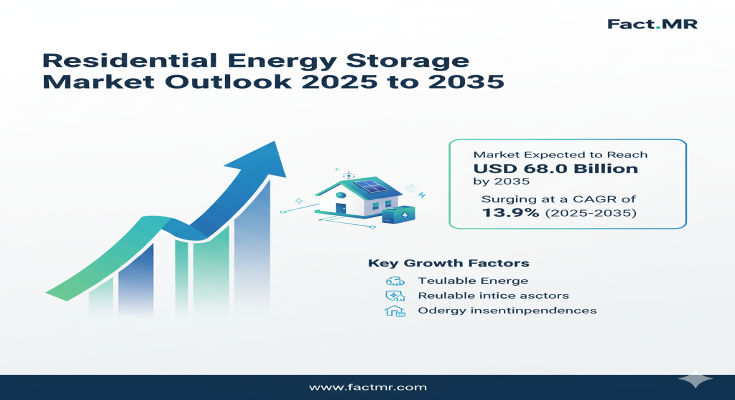

In an era of escalating energy costs and climate urgency, the residential energy storage market is charging ahead, empowering homeowners with self-sufficient, eco-friendly power systems. A new report from Fact.MR forecasts the global market, valued at US$ 18.5 billion in 2025, to expand dramatically to US$ 68.0 billion by 2035, achieving a compound annual growth rate (CAGR) of 13.9%. This nearly 3.7-fold growth—adding a staggering US$ 49.5 billion—highlights the sector’s pivotal role in fostering energy independence and integrating renewables into everyday living.

As households worldwide embrace lithium-ion batteries and smart inverters, residential storage is transforming homes into resilient microgrids. “Residential energy storage isn’t just about backup power—it’s a gateway to cost savings, sustainability, and energy autonomy,” said Dr. Aria Singh, Lead Energy Analyst at Fact.MR. “With governments worldwide incentivizing clean tech and innovations slashing costs by 40-60%, this market is poised to redefine how families power their futures.”

Key Drivers: Energy Independence, Policy Support, and Tech Advancements

The market’s momentum stems from intertwined forces. At the forefront is the quest for distributed power solutions, enabling homeowners to cut electricity bills by 40-60% through solar-integrated storage. Government initiatives, from tax credits in the U.S. to China’s National Energy Administration programs, are accelerating adoption, with many nations targeting efficiency mandates by 2030. Technological breakthroughs in lithium-ion batteries—boasting high energy density and durability—alongside smart inverters, are making systems more efficient and user-friendly.

Trends underscore this surge: Asia-Pacific’s residential boom, hybrid battery integrations for optimized management, and grid-edge innovations for seamless utility interaction. Yet, evolving grid infrastructure could temper some demand, though it ultimately bolsters hybrid models.

Segmentation Insights: Lithium-Ion and On-Grid Systems Lead the Charge

Fact.MR’s detailed breakdown reveals high-growth segments. By battery type, lithium-ion commands an 85.0% share in 2025, prized for its advanced chemistry and longevity, far outpacing lead-acid (10.0%) and niche alternatives (5.0%). Connection-wise, on-grid setups dominate at 70.0%, ideal for cost optimization and peak shaving, while off-grid (30.0%) thrives in remote locales seeking full independence.

End-use favors single-family homes with a 60.0% share, aligning with personalized energy needs, versus multi-unit dwellings (40.0%) in urban high-rises. Regions spotlight Asia-Pacific’s explosive potential, Europe’s steady climb, and North America’s mature ecosystem.

Regional Dynamics: China’s High-Octane Growth vs. U.S. Precision

Asia-Pacific emerges as the powerhouse, with China leading at a blistering 14.5% CAGR through 2035. Valued for its urban residential surge in cities like Beijing and Shanghai, China’s market benefits from policy-driven distributed energy pushes and cutting-edge battery deployments in housing districts. “China’s blend of construction booms and incentives is turbocharging residential storage,” Singh noted.

The United States follows closely at 13.0% CAGR, anchored by manufacturing hubs in California and Texas. With upgrades yielding 95% efficiency gains through energy provider partnerships, the U.S. emphasizes intelligent systems for modernized homes in states like Florida and New York.

Europe projects robust expansion from US$ 16.5 billion in 2025 to US$ 35.2 billion by 2035 (7.9% CAGR), led by Germany’s 24.2% regional share. Australia and the UK showcase 90% compliance in renewables programs, while South Asia & Oceania, Latin America, and Middle East & Africa unlock opportunities via urbanization and green financing.

Recent Developments: Collaborations and Deployments Accelerate Adoption

The sector hums with innovation. In major Chinese cities, suppliers are embedding advanced storage in new builds, achieving seamless integrations. Australia’s Sydney and Melbourne projects hit 90% performance benchmarks through renewable incentives. U.S. housing centers report 95% efficiency boosts via smart upgrades, while Germany’s residential utilization rose 25% annually. The UK demonstrates 60% faster operational timelines with hybrid systems. These milestones, including lithium-ion advancements and inverter launches, signal a wave of 2025 partnerships between manufacturers and builders.

Key Players Insights: Leaders Building Scalable Ecosystems

A moderately concentrated field of 20-25 players sees top firms like Tesla Energy, LG Energy Solution, and BYD holding 30-40% share through battery prowess and housing ties:

-

Tesla Energy: Dominates with integrated solar-storage, expanding via global partnerships for on-grid scalability.

-

LG Energy Solution: Leverages high-density Li-ion tech, focusing on multi-unit urban solutions and R&D for durability.

-

BYD: Excels in cost-effective innovations, targeting China’s residential boom with vertical integrations.

-

Sonnen and Panasonic: Specialize in premium, modular systems, emphasizing European and U.S. regional strengths.

-

Enphase, SolarEdge, Huawei: Drive inverter and management tech, with Huawei pushing Asia-Pacific smart home ties.

-

Regional challengers optimize manufacturing for compliance, while all pursue diversified portfolios (e.g., 85% Li-ion focus) and consolidations for scale.

Investors fuel growth through capacity funding and next-gen R&D, creating high barriers via switching costs.

Challenges and Opportunities: Navigating Costs Amid Policy Tailwinds

High upfront investments and installation complexities pose hurdles, alongside expertise gaps and regional performance variances that could sideline smaller markets. “System integration demands skilled networks, but that’s where opportunities lie,” Singh observed.

Bright spots include government funding, tax breaks, and standards for certification, spurring R&D in intelligent software and services. Emerging niches in next-gen batteries and real-time monitoring promise enhanced ROI, democratizing access for diverse settings.

Browse Full Report: https://www.factmr.com/report/residential-energy-storage-market

Future Outlook: A $68 Billion Era of Home Energy Autonomy

By 2035, Fact.MR envisions residential storage as ubiquitous, fused with AI management and renewables for net-zero homes. With 35.0% growth in the first half-decade and 65.0% in the latter, the market will empower billions in energy savings and resilience. Stakeholders: prioritize policy-aligned innovations to capture this green wave.

This Fact.MR report arrives as global renewables accelerate, arming industry pioneers with strategies for sustainable dominance.