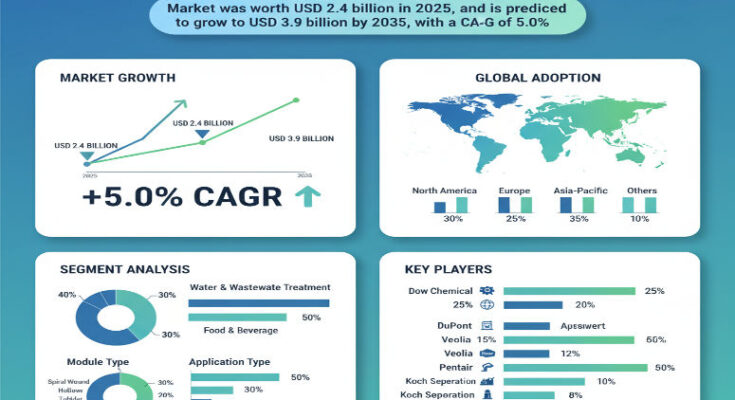

The global ultrafiltration market is entering a phase of strong growth, spurred by rising demand for advanced filtration and separation across water treatment, industrial processing, biopharmaceutical, and food & beverage sectors. Market projections indicate the ultrafiltration market was valued at approximately USD 2.4 billion in 2025 and is expected to grow to about USD 3.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.0% over the the forecast period. This growth underscores how ultrafiltration technologies are becoming a critical enabler for industries needing reliable removal of suspended solids, bacteria, endotoxins, and macromolecules, especially in applications where water reuse, product purity, or waste reduction are essential.

Market Drivers & Growth Catalysts

A number of key factors are driving expansion in the the ultrafiltration market. First, municipal and industrial facilities are under increasing pressure to treat and reuse wastewater or industrial effluent due to water scarcity, regulatory constraints, and environmental sustainability goals. Ultrafiltration offers a low-chemical, membrane-based solution that enables removal of fine particles, microorganisms and macromolecules from water or process fluids.

Second, industries such as biotech, pharmaceuticals, and food / beverage processing require filtration of proteins, contaminants or high-purity streams. Ultrafiltration is widely used for protein concentration, clarification, dialysis, or ingredient recovery, supporting product quality and regulatory compliance. Third, technological improvements—such as more durable polymeric membranes and ceramic membranes resistant to fouling, chemical attack, or temperature fluctuations—are enhancing performance and operational lifetimes in harsh conditions, making ultrafiltration more attractive across more demanding processes.

Product & Application Segmentation

Ultrafiltration systems are typically segmented by membrane type (polymeric membranes or ceramic membranes) and module configuration (hollow fiber, tubular, plate & frame or other modules). Polymeric membranes remain widely adopted due to cost efficiency and versatility; ceramic membranes are gaining traction in industrial or demanding applications because of higher chemical and thermal resistance. Modules such as hollow fiber or tubular configurations are valued for their high packing densities and ease of integration into filtration systems.

In terms of application, major segments include municipal water treatment (for potable water or wastewater reuse), industrial water treatment (for cooling water, process water, effluent treatment), and food & beverage or biopharmaceutical applications (clarification, protein separation, ultrafiltration for process streams). End users span water utilities, chemical & process industries, pharmaceutical or biotech manufacturers, and food / beverage processors.

Regional Insights & Growth Opportunities

Regionally, growth is strong in areas with water stress and industrial expansion. Regions such as Asia-Pacific are emerging as growth hotspots driven by rapid industrialization, urbanization and investment in infrastructure and water treatment capacity. Governments are increasingly mandating water reuse and wastewater treatment, which fuels demand for ultrafiltration systems. Developed regions such as North America and Europe exhibit steady demand driven by regulatory standards for water quality, industrial reuse and adoption in high-purity sectors like pharmaceuticals, where ultra-clean water or process streams are required. Emerging markets in Latin America, Middle East & Africa are also beginning to adopt ultrafiltration more broadly as infrastructure investment and environmental regulation improve.

Competitive Landscape & Strategic Trends

The ultrafiltration market includes membrane manufacturers, system integrators, module suppliers, and engineering firms that design turnkey filtration plants. Key competitive levers include membrane material innovation (durability, fouling resistance), module design (compact or high packing density options), operational cost (energy, cleaning cycles) and ease of integration with existing process systems. Many companies are expanding manufacturing capacity, developing more fouling-resistant or ceramic membranes, and offering integrated ultrafiltration + pre-/post-treatment systems. There is also focus on digital monitoring and automation to optimize cleaning cycles, maintain flux and reduce downtime.

Challenges & Market Restraints

However, there are challenges. Membrane fouling, cleaning or membrane replacement costs remain important constraints, especially in industrial or high-fouling feed streams. Upfront capital investment for large ultrafiltration systems (especially ceramic or high performance modules) can be significant, which may slow adoption in cost-sensitive or smaller plants. Variation in feed water quality or process fluids can also impact performance; incorrect module selection or inadequate pretreatment can reduce lifetime or separation efficiency. Regulatory or localized standards may vary, requiring compliance with water quality, discharge limits or purity standards, which can affect system design and cost.

Forecast & Strategic Recommendations

With the market expected to grow from USD 2.4 billion in 2025 to about USD 3.9 billion by 2035 at a 5.0% CAGR, companies operating in this space should focus on expanding capacity and developing better membrane technologies that resist fouling, operate under variable feed conditions, and offer efficient cleaning cycles. Strategic growth in high-growth regions (especially in Asia-Pacific) will be beneficial. Offering bundled solutions—membrane modules, cleaning systems, monitoring & control—can help reduce barriers to adoption. Emphasizing high-purity performance for biotech / pharma markets or water reuse applications will provide differentiation.

Browse Full Report: https://www.factmr.com/report/ultrafiltration-market

Editorial Perspective

Ultrafiltration is positioning itself as a backbone technology in water management and industrial separation. As industries increasingly prioritize water reuse, environmental compliance, and process purity, ultrafiltration systems will be essential tools in achieving those goals. The next decade will see continued innovation in membrane materials, system design and digital integration, enabling more efficient, higher purity, and more sustainable operations. Companies that innovate, adapt to regional needs and deliver turnkey solutions will be well placed to capture growth in the projected USD 3.9 billion ultrafiltration market by 2035.