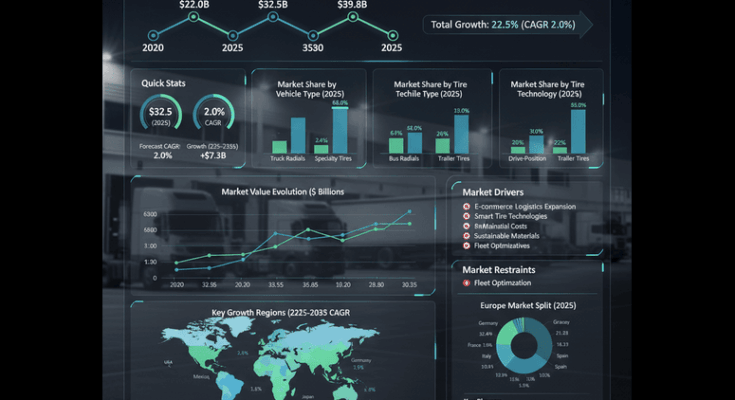

Global demand for truck and bus radial (TBR) tires is forecast to grow steadily through the next decade, according to the latest industry assessment. The market, valued at USD 32.5 billion in 2025, is projected to reach USD 39.8 billion by 2035, reflecting an absolute increase of USD 7.3 billion and a compound annual growth rate (CAGR) of 2.0% over the period.

The market expansion is underpinned by a resurgence in commercial vehicle production, logistics and freight transport activity, and a shift toward fuel-efficient and sustainable tire technologies. Continuous fleet modernization, the rise of e-commerce logistics, and the growing emphasis on total cost of ownership (TCO) optimization are also expected to reinforce demand for advanced radial tires across both OEM and replacement channels.

Market Overview and Growth Outlook

Between 2025 and 2030, the global TBR tire market is projected to expand from USD 32.5 billion to USD 35.8 billion, capturing nearly half of the decade’s total incremental growth. This first half of the period will be characterized by sustained replacement demand, expansion of freight networks, and greater tire adoption in medium and heavy-duty fleets.

From 2030 to 2035, the market is forecast to gain an additional USD 4 billion, supported by the commercialization of smart tire systems, IoT-enabled maintenance solutions, and advanced rubber compounds developed through sustainable manufacturing practices.

Factoring in macroeconomic normalization, the overall market size is expected to rise by 1.2× during the decade, signaling a phase of gradual but stable expansion across global transportation industries.

Segmental Analysis

By Vehicle Type:

The truck radial segment is projected to dominate with a 66 percent market share in 2025, reaffirming its position as the primary tire category supporting global freight and long-haul logistics. Truck radials remain preferred for their superior load-carrying capacity, optimized rolling resistance, and durability under intensive duty cycles.

By End Use:

The OEM segment is estimated to account for 55 percent of total demand in 2025, driven by recovery in commercial vehicle assembly and increasing integration of performance-oriented tire systems at the factory level. OEM demand growth will be supported by manufacturer initiatives aimed at enhancing vehicle efficiency and meeting tightening emission and safety standards.

By Tire Technology:

Among technology types, the all-position tire segment continues to lead with a 48 percent market share, favored for its operational versatility across multiple axle configurations. Its ability to optimize inventory management and simplify fleet maintenance procedures sustains long-term adoption among logistics and transportation operators.

Regional Insights

Regional performance remains uneven but stable across mature and developing markets:

- North America is expected to maintain leadership, led by the United States, which is projected to record a 2.4 percent CAGR through 2035. Market growth is anchored in freight infrastructure investment, fleet electrification, and the modernization of tire service networks.

- Mexico follows closely at 2.2 percent CAGR, supported by commercial vehicle manufacturing expansion and its position as a production hub serving both domestic and North American transport corridors.

- Europe is forecast to grow at a moderate 1.7 percent CAGR, with Germany, France, and the UK accounting for more than two-thirds of regional demand due to strong commercial vehicle innovation and sustainable tire adoption programs.

- Asia Pacific will continue to represent the largest cumulative volume opportunity, driven by rising logistics requirements in China, India, Japan, and South Korea, coupled with expanding regional trade and e-commerce logistics networks.

Key Market Drivers

- Growth of Freight and Logistics Activities:

The proliferation of e-commerce, omnichannel retailing, and regional supply-chain integration continues to stimulate road freight volumes. Increased vehicle utilization directly supports replacement demand for radial tires optimized for longer service life and lower fuel consumption. - Sustainability and Efficiency Imperatives:

Fleet operators and OEMs are adopting eco-friendly tire technologies to comply with emission targets and cost-reduction mandates. Low-rolling-resistance compounds, retreadable casings, and bio-based materials are gaining traction as tire manufacturers advance green production processes. - Integration of Smart Tire and IoT Solutions:

The evolution of sensor-enabled, data-connected tires capable of real-time performance monitoring is transforming fleet maintenance practices. Predictive analytics are helping operators enhance uptime, reduce unplanned downtimes, and extend overall tire longevity. - Commercial Vehicle Electrification:

The rise of electric and hybrid trucks is spurring demand for specialized radial tires engineered for torque management, weight distribution, and thermal stability—factors crucial for next-generation mobility platforms.

Challenges and Restraints

Despite positive momentum, several headwinds persist. Volatile raw-material pricing—particularly for natural rubber, carbon black, and synthetic polymers—continues to pressure margins. Competitive pricing from low-cost regional manufacturers and the growing popularity of tire retreading services also challenge new tire sales growth. Furthermore, supply-chain disruptions and logistic cost fluctuations remain key operational risks for manufacturers.

Competitive Landscape

The global truck and bus radial tire market remains moderately consolidated, with leading players—Bridgestone, Michelin, Goodyear, Continental, Pirelli, and Hankook—collectively accounting for a substantial share of industry revenue. These companies are expanding product portfolios through:

- R&D investments in smart tire platforms and predictive maintenance algorithms;

- Sustainability initiatives integrating renewable materials and circular manufacturing;

- Strategic alliances and OEM partnerships to strengthen global distribution networks; and

- Digital service ecosystems that connect tire performance data with fleet management analytics.

Emerging participants such as Yokohama, Kumho, MRF, and Apollo Tyres are focusing on regional production capacities and cost-competitive product differentiation to capture share in high-growth markets across Asia Pacific and Latin America.

Browse Full Report : https://www.factmr.com/report/5246/truck-and-bus-radial-tbr-tire-market

Future Outlook (2025–2035)

Over the next decade, the truck and bus radial tire industry is projected to evolve from a traditional component market into a technology-driven mobility enabler. Advancements in tire-embedded sensors, real-time analytics, and sustainable compounds will redefine how fleets manage performance and environmental impact.

While overall growth will remain moderate, continuous innovation in tire materials, coupled with the electrification of commercial transport and global supply-chain expansion, will create long-term opportunities for manufacturers emphasizing durability, energy efficiency, and digital integration.

About the Report

The Truck and Bus Radial Tire Market Forecast and Outlook 2025–2035 provides quantitative and qualitative analysis across key vehicle types, end-use sectors, and tire technologies. The study covers major regional and country-level trends, identifies leading manufacturers, and evaluates technological advancements shaping the future of commercial transportation tires.