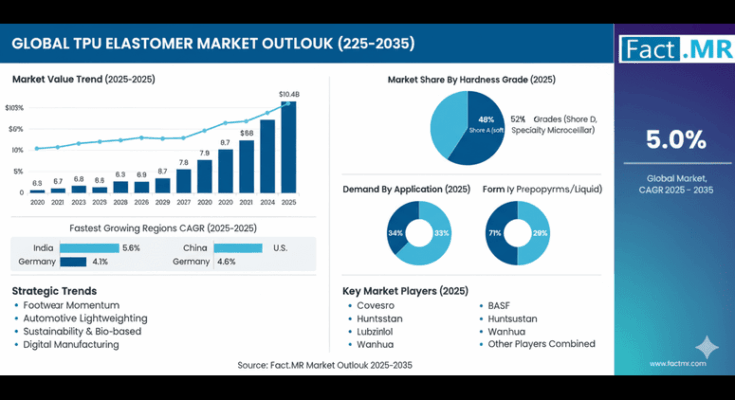

The global Thermoplastic Polyurethane (TPU) Elastomer Market is entering a transformative decade, expected to expand from USD 6.5 billion in 2025 to USD 10.4 billion by 2035, registering a 5.0% CAGR. This trajectory underscores the industry’s growing commitment to advanced material technologies, sustainability, and integrated manufacturing performance across footwear, automotive, and industrial sectors.

According to the latest TPU Elastomer Market Outlook 2025–2035, this growth is driven by surging demand for flexible, durable, and eco-efficient elastomers that meet the evolving standards of next-generation production systems. The report projects the first half of the forecast period (2025–2030) to deliver a sharp rise of USD 1.7 billion, while 2030–2035 will add USD 2.2 billion, reflecting intensified market penetration of specialized TPU technologies.

Industry Overview: A Decade of Smart, Sustainable Material Expansion

The TPU elastomer market is transitioning from traditional polymer engineering toward performance-by-design materials—elastomers that offer flexibility, high tensile strength, and recyclability without compromising durability.

Shore A (soft) TPU grades, which currently command 48% of total market share, continue to dominate due to their flexibility and superior comfort attributes, especially in footwear and consumer applications. These soft formulations will maintain their leading role, while Shore D (hard) and specialty microcellular systems expand their relevance in automotive and industrial applications.

The market’s evolution reflects a structural shift in how industries select materials—emphasizing not only product performance but operational efficiency, sustainability, and digital integration.

Key Market Metrics (2025–2035)

| Metric | Value |

|---|---|

| Market Size (2025) | USD 6.5 billion |

| Market Size (2035) | USD 10.4 billion |

| CAGR (2025–2035) | 5.0% |

| Leading Grade | Shore A (soft) elastomers |

| Top Applications | Footwear, Automotive, Industrial |

| Top Growth Regions | Asia Pacific, North America, Europe |

| Leading Companies | Covestro, BASF, Huntsman, Lubrizol, Wanhua |

Demand Drivers and Strategic Trends

- Footwear Industry Momentum

The global footwear segment, representing 34% of TPU demand, continues to anchor market growth. Athletic and lifestyle footwear manufacturers increasingly deploy TPU systems for comfort optimization, impact resistance, and durability. Automated molding systems and flexible design capabilities are enabling footwear brands to achieve cost-effective scalability while enhancing end-user performance. - Automotive Lightweighting and Durability

Automotive manufacturers, representing 33% of the TPU market, are accelerating TPU adoption to reduce vehicle weight, improve fuel efficiency, and ensure component resilience. Shore D (hard) elastomers and microcellular grades are integral to interior, sealing, and structural applications, with high performance and sustainability now key differentiators. - Sustainability and Bio-based Alternatives

The rise of bio-based TPU formulations—projected to hold up to 4% market share by 2030—marks a significant step toward a circular economy. Material leaders are investing in renewable chemistries, recyclable elastomer systems, and closed-loop production models that align with evolving environmental regulations and global sustainability mandates. - Digital Manufacturing and Automation

Integration of TPU materials into automated processing systems and digital quality management platforms is enhancing consistency, throughput, and design flexibility. The “performance-by-design” model supports smart factories that require adaptive materials capable of real-time monitoring and production traceability.

Regional Dynamics: Leadership Across Key Manufacturing Economies

North America leads the market with the United States achieving a 5.6% CAGR, fueled by the expansion of domestic automotive manufacturing and advanced consumer goods. Mexico follows at 5.1%, leveraging competitive production costs and rising industrial modernization.

Europe remains a hub for premium material innovation, growing from USD 1.6 billion in 2025 to USD 2.4 billion by 2035 (4.6% CAGR). Germany sustains leadership in automotive-grade TPU systems, while France and the UK emphasize luxury and advanced manufacturing applications respectively.

Asia-Pacific, encompassing Japan (4.2% CAGR) and South Korea (4.3% CAGR), anchors technological innovation. Regional manufacturers are investing in precision-grade TPU for electronics, sports, and mobility sectors. Meanwhile, China and India represent fast-developing markets, driven by consumer goods expansion and infrastructure manufacturing growth.

Market Segmentation Snapshot

- By Hardness Grade

- Shore A (soft): 48% market share – flexibility and comfort leader

- Shore D (hard): 30% – structural and automotive focus

- Specialty microcellular: 22% – lightweight and performance applications

- By Application

- Footwear: 34%

- Automotive: 33%

- Industrial & Sports: 33%

- By Form

- Pellets: 71% (dominant in injection molding)

- Prepolymers/Liquid: 29% (used in casting and specialty production)

Competitive Landscape and Strategic Imperatives

The global TPU market features 20–25 key players, with the top five—Covestro, BASF, Huntsman, Lubrizol, and Wanhua—accounting for nearly 50% of global revenue. Market leadership hinges on formulation expertise, processing reliability, and application innovation.

Emerging competitive strategies include:

- Sustainability integration through bio-based and recyclable TPU systems.

- Application specialization, offering tailored TPU grades for specific industrial uses.

- Comprehensive material packages, combining technical support, processing guidance, and digital traceability systems.

- Value-based service models, enabling manufacturers to access performance guarantees and eco-innovation through subscription and service tiers.

As standard Shore A grades become commoditized, margin opportunities are shifting toward microcellular, bio-based, and specialty performance formulations.

Industry Outlook: Innovation and Investment Horizon

Over the next decade, the TPU elastomer market will evolve from a performance material category to a strategic enabler of advanced manufacturing ecosystems. Manufacturers that align material development with digitalization, sustainability, and localized production will capture the largest growth opportunities.

“TPU systems are redefining how industries design, produce, and deliver performance,” said an analyst from the TPU Market Research Council. “The convergence of sustainability, smart manufacturing, and comfort engineering is positioning TPU as a critical material platform for the next generation of industrial innovation.”

Browse Full Report : https://www.factmr.com/report/3445/tpu-elastomers-market

About the TPU Elastomer Market Outlook Report

The TPU Elastomer Market Forecast and Outlook 2025–2035 provides a comprehensive analysis of global demand, pricing dynamics, material innovation, and regional adoption trends. It evaluates more than 30 national markets, detailing grade-level segmentation, application-based performance trends, and competitive strategies among global and regional players.