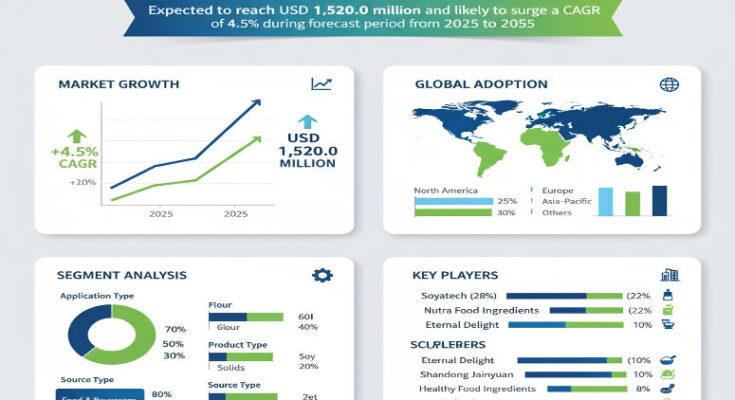

The global okara market is projected to grow from USD 980 million in 2025 to USD 1,520 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.5% over the the forecast period. This growth trajectory highlights the transition of okara—from a by-product of soy processing (soy milk, tofu) into a versatile ingredient with wide applicability in food, feed, and value-added sectors.

Market Drivers & Growth Catalysts

Several key factors are fueling the expansion of the the okara market. First, the growing demand for plant-based proteins and sustainable food ingredients is encouraging food manufacturers to adopt okara as a nutritional, fiber-rich ingredient. Okara is rich in dietary fiber, protein, and micronutrients, which makes it attractive for upcycled ingredient positioning and clean-label formulations. Second, food processors are focusing on waste reduction and circular economy practices; using okara helps reduce waste from soy processing and increases overall resource efficiency. Third, animal feed producers are recognizing okara’s nutritional value in livestock and aquafeed, supporting demand from the feed side of the market as well.

Product & Application Segmentation

Okara is distributed in different product forms, typically in dry or wet form. The dry form tends to dominate due to better shelf life and easier storage and logistics, whereas wet okara is used when immediate processing or value addition is feasible. Applications span across food & beverage (bakery, noodles, snacks, meat alternatives), animal feed or livestock feed, and value-added food products where okara is used as a functional ingredient for fiber or protein enhancement.

Regional Insights & Growth Opportunities

Growth is driven by Asia-Pacific, where soy consumption is high, and soy processing generates large volumes of okara. Countries like China, Japan, Korea and India are both producers and consumers of okara in traditional and modern formulations. North America and Europe are also emerging as key markets, driven by demand for upcycled ingredients, plant-based foods, and sustainable production practices. As animal feed and pet food industries become more value-oriented, these regions provide additional demand for processed and dried okara in feed formulations.

Competitive Landscape & Strategic Trends

Manufacturers and processors in the okara market are investing in drying, fermentation, or extraction technologies to convert okara into value-added forms (protein concentrates, fiber powders or extruded products). There is increasing attention on value addition—fermentation or drying to stabilize wet okara and develop powder or extract forms that can be used in functional foods or feed. Partnerships between soy processors, ingredient suppliers, and food or feed manufacturers are helping develop new product applications and improve supply chain integration.

Challenges & Market Restraints

Despite favorable trends, there are constraints. Wet okara has limited shelf life, high moisture content, and needs proper processing or drying to avoid spoilage. Drying, fermentation or extracting value requires investment in equipment and process control, which can be costly for smaller processors. Regulatory compliance and food safety are important, especially when okara is used in human food or specialized applications. Price sensitivity or availability issues of soy raw materials can also impact supply consistency.

Forecast & Strategic Recommendations

Given the projected growth from USD 980 million in 2025 to USD 1,520 million by 2035 at a 4.5% CAGR, stakeholders should focus on scaling drying and value-addition operations to convert raw okara into powder or protein / fiber concentrate. Expanding capacity in soy-processing regions, integrating with feed manufacturers or food formulators, and developing dried okara or extracted forms will help capture value. Innovations in fermentation or drying to improve shelf life and nutritional quality will also support product development.

Browse Full Report: https://www.factmr.com/report/okara-market

Editorial Perspective

Okara is increasingly being re-positioned from a waste by-product into a strategic ingredient playing a dual role: in human food formulations and livestock / feed markets. As industries prioritize sustainability, clean-label nutrition, and circular economy principles, okara is becoming a valuable resource with growing demand. Firms that can process, dry, standardize and integrate okara into functional food or feed will be well positioned to benefit from the projected USD 1.52 billion market by 2035.