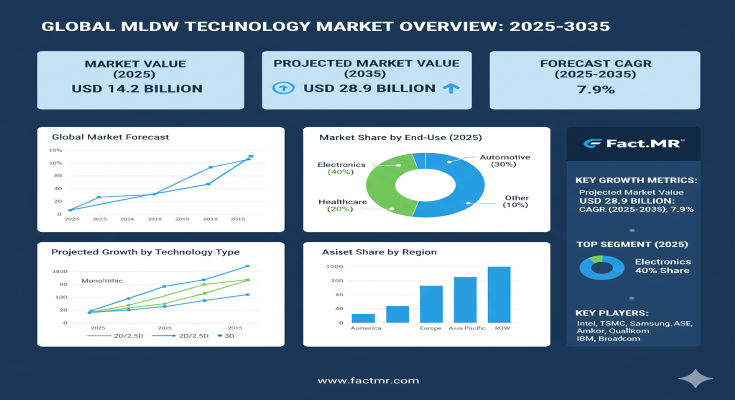

Industry analysis indicates that the global MLDW technology market is estimated at USD 14.2 billion in 2025, and is projected to grow to USD 28.9 billion by 2035, representing a compound annual growth rate (CAGR) of 7.9% over the the forecast period. This strong growth reflects the rising demand in refinery and lubricant manufacturing for efficient catalytic dewaxing solutions that replace older solvent extraction or dewaxing techniques. The market is driven by requirements for higher quality base oils, improved low-temperature flow, and cost optimization in lubricant production.

Market Drivers & Growth Catalysts

MLDW technology is widely used in lube refineries to produce high-viscosity-index lubricant base oils by removing waxy components (paraffin, microcrystalline wax) that impair cold flow or low-temperature performance. The use of effective catalysts (such as Ni-erionite or metal containing ZSM-5) enables dewaxing of a wide range of solvent-extracted or hydrocracked feed stocks, improving yield, and producing cleaner base oils for lubricants and other petroleum derivatives. As automotive and industrial lubricant demand grows, refineries increasingly adopt catalytic dewaxing to meet stricter specifications and reduce operational costs.

In addition, growth in automotive production (vehicles requiring advanced engine oils), industrial equipment, mechanical systems, and heavy-duty machinery increases demand for lubricants with better low-temperature properties, oxidative stability, and refined base oil quality. MLDW technology enables refineries to produce base oils suitable for such demanding applications, including greases, motor oils, metalworking fluids, and more.

Click Here for Sample Report Before Buying: https://www.factmr.com/connectus/sample?flag=S&rep_id=3375

Application & End-Use Segmentation

The technology finds applications across multiple domains. It is used in the production of paraffin wax, gasoline (by cracking heavier paraffinic wax into lighter fractions or LPG or gasoline components), and base oils used as feed for lubricant production. End-users span the automotive industry, industrial equipment & machinery, cosmetics (via paraffin / wax derivatives), and oil & gas sectors. In cosmetics, dewaxed paraffin or wax is used for cosmetic formulations (e.g. waxes, emollients) that require high purity or low wax content.

Catalyst types are also key differentiators. Ni-erionite catalysts or metal containing ZSM-5 catalysts are among the leading catalyst families in this technology, enabling better selectivity, dewaxing efficiency, and lower by-product formation. The choice of catalyst affects yield, energy consumption, and final base oil / wax quality.

Regional Insights & Market Opportunities

Regionally, growth is supported by different refinery capacities and lubricant manufacturing ecosystems. Asia-Pacific is a major growth region given the rapid expansion of refining capacity, automotive industry, lubricant consumption, and growing cosmetics & industrial sectors. Refineries in this region are adopting advanced catalytic dewaxing to improve base oil quality and meet stringent specifications.

North America and Middle East & Africa also offer strong opportunities due to presence of large oil & gas sectors, established refineries, and demand for high-quality base oils. In the Americas, refineries upgrade processes to meet stricter lubricant specs and produce specialty base oils. Latin America can benefit as natural gas and refining industries expand, adopting technologies like MLDW to improve yields and wax removal.

Competitive Landscape & Strategic Trends

Key players in the MLDW technology landscape include major refinery technology licensors, chemical companies that supply catalysts, and large refining operators. Some notable names are established petrochemical or refinery technology providers who supply license, catalysts, and process designs for lube dewaxing units.

Industry participants are increasingly focusing on improving catalyst formulations, optimizing process parameters (temperature, pressure, solvent or hydroprocessing integration), and improving energy efficiency and yield in dewaxing operations. There is also a shift from older solvent dewaxing processes toward more efficient catalytic dewaxing methods, leveraging MLDW technology to reduce solvent consumption, lower operating costs, and improve wax removal.

Challenges & Market Restraints

There are some constraints to adoption. The capital expenditure for implementing MLDW units or retrofitting older solvent dewaxing plants can be significant. Integration with existing hydroprocessing or solvent dewaxing units may require redesign or new catalyst loading, which can increase downtime or require specialized engineering. Competition from alternative dewaxing technologies (solvent extraction, alternative catalytic processes) can slow adoption if refineries opt for lower cost or proven older approaches.

Furthermore, feedstock variability (different paraffin content, wax composition) can affect dewaxing performance; selecting the optimal catalyst or process conditions becomes critical. Regulations on emissions, solvent disposal or environmental compliance also need to be managed.

Forecast & Strategic Recommendations for Buyers

With the market expected to nearly double from USD 14.2 billion in 2025 to USD 28.9 billion by 2035, at a 7.9% CAGR, stakeholders in the refining, catalyst, lubricant additive, and technology licensing segments should take note of significant growth potential. Refiners should evaluate investment in MLDW units or retrofit projects to improve base oil quality, reduce wax content, and improve low temperature fluidity.

Catalyst suppliers should focus on advanced catalyst formulations (e.g. ZSM-5 variants, erionite catalysts) to address feedstock variability and improve dewaxing efficiency. Technology licensors and equipment providers should target emerging regions (especially Asia-Pacific and Latin America) where refining capacity and lubricant consumption are rising.

Browse Full Report: https://www.factmr.com/report/3375/mldw-technology-market

Editorial Perspective & Call to Action

MLDW technology is far more than a process step — it is a strategic enabler for refineries looking to produce high-quality lubricant base oils, clean paraffin wax, and lighter gasoline or LPG derivatives from waxy feedstocks. As the lube refining industry intensifies, the ability to dewax more effectively with catalytic processes becomes critical for competitiveness.

Investing in the full MLDW Technology Market Report offers decision-makers access to detailed market sizing, segmentation (by application, catalyst type, end use, region), competitive analysis, and forecasts through 2035. The report equips refiners, catalyst manufacturers, and strategic planners with the data and insights needed to capitalize on this growing market.

For anyone evaluating refinery upgrades, catalyst development, or expansion into dewaxing technologies, acquiring this research provides strategic forecast, competitive benchmarking, and market intelligence to inform investments and partnerships confidently.