0% CAGR), continues to emphasize innovation, performance quality, and regulatory compliance, maintaining steady demand for high-grade vinyl acetate used in premium formulations.

In Europe, countries like Germany (2.8%), France, and the UK are focused on sustainable processing, technical innovation, and high-performance chemical production. Meanwhile, South Korea and Japan exhibit steady growth driven by precision chemical manufacturing and advanced industrial applications.

Key Growth Drivers

The Vinyl Acetate Market benefits from multiple long-term growth drivers. Rising industrial and construction activities worldwide continue to generate demand for chemical intermediates that deliver consistent quality and processing performance. Advanced manufacturing requirements are pushing producers to adopt high-purity vinyl acetate with tighter process controls. Additionally, sustainability and efficiency mandates are encouraging the use of vinyl acetate as a cleaner, more controlled intermediate compared to conventional alternatives.

In the packaging industry, vinyl acetate is increasingly favored for its clarity, toughness, and adhesion strength, supporting both traditional and eco-friendly materials. In construction, it serves as a crucial binder in adhesives, paints, and sealants. The growing focus on performance optimization and long-term material reliability continues to expand its role across industrial and consumer goods manufacturing.

Competitive Landscape

The Vinyl Acetate Market is moderately consolidated, led by major global chemical companies with integrated production capacities and advanced R&D capabilities. Key players include Celanese Corporation, Dow Inc., LyondellBasell Industries N.V., Sinopec Corporation, Kuraray Co., Ltd., Wacker Chemie AG, Dairen Chemical Corporation, CNPC, Clariant AG, and LG Chem Ltd.

These industry leaders are investing in vertical integration, sustainable feedstock optimization, and process automation to enhance yield and product quality. Smaller regional processors are focusing on specialty grades and niche formulations, catering to specific performance or regulatory requirements. Continuous innovation in catalysts, purification, and polymer technologies remains the defining factor for competitive differentiation.

Browse Full Report: https://www.factmr.com/report/vinyl-acetate-market

Summary

The Vinyl Acetate Market is set to expand steadily over the next decade, with a forecasted increase from USD 9,800.0 million in 2025 to USD 13,400.0 million by 2035, at a 3.2% CAGR. Growth is underpinned by industrial modernization, increased adoption in adhesives, emulsions, and coatings, and expanding demand from packaging and construction industries.

Asia Pacific continues to dominate global consumption, supported by manufacturing expansion in India and China, while North America and Europe maintain leadership in technological innovation and product quality standards. Industry participants investing in production scalability, supply chain reliability, and advanced process technology will be best positioned to capture value in this evolving global market.